One Chart Says It All

People sense the ‘recovery” is bogus, and their rational response is to save more money rather than squander it.

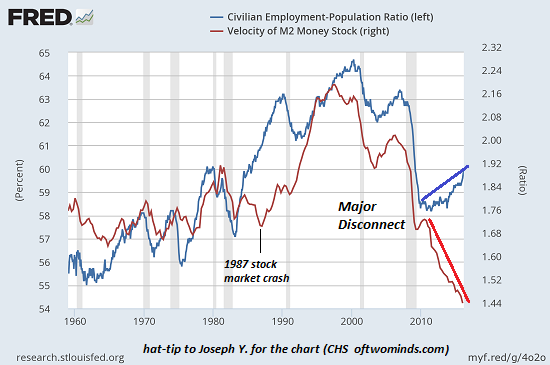

Sometimes one chart captures the fundamental reality of the economy: for example, this chart of money velocity and the civilian-population ratio. (thank you, Joseph Y. for posting it on my Facebook feed.)

When the blue line is up, more of the population has a job. (the blue line is the Employment-Population ratio.)

The red line is money velocity, the rate at which money changes hands. (Money buried in the coffee can in the back yard has a money velocity of zero.)

As Joseph noted, the correlation between the percentage of people working and money velocity was strong until 2010. In the post-2009 recession “recovery,” the percentage of the populace with jobs rose modestly, but money velocity absolutely cratered to unprecedented lows.

(The one other disconnect was triggered by the 1987 stock market crash, which caused money velocity to dip even as more people entered the workforce. This absence of correlation was relatively brief.)

The correlation between more people working and money velocity is commonsensical. More people working = more household income = more spending = higher money velocity.

But something changed in 2010. Did the quality and compensation of work change? Joseph observed: People started going back to work after the official recession ended in Q4 2009 but they were working for lower pay. With lower pay comes less disposable income, hence the cliff-like drop off in velocity.

Another potential factor is higher inflation. Some recent estimates (Where’s The Beef? ‘Lies, Damned Lies, And Statistics’) suggest the gap between official inflation and actual inflation in rent, food, energy and medical care in the past 20 years has subtracted 20% from paychecks.

…click on the above link to read the rest of the article…