Home » Posts tagged 'saudi arabia' (Page 5)

Tag Archives: saudi arabia

The Great American Shale-Oil Bust Turns into Massacre

The Great American Shale-Oil Bust Turns into Massacre

Shares of shale oil drillers collapsed by 25%-50% today. Their bonds got massacred. Saudi-Russia price-war strategy appears successful in wiping out investors in the US shale-oil sector.

It was so chaotic and brutal in the crude oil market today that the EIA, which is part of the US Department of Energy, emailed out a statement that it would have to delay its monthly Energy Outlook to figure in all the chaos: “We have delayed the release of the Short-Term Energy Outlook to allow time to incorporate recent global oil market events. The outlook will now be released Wednesday, March 11, at 9:00 a.m.”

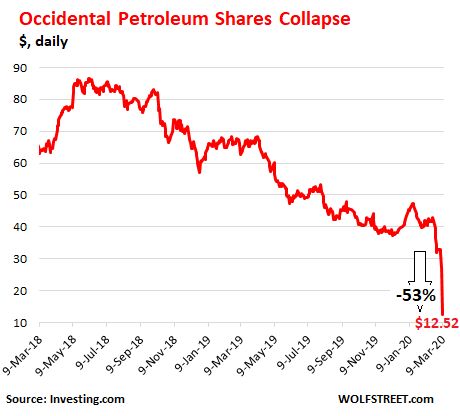

Shares of Occidental Petroleum, which is heavily involved in US shale oil and gas, collapsed by 53% today to $12.51. They’re down 85% since October 2018, when phase two of the Great American Oil Bust set in, with phase one having commenced in July 2014:

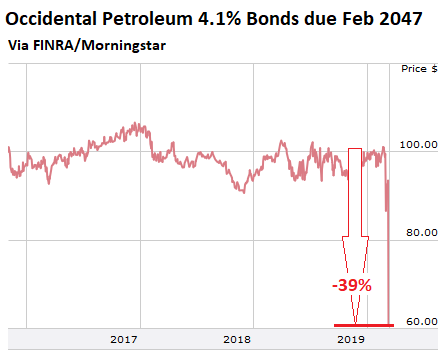

Oxy’s bonds – those that even traded – collapsed today. For example, this $750 million 30-year senior unsecured bond, with a coupon interest of 4.1%, closed on Friday at 92.5 cents on the dollar. Like many bonds, they don’t trade much, but are stuck in bond funds or held by institutional investors, and it’s hard to sell them because there are not many buyers.

Today, there are only two trades listed on FINRA-Morningstar, but they were big trades, with institutional investors unloading them for whatever they could get. So the price today collapsed by 34% from the close on Friday, and by 39% over the past three trading days, to 61 cents on the dollar:

Shares of Chesapeake Energy, a former shale oil-and-gas giant, particularly focused on natural gas, plunged 28% today, from nearly nothing to almost nothing, closing at $0.16. The company has been dilly-dallying around near the bankruptcy-filing counter for years, without having filed yet, as investors continued to feed it fresh cash and agreed to haircuts and restructure its debts. But that fresh-cash option appears to be off the table.

…click on the above link to read the rest of the article…

Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices

Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices

With the commodity world still smarting from the Nov 2014 Saudi decision to (temporarily) break apart OPEC, and flood the market with oil in (failed) hopes of crushing US shale producers (who survived thanks to generous banks extending loan terms and even more generous buyers of junk bonds), which nonetheless resulted in a painful manufacturing recession as the price of Brent cratered as low as the mid-$20’s in late 2015/early 2016, on Saturday, Saudi Arabia launched its second scorched earth, or rather scorched oil campaign in 6 years. And this time there will be blood.

Following Friday’s shocking collapse of OPEC+, when Russia and Riyadh were unable to reach an agreement during the OPEC+ summit in Vienna which was seeking up to 1.5 million b/d in further oil production cuts, on Saturday Saudi Arabia kick started what Bloomberg called an all-out oil war, slashing official pricing for its crude and making the deepest cuts in at least 20 years on its main grades, in an effort to push as many barrels into the market as possible.

