The Most Splendid Housing Bubbles in Canada: Even the Bank of Canada Gets Nervous and Tapers

House prices in the largest markets have gone nuts amid “extrapolative expectations and speculative behavior,” as the Bank of Canada put it.

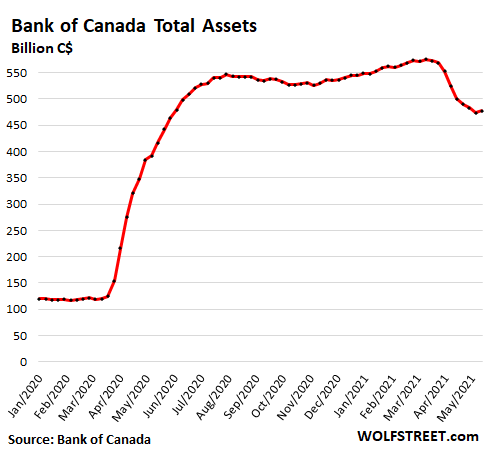

The first thing to know about the housing bubble in Canada is what the Bank of Canada has been doing, after its furious bout of QE: In October last year, it tapered purchases of Government of Canada bonds by one notch and also ended buying mortgage-backed securities. In March, it started unwinding its liquidity facilities, citing “moral hazard” as reason. In April, it tapered by another notch its purchases of Government of Canada bonds, citing “signs of extrapolative expectations and speculative behavior” in the housing market.

The assets on its balance sheet have now dropped from C$575 billion in March, to C$478 billion as of May 12:

House prices have truly gone nuts.

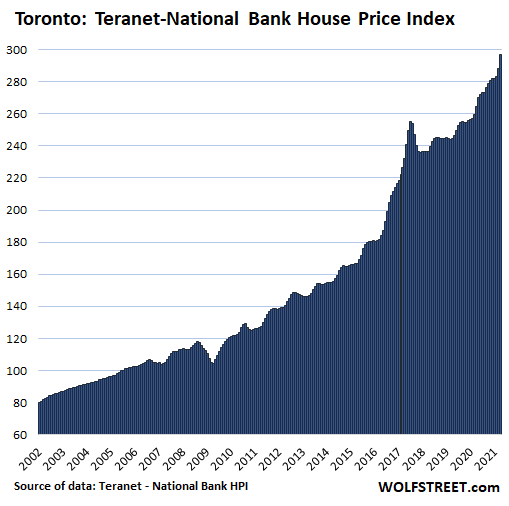

In the Greater Toronto Area (GTA), house prices spiked by 3.0% in April from March, and by 12.3% year-over-year, and have nearly tripled over the past 15 years, according to the Teranet-National Bank House Price Index today.

The index tracks prices of single-family houses through “sales pairs,” similar to the Case-Shiller Home Price Index in the US, comparing the price of a house that sold in the current month to the price of the same house when it sold previously, often years earlier. By tracking how many more Canadian dollars it takes to buy the same house over time, the index is a measure of house price inflation.

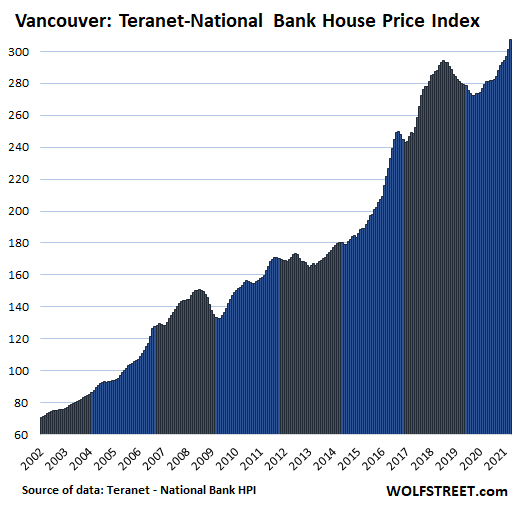

In Greater Vancouver, house prices jumped by 2.0% in April from March and are up 9.4% year-over-year. The Bank of Canada’s pandemic magic has completely turned around the housing bust that had started in mid-2018. The index has more than tripled in 15 years:

…click on the above link to read the rest of the article…