The US Oil Bust Just Got Worse

The price of Oil did today what it has been doing for a while: it waits for a trigger and plunges. As I’m writing this, West Texas Intermediate is down 4.4%, trading at $44.99 a barrel, less than a measly buck away from this oil bust’s January low. It’s down over 20% from the peak of the most recent sucker rally.

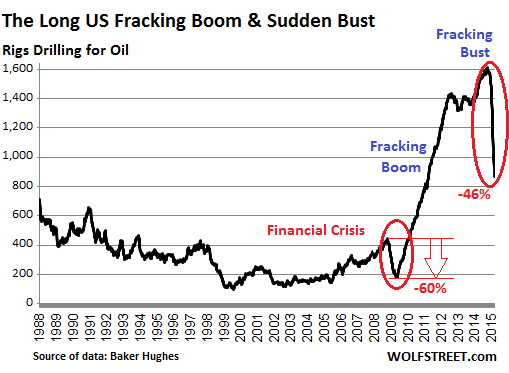

US oil drillers have been responding by slashing capital expenditures, including drilling, in a deceptively brutal manner. In the latest week, drillers idled 56 rigs that were classified as drilling for oil, according to Baker Hughes. Only 866 rigs were still active, down 46.2% from October, when they’d peaked at 1,609. In the 22 weeks since, drillers have taken out 743 rigs, the most dizzying cliff dive in the data series, and probably in history:

You’d think this sort of plunge in drilling activity would curtail production. Eventually it might. But for now, the industry has focused on efficiencies, improved drilling technologies, and the most productive plays. Drillers are trying to raise production but with less money so that they can meet their debt payments. Thousands of wells have been drilled recently but haven’t been completed and aren’t yet producing. This is the “fracklog,” a phenomenon that has been dogging natural gas for years.

…click on the above link to read the rest of the article…