In the first major marketing decision since the meeting, the Saudi state producer Aramco, which successfully IPOed just before the price of oil cratered…

… launched unprecedented discounts and cut its April pricing for crude sales to Asia by $4-$6 a barrel and to the U.S. by a whopping $7 a barrel in attempts to steal market share from 3rd party sources, according to a copy of the announcement seen by Bloomberg. In the most significant move, Aramco widened the discount for its flagship Arab Light crude to refiners in north-west Europe by a hefty $8 a barrel, offering it at $10.25 a barrel under the Brent benchmark.

…click on the above link to read the rest of the article…

Saudis Urge More Than 1 Million Bpd Oil Cut To Prop Up Prices, Russia Opposes

Saudis Urge More Than 1 Million Bpd Oil Cut To Prop Up Prices, Russia Opposes

Update (0800ET): The Wall Street Journal reports that Russia opposes the Saudi plan to deepen OPEC+ cuts by 1.2mm b/d.

Developing…

* * *

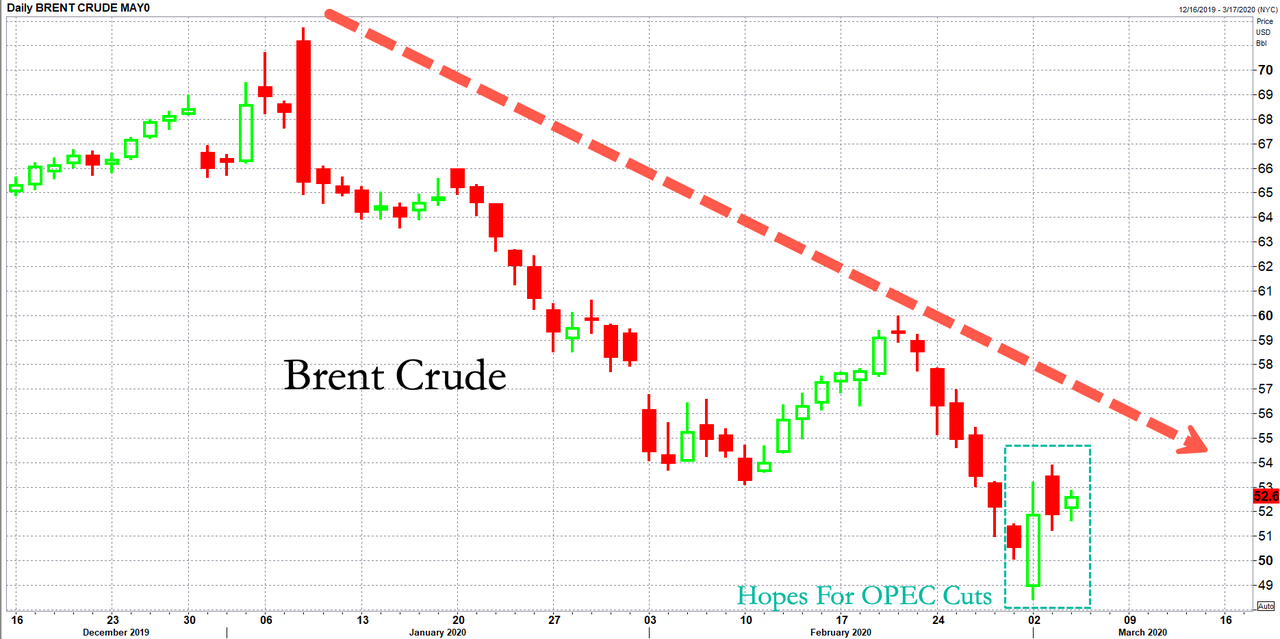

As we detailed earlier, Brent crude futures were up 75 cents, or 1.45%, at 52.61 a barrel at 0700ET Wednesday after a three-day move of +10%, following expectations that major oil producers could make significant production cuts at the OPEC meeting on March 5.

