Home » Posts tagged 'imf' (Page 26)

Tag Archives: imf

Did An Obscure IMF Document Start A Global Bail-In Revolution? by Daniel Amerman

Did An Obscure IMF Document Start A Global Bail-In Revolution? by Daniel Amerman.

When revolutions start, it’s not uncommon for almost nobody to notice. It may take years or even decades before historians can look back, point a finger and say “that’s where it really began.”

An obscure International Monetary Fund “Staff Discussion Note” may have already started a “Bail-In” financial revolution that could transform the global investment world.

In this quite remarkable document, the staff discusses a world where risks to the global financial system have not gone away – but are worse than ever. As candidly discussed, the “SIFI” (systemically important financial institution) problem has not been improving, but instead has been getting worse than ever – and there doesn’t appear to be any solution under existing contract law and bankruptcy law.

More risk than ever is concentrated in fewer financial institutions, while there is no way under existing law to unwind a failure of one of these institutions without risking triggering global financial chaos. Moreover, there is a deadly feedback loop between these “too-big-to-fail” institutions and sovereign governments. That is, as the IMF staff discusses, the bailing out of these massive institutions can bankrupt sovereign governments, and sovereign governments going bankrupt can wipe out the “too-big-to-fail” institutions.

So the IMF staff has come up with an audacious plan for how the globe can emerge from this seemingly impossible situation. The key word is “insurance”.

…click on link above to read the rest of the article…

Wealth Inequality Is Not A Problem, It’s A Symptom – The Automatic Earth

Wealth Inequality Is Not A Problem, It’s A Symptom – The Automatic Earth.

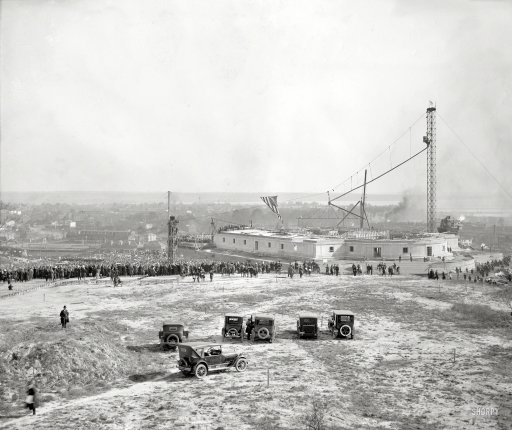

NPC Dedication, George Washington Masonic Memorial, Alexandria, VA Nov 1 1923

The article in question is Charles Hugh Smith’s Why Nations (and organizations) Fail: Self-Serving Elites, and the book he references is Why Nations Fail: The Origins of Power, Prosperity, and Poverty by Daron Acemoglu and James Robinson.

Charles starts off by saying:

The book neatly summarizes why nations fail in a few lines:

(A nation) is poor precisely because it has been ruled by a narrow elite that has organized society for their own benefit at the expense of the vast mass of people. Political power has been narrowly concentrated, and has been used to create great wealth for those who possess it.

…click on the link above for the rest of the article…

The IMF and Austrian Theory – Ludwig von Mises Institute Canada

The IMF and Austrian Theory – Ludwig von Mises Institute Canada.

Back in the early 1960s, financial journalist Henry Hazlitt warned against efforts to create an international system to help facilitate the smooth transfer of currencies. Representatives from the world’s leading governments were attempting to increase liquidity in global markets. They wanted to make sure the banking system and sovereign governments would never had a lack of funds. Hazlitt was not fooled. “In plain English” he wrote, “they are pushing for more world inflation.” His words, though accurate, went unheeded. The International Monetary Fund, which was established decades earlier, was to play a role in facilitating endless inflation.

Back in the early 1960s, financial journalist Henry Hazlitt warned against efforts to create an international system to help facilitate the smooth transfer of currencies. Representatives from the world’s leading governments were attempting to increase liquidity in global markets. They wanted to make sure the banking system and sovereign governments would never had a lack of funds. Hazlitt was not fooled. “In plain English” he wrote, “they are pushing for more world inflation.” His words, though accurate, went unheeded. The International Monetary Fund, which was established decades earlier, was to play a role in facilitating endless inflation.

Half a century later, the IMF has overseen a tumultuous business cycle that came to a screeching halt in 2008. Big, overleveraged banks were on the verge of collapsing; millions of people lost their jobs and their homes; governments spent billions of dollars to maintain their welfare safety nets. The end result, which is still ongoing, is stagnant economic growth with dim prospects for recovery.

…click on the above link for the rest of the article…