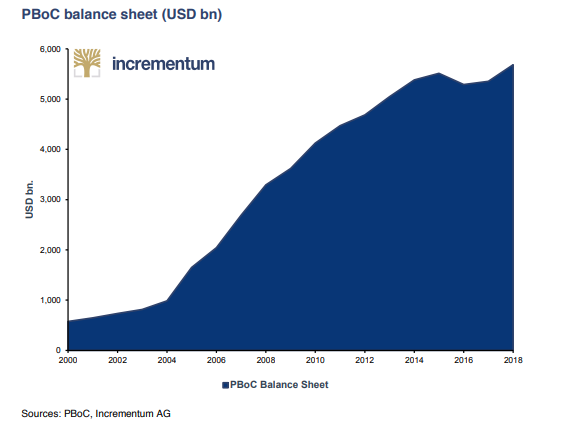

While the rulers of China have been able all along to hedge their plans over longer periods than their Western counterparts have, the new legal situation has extended this planning horizon even further.1 In comparison with those of Western economies, China’s countermeasures against the crisis in 2008 were significantly more drastic. While in the US the balance sheet total of the banking system increased by USD 4,000bn in the years after the global financial crisis, the balance sheet of the Chinese banking system expanded by USD 20,000bn in the same period. For reference: This is four times the Japanese GDP.

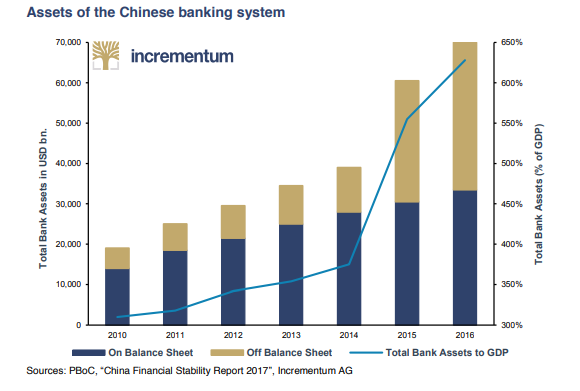

The following chart shows the expansion of the bank balance sheet total as compared to economic output. Did the Chinese authorities assume excessive risks in fighting the crisis?

Neither the fact that China’s bank balance sheets amount to more than 600% of GDP nor the fact that they have doubled in terms of percentage of GDP in the past several years suggests a healthy development. Our friends from Condor Capital expect NPL ratios51F to rise in China, which could translate into credit losses of USD 2,700 to 3,500bn for China’s banks, and this is under the assumption of no contagion (!). By comparison, the losses of the global banking system since the financial crisis have been almost moderate at USD 1,500bn

The most recent crisis does teach us, however, that the Chinese are prepared to take drastic measures if necessary. China fought the financial crisis by flooding the credit markets: 35% credit growth in one year on the basis of a classic Keynesian spending program is no small matter.

…click on the above link to read the rest of the article…