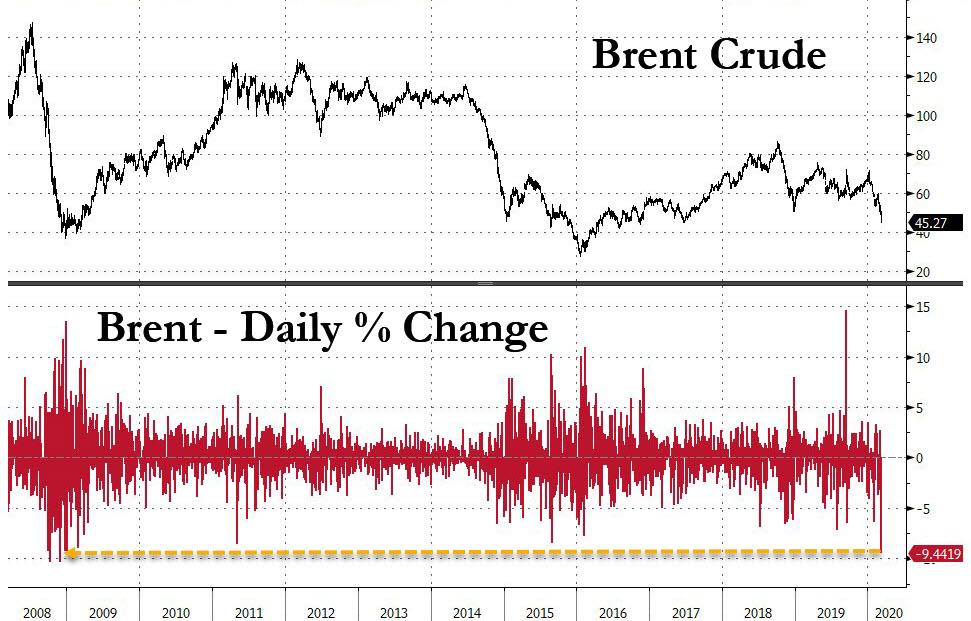

Brent has tumbled into a bear market, down 26.5% in 38 sessions, following the outbreak of Covid-19 in China, now spreading across the world, has slashed global oil demand.

“This is a sudden, instant demand shock,” said Jim Burkhard, vice president and head of oil markets at IHS Markit Ltd.

“The scale of the decline is unprecedented.”

OPEC+ Joint Ministerial Monitoring Committee, the body that oversees production, will meet on Wednesday, ahead of the formal meeting, to discuss cuts. Saudi Arabia is urging OPEC+ to come to an agreeance ahead of Thursday for a reduction of 1 million barrels per day to compensate for lost demand seen by the virus crisis, Bloomberg notes.

“The recommended 600,000-barrel-a-day additional cut for the second quarter of 2020 will be seen as too little,” Mohammad Darwazah of consultant Medley Global Advisors said in a note. “It is clear that the group is mulling a deeper production pullback.”

The push for deep cuts comes as crude had its worst weekly decline since the 2008 financial crisis on mounting macroeconomic headwinds developing because of the virus spread, which forced Saudi Arabia to demand Russia jump on board with production cuts.

…click on the above link to read the rest of the article…

Are Russia and Turkey on a Collision Course?

Are Russia and Turkey on a Collision Course?

The murder of the Iranian hero-martyr General Soleimani created a situation in which a war between Iran and the Axis of Kindness (USA/Israel/KSA) became a real possibility but, at the very last minute, Uncle Shmuel decided that he had no stomach for a full-scale war against Iran. Wise decision.

This, however, does not at all imply that the AngloZionist Empire decided to stand by idly, far from it. The need to take quick and determined action became particularly acute following the huge anti-US demonstrations in Iraq (well over one million people in the streets!) which directly put at risk the US occupation (the MSM would call it “presence”) in both Iraq and Syria.

At the same time, Turkish President Erdogan’s refusal to remove all the “bad terrorists” from the Idlib province eventually resulted in a joint Syrian-Russian offensive to liberate the province. That offensive, in turn, clearly infuriated the Turks who warned of a major military operation to prevent the Syrians from liberating their own country.

This begs the question: are Russia and Turkey really on a collision course?

