When the economy begins to sink into recession, politicians, mainstream economists, policy wonks, and the Federal Reserve begin beating the economic stimulus drum.

Politicians, however, disagree over the type of stimulus to implement. The center-left party proposes greater expenditures on public assistance programs. The center-right party supports permanent tax rate reductions. The center-left party opposes tax cuts because they say it benefits the rich. The center-right party opposes raising government expenditures because it increases government debt. This discord generally results in a temporary compromise where government expenditures are boosted and tax rates are cut. This compromise is called “discretionary fiscal stimulus.”

While the debate over discretionary fiscal stimulus has to overcome Senate filibusters and heated House debates, the central bankers at the Fed quickly implement monetary stimulus. Boosting aggregate demand is the intended purpose of it and discretionary fiscal stimulus. In mainstream economic theory, greater aggregate demand lowers unemployment and raises GDP. In spite of grave warnings from Austrian-school economists, the Fed pursues these goals by lowering interest rates via an expansion credit.

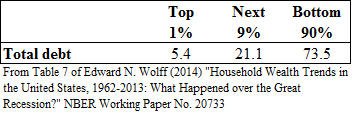

Although the political parties disagree over the type of fiscal stimulus to implement, both support the Fed’s monetary stimulus. Perhaps they do so because lower interest rates lower the cost of the budget deficits their discretionary fiscal stimulus produces. The lower interest rates also reduce the interest Americans pay on their debts. The total of this debt is unevenly distributed across the richest 1 percent, the next 9 percent, and the bottom 90 percent of Americans (as ranked by wealth), according to the following table.

Total household debt averaged $11.295 trillion dollars over the four quarters in 2013, according to the Federal Reserve Bank of New York. Multiplying this value by the percentages in the above table indicates that the richest 1 percent, the next 9 percent, and the bottom 90 percent have aggregate debts of $610 billion, $2.383 trillion, and $8.302 trillion, respectively. These values are listed in the Total Debt column below.

…click on the above link to read the rest of the article…