Please Don’t Pop My Bubble!

So ride your bubble of choice up–stocks, bonds, housing, bat guano, take your pick–but it’s best to keep your thumb on the sell button.

One person’s bubble is another person’s “fair market value.” What is clearly an outrageously overvalued asset perched at nosebleed levels of central-bank fueled speculative euphoria is to the owner an asset at “fair market value.”

But beneath the euphoric confidence that valuations can only drift higher forever and ever is the latent fear that something could stick a pin in “my bubble”— that is, whatever bubblicious asset we happen to own and treasure as a source of our financial wealth could be popped, destroying not just our financial bubble but our psychological bubble of faith in permanent manias.

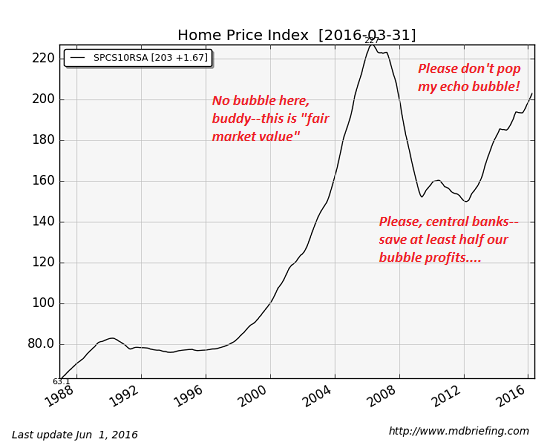

Consider housing prices, which are clearly in an echo-bubble of the Great Housing Bubble of 2000-2007. (Chart courtesy of Market Daily Briefing.)

The psychological underpinning of all bubbles and echo bubbles is on display here. In the first bubble, those benefiting from the stupendous price increases are not just euphoric at the surge in unearned wealth–they believe the hype with all their hearts and minds that the bubble is not a bubble at all, it’s all just “fair market value” at work.

In other words, the massive increase in unearned personal wealth is not just temporary good fortune–it is permanent, rational and deserved.

Alas, all bubbles, no matter how euphoric or long-lasting, eventually pop. All the certainties that seemed so obviously true and timeless to the believers melt into air, and their touching faith that the bubble valuations were permanent, rational and deserved dissipates in a wrenchingly painful reconciliation with reality.

The agonized cries of those watching their bubble-wealth vanish do not fall on deaf ears.

…click on the above link to read the rest of the article…