There are certainly some very worrying warning signs including a number of very harsh statements by Erdogan himself, and a suddenly re-kindled Turkish interest for the US “Patriots”.

On the ground in Idlib, the Turks have clearly provided the “bad terrorists” with a lot of support including equipment, MANPADs, tanks and armored personnel carriers. The Turks actually went as far as sending special forces to assist the “bad terrorists” directly. Finally, from footage taken by Russian and Syrian drones, and even the “bad terrorists” themselves, it appears undeniable that Turkish MLRS and regular artillery provided the “bad terrorists” with fire support.

…click on the above link to read the rest of the article…

Saudi Arabia Pushes For OPEC Production Cut Of Up To 1 Million B/d As Outbreak Weighs On Demand

Saudi Arabia Pushes For OPEC Production Cut Of Up To 1 Million B/d As Outbreak Weighs On Demand

Half of China’s economy – the second largest in the world – is expected to be offline through at least mid-February. Traders started pricing in the impact on oil demand weeks ago. And now that it’s become clear to everybody that this problem isn’t going away any time soon, and after oil prices recorded their largest monthly drop in 30 years, OPEC might step in to ‘re-balance’ the global energy market.

Confirming earlier whispers, Saudi Arabia is reportedly pushing for a major, short-term oil production cut, WSJ reported Monday morning, citing anonymous OPEC officials.

A group of OPEC countries and their allies – collectively known as OPEC+ – are planning to meet Tuesday and Wednesday to debate possible action thanks to the outbreak in China, the world’s largest oil importer and consumer.

One scenario being discussed is that Saudi Arabia, OPEC’s kingpin, would lead a collective reduction of 500,000 barrels a day. The production cut will remain in place until the outbreak has subsided, cartel officials said.

Another, more drastic, option being considered would involve a temporary cut of 1 million b/d, a cut that would deliver a decisive ‘jolt’ to the market (and potentially trigger another flurry of angry Trump tweets about oil prices – the ‘invisible tax’ – being too high.

…click on the above link to read the rest of the article…

Crude Crashes As Asia Trading Opens; Stocks Slump, Gold Jumps, Yuan Dumps

Crude Crashes As Asia Trading Opens; Stocks Slump, Gold Jumps, Yuan Dumps

While gold is spiking higher and stocks are getting hammered lower after a weekend of ugly headlines surrounding the lethality and spread of the novel coronovirus, the Saudis are desperately talking down the crash in crude oil prices…

Brent is back below $60 and WTI has crashed to almost a $51 handle…

Saudi Arabia is “closely monitoring” the impact of the coronavirus outbreak on oil markets, but so far sees the crisis having a “very limited impact” on global demand, Energy Minister Prince Abdulaziz bin Salman says in a statement.

Current market impact on oil, “primarily driven by psychological factors and extremely negative expectations adopted by some market participants, despite its very limited impact on global oil demand.”

It seems that “psychological” impact is sending gold higher…

And stocks lower… Dow futures down over 300 points, back below 29,000…

And S&P futures back below the key 3,300 level…

…click on the above link to read the rest of the article…

Tanker Operators Suspend Travel Through Strait Of Hormuz

Tanker Operators Suspend Travel Through Strait Of Hormuz

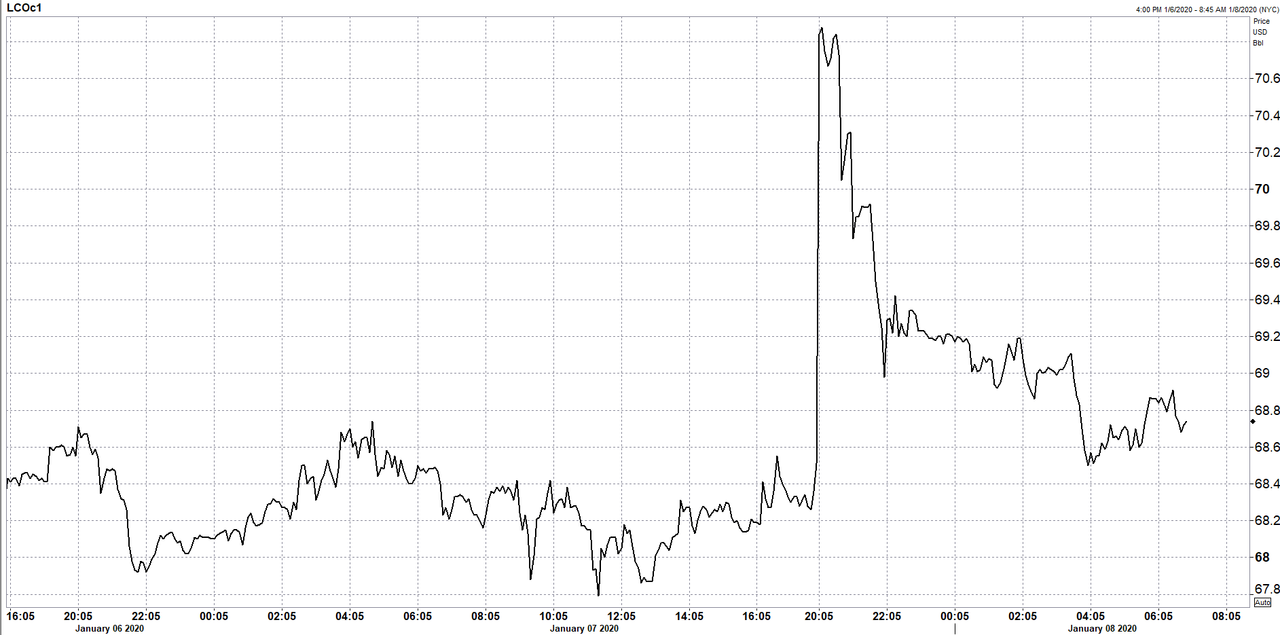

Following Iran’s decision to lob missiles at US-Iraqi bases last night, several major tanker operators have suspended sailing through the Straits of Hormuz, the site of several tanker attacks last year.

Petrobras, Bahri – Saudi Arabia’s state-run tanker operator – and other tanker companies have suspended sailing through the Straits of Hormuz, WSJ reports, citing unidentified people familiar with the matter.

Meanwhile, Gulf officials are already trying to convince the world that there’s nothing to worry about in what’s essentially a tinderbox inside another tinderbox. United Arab Emirates’ Energy Minister Suhail al-Mazrouei said on Wednesday he saw no immediate risk to oil passing through the critical gateway through which 20% of the global supply of crude travels. al-Mazrouei made the comments on the sidelines of a conference in Abu Dhabi, the UAE capital.

The source of their concerns is clear: Iran carried out its “retaliation” for the killing of General Suleimani last night – though the Pentagon has confirmed that there have been no American casualties from Iran’s strikes. However, many fear that Iran isn’t finished with its retaliation.

Mazrouei added that OPEC was not discussing any precautionary steps at the moment, but would re-evaluate the situation if a supply shortage emerged, according to Reuters. He said earlier that the global oil market was well supplied.

Oil prices initially moved higher after last night’s attacks, but prices have since settled, and the market largely ignored the news about the tanker suspensions, as it was already largely priced in.

On Tuesday, Washington warned about “the possibility of Iranian action against US maritime interests” in the Middle East.

“U.S. commercial vessels are advised to exercise caution and coordinate vessel voyage planning for transits of the Persian Gulf and nearby waterways,” the U.S. Maritime Administration said in a statement on its website.

…click on the above link to read the rest of the article…

IEA: An Oil Glut Is Inevitable In 2020

IEA: An Oil Glut Is Inevitable In 2020

Despite the OPEC+ cuts, the oil market is still facing a supply surplus in 2020, according to a new report from the International Energy Agency (IEA).

OPEC+ announced additional cuts of 500,000 bpd, which sounds more impressive than it is because the group was already producing under its limit. In November, for instance, OPEC was producing 440,000 bpd below the agreed upon ceiling.

Saudi Arabia agreed to shoulder an additional 400,000 bpd of voluntary cuts. But the deal also exempts 1.5 million barrels per day (mb/d) of Russia’s condensate production, allowing Russia to actually increase condensate output by 0.8 mb/d.

Still, the deal should take supply off the market. “If all the countries comply with their new allocations and Saudi Arabia delivers the rest of its voluntary cut of 0.4 mb/d, the fall in production volume versus today will be about 0.5 mb/d,” the IEA said.

OPEC said in its own report that the oil market would be largely in balance in 2020, albeit with a temporary glut in the early part of the year. The IEA sees inventories building at a rate of 0.7 mb/d in the first quarter.

The IEA cut its forecast for non-OPEC supply growth from 2.3 mb/d to 2.1 mb/d, due to weaker growth from Brazil, Ghana and the United States. The U.S. typically gets all of the attention, but disappointing news from Brazil and Ghana also led the IEA to revise forecasts lower.

Notably, Tullow Oil revealed a major disappointment from its Ghana operations, causing a complete meltdown in its share price this week. Its stock fell nearly 70 percent in a single day as investors overhauled their valuation of the company. Tullow admitted that its production from Ghana would decline in the years ahead.

…click on the above link to read the rest of the article…

Saudi Bases and the Bin Ladens: A Love Story

Saudi Bases and the Bin Ladens: A Love Story

What is Trump really up to? It’s almost unknowable. At the same time that the president was pulling (some) troops out of Northeast Syria, giving an antiwar speech, and then sending other troops back into Syria to “secure the oil,” he also quietly sent another 1800 service members into Saudi Arabia. What little Trump did say about it consisted of a peculiar defense of his actions. Faced with the obvious question from a reporter: “Mr. President, why are you sending more troops to Saudi Arabia when you just said it’s a mistake to be in the Middle East?” Trump argued that there was no contradiction in his policy because, well, the Saudis “buy hundreds of billions of dollars’ worth of merchandise from us,” and have “agreed to pay us for everything we’re doing to help them.” It seems the U.S. military is going full mercenary in the Gulf.

While I’ve noted that Trump’s recent antiwar remarks were profound – though largely unfulfilled – these words will amount to nothing if followed by a military buildup in Saudi Arabia that leads to a new, far more bloody and destabilizing, war with Iran. Nothing would please the “three Bs” – Israeli Prime Minister Bibi Netanyahu, Saudi Crown Prince Mohammed Bin Salman, and former National Security Adviser John Bolton – more than a US military strike on the Islamic Republic, cost and consequences be damned.

It’s just that an Iran war isn’t the only risk associated with basing majority-Christian, foreign American troops in the land of Islam’s two holiest cities. And a brief historical review of US presence in Saudi Arabia demonstrates quite clearly the potential transnational terrorist “blowback” of Washington’s basing decisions. In fact, Trump’s latest deployment constitutes at least the third time the US military has been stationed on the Arabian peninsula.

…click on the above link to read the rest of the article…

The troubled Saudi Aramco IPO: It’s what you can’t see that counts

The troubled Saudi Aramco IPO: It’s what you can’t see that counts

It’s what you can’t see—the oil beneath the Arabian sands—that potential investors in Saudi Aramco’s on-again, off-again initial public offering (IPO) ought to focus on. The truth about the remaining oil resources beneath the Saudi desert continues to be a state secret. I’ll elaborate on this after a little background to set the context.

Recently, Saudi Aramco, the state-owned Saudi oil company, delayed its planned IPO again. For those who missed the previous time, plans for the IPO first came to light in 2016 as part of Saudi Arabia’s 2030 Vision, essentially a plan to diversify the country’s economy away from heavy dependence on oil. The feverish attention the proposed IPO produced abated when the world’s largest company unexpectedly withdrew it in 2018. The financial firms advising the government were let go as the government looked for other ways to raise money for its 2030 Vision plans.

And yet, the IPO idea remained a possibility and was later revived. The problem has been that both times the IPO looked like it was about to happen, the Kingdom of Saudi Arabia got cold feet, worried that it might not get the $100 billion it wants for 5 percent of the company.

Initial hopes of listings on prominent international exchanges such as the New York Stock Exchange and the London Stock Exchange have long since been abandoned. But the most recent IPO attempt was to be made wholly on Saudi Arabia’s own domestic exchange. Even that apparently looked like it might fail.

So, the big question is why. The answer is probably right beneath the Saudis’ feet: The oil under Saudi sands—or rather the uncertainty about the amount of extractable oil that still lies there.

…click on the above link to read the rest of the article…

Major Blaze At Iran Oil Refinery Raises Suspicions Of Saudi Revenge Attack

Major Blaze At Iran Oil Refinery Raises Suspicions Of Saudi Revenge Attack

A section of Iran’s sprawling Abadan oil refinery in the southwest of the country went up in flames Saturday, and state media sources reported the emergency was under control as of Sunday morning.

State media is describing it as “a fire in a canal carrying waste from Iran’s Abadan oil refinery,” with Iranian official broadcaster IRIB saying, “The refinery’s fire department contained the fire and prevented it from spreading to other units.”

#BREAKING

A fire in a canal carrying waste from #Iran’s #Abadan oil refinery was brought under control on Sunday: State Media

However, given the extent of the blaze captured in social media circulating videos, and especially given it comes after a tense summer of attacks on tanker and refineries — notably the Sept. 14 Saudi Aramco drone and missile attack — the newest Iran facility fire raises serious question.

Could the clearly massive Abadan blaze, which Iranian state sources appear ready to downplay, be the result of a Saudi revenge attack?

Though unverified and unconfirmed, Iranian opposition sources are pointing to a potential cyber attack as a possible cause for the fire.

…click on the above link to read the rest of the article…

Uncertainties following the Abqaiq attack have shrunk the world’s safe oil reserves by around half (part 1)

Uncertainties following the Abqaiq attack have shrunk the world’s safe oil reserves by around half (part 1)

The world has returned to business as usual after the Saudis assured oil markets that production will be back soon and as oil prices have returned to pre-attack levels and even lower, indicating that oil traders focus on a weak global economic outlook.

The peak oil barrel blog monitors OPEC’s oil production and published the above graph for September 2019, using data from OPEC’s Monthly Oil Market Report. The drop from around 9,800 kb/d to 8,500 kb/d translates into an approximate loss in September of 40 mb Arab Light. Saudi oil stocks were 180 mb before the attack. Maybe tanks are filled with partially processed oil with a high sulfur content.

Iran’s oil exports

From the IEA Monthly Oil Market Report dated 12/9/2019 (2 days before the Abqaiq attack):

The data on Iranian oil exports are fuzzy. On 13 Sep 2019 S&P Global Platts reported 424 kb/d in August (mainly to China and Syria) but warns that Iranian storage is filling up quickly, including 50 mb on tankers (mostly condensate). During the last round of sanctions in 2016 storage reached 55-60 mb.

In July 2019 the Atlantic Council calculated in an article entitled

Iran’s Crude Oil Exports: What Minimum Is Enough to Stay Afloat?

that Iran needs to export 1.5 mb/d to balance the budget and 720 Kb/d as an absolute minimum in survival mode (withdrawals from the National Development Fund, foreign exchange and gold reserves)

Changed balance of power in Middle East

As Iranian oil exports have dropped below these thresholds, attacks have intensified:

12 May: Fujairah, UAE, 4 tankers damaged in Gulf of Oman by limpet mines

…click on the above link to read the rest of the article…

Iran Claims To Have Video Evidence Of Oil Tanker Attacks

Iran Claims To Have Video Evidence Of Oil Tanker Attacks

By – Oct 16, 2019, 2:30 PM CDTJoin Our Community

Iran has claimed that it has footage of last week’s attack on its oil tanker while off the Saudi Arabian Jeddah port, and it proves that the attacks were carried out by Israel, Saudi Arabia, and the United States, according to Mehr news agency, who quoted Abolfazl Hassan Beigi, Iran’s National Security and Foreign Policy Commission member.

This evidence, Hassan Beigi said, will be provided to the UN and Security Council.

“Saudi Arabia and the U.S. are trying to put the blame on the ISIL [Islamic State] or the Taliban for the attack, but the documents dismiss such a notion as no ISIL or Taliban terrorists are present in the Red Sea,” Hassan Beigi said, adding that both ISIS and the Taliban were created and sponsored by Saudi Arabia and Israel.

Iran’s President Hassan Rouhani on Tuesday, in his first media conference in over a year, that the attack on the tanker would not go unpunished, adding that it was “carried out by a government” rather than an individual.

Rouhani stopped short of naming that state actor, however.

“If a country thinks that it can create instability in the region without getting a response, that would be a sheer mistake,” Rouhani said.

The Iranian tanker, the Sabiti, was attacked last Friday in the Red Sea, damaging the vessel and causing oil to spill into the water. The Sabiti belongs to the National Iranian Oil Company.

The attack on the Iranian oil tanker follows the September 14 attack on Saudi Aramco’s oil infrastructure that took offline nearly 6 million bpd of production. Tensions in the Middle East have been flaring up as the United States continues to sanction Iran’s oil industry for noncompliance with the nuclear deal.

US To Send ‘Thousands’ More Troops To Saudi Arabia

US To Send ‘Thousands’ More Troops To Saudi Arabia

Reuters reports, citing defense or administration sources, that the US is set to send thousands of additional troops to Saudi Arabia in the wake of last month’s Aramco attacks.

“The United States is planning to send a large number of additional forces to Saudi Arabia following the Sept. 14 attack on its oil facilities, which Washington and Riyadh have blamed on Iran,” according to a breaking Reuters report.

Though the Pentagon has yet to officially confirm the report with comment, Reuters noted the “sources did not specify exactly how many troops would be deployed but said it was expected to be in the thousands.”

And Bloomberg reports this could be as many as 1,800 new personnel, pending an official Pentagon statement:

Defense Secretary Mark Esper is expected to announce a new deployment of U.S. forces to the Middle East as tensions rise over Turkey’s military operations in northern Syria and an explosion on an Iranian oil tanker.

As many as 1,800 military personnel, including two air squadrons, are expected to be deployed to the region,including to Saudi Arabia, according to a defense official.

Earlier in the month the Pentagon deployed 500 troops in coordination with King Salman and crown prince MbS for “regional stability” and to counter Iran.

Ironically this comes as Trump has promised to “slowly” get “out of the Middle East”.

Iranian Oil Tanker Struck By 2 Missiles Near Saudi Port

Iranian Oil Tanker Struck By 2 Missiles Near Saudi Port

Many questions remained unanswered early Friday after an attack on an Iranian oil tanker in the Red Sea sent oil prices higher, in the latest attack on energy-industry infrastructure in an increasingly volatile part of the world. According to the New York Times, a fire erupted on an Iranian oil tanker about 60 miles from the Port of Jeddah on Friday after the tanker’s two major tanks were struck by missiles, causing an oil spill.

No crew members were hurt and the ship is reportedly in stable condition, according to Iranian state news media. The National Iranian Oil Company, which owns the tanker, said the ship was struck at 5 am local time and 5:20 am local time. Iranian officials said Friday that the incident was “an act of terrorism”, but they insisted that the ship had suffered minimal damage and that only a small amount of oil had spilled into the ocean. The Iranians also denied that the ship had caught fire, despite photos purportedly depicting the blaze.

#BREAKING: There is No longer fire & oil leakage in #Iran‘s oil tanker #SABITI. Images taken an hour ago show the oiler in #RedSea after changing its course. There are two possibilities behind the two explosions in the ship: 1-#SaudiArabia‘s attack 2-#Israel Navy attack.

Iranian media said “technical experts” are still investigating the cause of the explosion, though Iranian state media initially blamed Saudi Arabia. The Kingdom, meanwhile, denied any responsibility for the attack. However, according to conflicting reports, the National Iranian Oil Company denied that Saudi Arabia, Iran’s archrival in the region, was behind the attack, and instead pointed the finger toward Israel.

Another inconsistency emerged when Iran said a tanker known as the Sabiti had been hit. But the ship-tracking website Marine Traffic shows the vessel hasn’t transmitted any location data since mid-August.

…click on the above link to read the rest of the article…