Home » Posts tagged 'canada' (Page 11)

Tag Archives: canada

Greta Thunberg Urges Norway and Canada to Honor Climate Commitments

Greta Thunberg Urges Norway and Canada to Honor Climate Commitments

When you want a seat on the UN Security Council, the last thing you need is a teenage activist, practiced at the art of shaming government officials, working against you. However, that’s just what Norway and Canada have.

Canada, Norway and Ireland are vying for the two available seats on the UN Security Council. Enter Greta Thunberg, bearing some free and stern advice.

The 17-year-old Swedish climate activist is the headline signatory on a letter to UN ambassadors of small developing nations. The letter argues that Canada and Norway both say they are concerned about the climate crisis, but will not shed their ardent commitment to expand fossil fuel production, build pipelines through native land, and subsidize oil companies, as the CBC reported.

“For the young generation who will inherit the consequences of these decisions, it is critical that those who claim to be leading on climate action are held to account for decisions they are making back at home,” the letter reads, according to the CBC.

The letter also featured the signature of three other youth activists and 22 climate scientists.

The writers argue that if Canada wants to honor its commitment to the Paris agreement, it should make permanent its temporary ban on extracting oil and gas in the Arctic, cancel both the Trans Mountain and Keystone XL pipeline projects, and end all subsidies to the oil and gas industry, according to Radio Canada International.

Canada, despite its pristine air and forests, is actually among the worst in the G20 in meeting its Paris agreement greenhouse gas emissions targets, according to data compiled in 2019 by Climate Transparency, as Radio Canada International reported.

…click on the above link to read the rest of the article…

Job Loss Disaster Slams Low-Wage, Young Workers

Job Loss Disaster Slams Low-Wage, Young Workers

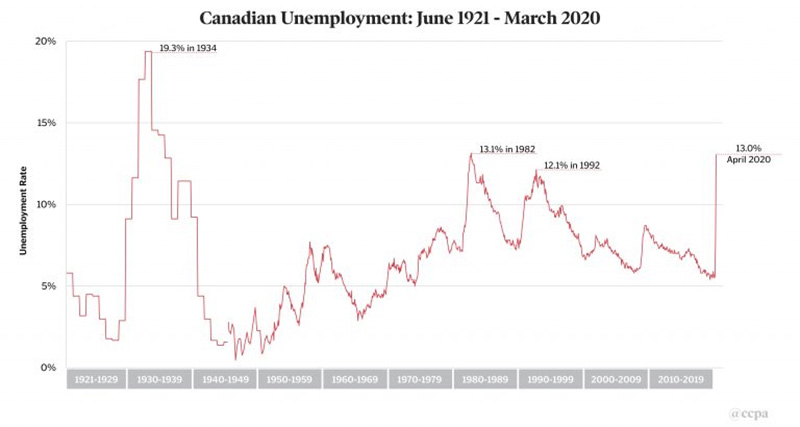

April numbers show three million lost jobs, while another 2.5 million people had their hours cut in half.

We thought the March jobless numbers were bad, but it is almost a good news story compared to what we saw Friday in the April figures.

The unprecedented closure of major sections of Canada’s economy in mid-March is finally being reflected in the jobless numbers. Of course, without those closures we would be in a historic health crisis with emergency rooms overflowing and our health system shutting down, as we saw elsewhere.

In that sense, this shutdown was exactly the right thing to do. I look at these unprecedented joblessness numbers and think: this is how we protected many workers from contracting the virus — though they sacrificed their income.

The official unemployment rate for April is 13 per cent. This is a historic high. There was a single month, December 1982, when unemployment was slightly higher at 13.1 per cent. But after that one month you’d have to go back to May 1936 at the end of the Great Depression to see anything similar. Put another way all jobs created since October 2005, 15 years ago, have been lost by April 2020. While the March data was collected as the shutdown was in progress during the third week of March, the April figures show the full impact of a month’s worth of pandemic lockdown.

…click on the above link to read the rest of the article…

Rabobank: Stocks Go Up As Everything Is Going Down In Flames

Rabobank: Stocks Go Up As Everything Is Going Down In Flames

It’s All Going to the Dogs (and Goats)

Friday’s April US payrolls report showed 20.5 million jobs lost when in an ordinary downturn 200,000 might be considered bad; the drop in March alone was larger than that seen during the worst of the global financial crisis. In short, we face a global future of mass unemployment (now 14.7% in the US and 13% in Canada) on top of mass debt, both public and private.

Last week the German Constitutional Court (GCC) ruled that it is superior to the European Court of Justice (ECJ), and that the ECB has three months to prove it is not exceeding its remit with its extraordinary monetary policy. Yesterday the President of the EU Commission von der Leyen threatened to sue Germany, stating the final word on EU law is always spoken by the ECJ. Guess which court ultimately hears the case? The ECJ. How is this going to play out if the GCC doesn’t back down? Very badly in the Eurozone periphery, to the benefit of Euroskeptics. How is it going to play out in Germany if the GCC is forced to back down? Badly in Germany, to the benefit of Euroskeptics. Given the ECJ won’t back down and the ECB has said it will ignore the GCC, and the GCC is not likely to blink either, we seem set for an institutional crisis over the scope and shape of the Eurozone financial market – albeit one that rumbles on rather than erupting immediately.

US Vice-President Mike Pence, titular head of the US virus task force, is self-isolating after figures close to the White House were diagnosed as positive for Covid.

…click on the above link to read the rest of the article…

Why Trump Is Desperate To Secure This Rare Metal

Why Trump Is Desperate To Secure This Rare Metal

While the United States is slowly working towards ending the lockdown and restarting the economy, the federal government is quietly fighting a second war with China over critical metals.

One of those critical metals in particular is the extremely rare key to global technological dominance because it’s crucial to winning the 5G war–the national security battle of the century.

The metal is cesium (Cs), the most active metal on Earth, and it’s so rare that it’s hard to even put a price on it. It’s also a vital ingredient in our ability to make 5G happen.

Despite this, America has none, and it dropped the ball a long time ago. At the 11th hour, the Trump administration is now bent on reversing the loss of cesium to China, spanning the globe for lower-risk venues with potential reserves.And that desperate search for cesium potentially makes one particular Canadian junior miner–Power Metals (TSXV:PWM,OTC:PWRMF)–a highly critical component.

There are only three cesium mines in the world and Power Metals owns three of the five cesium occurrences in the province of Ontario.

In February this year, Power Metals started drilling for what is hoped to become the only potential cesium mine that China doesn’t already control.

“There is a global shortage of this rare metal and we are very lucky to have found it at our 100% owned Case Lake Property with grades as high as 14.7 % Cs2O,” Power Metals Chairman Johnathan More said in a recent press release.

Cesium: The Star of the Critical Minerals Show

Unlike some other commodities, cesium is immune to the demand-decimating effects of the coronavirus pandemic because it is critical to everything from the 5G revolution, healthcare advances and defense to oil and gas drilling–and even time itself.

…click on the above link to read the rest of the article…

U.S. Oil, Gas Rigs Fall Below 400 For The First Time Since 1940

U.S. Oil, Gas Rigs Fall Below 400 For The First Time Since 1940

Baker Hughes reported on Friday that the number of oil and gas rigs in the US fell again this week by 34, falling to 374, with the total oil and gas rigs sitting at 614 fewer than this time last year as U.S. drillers scurry to keep their heads above water amid strict stay-at-home orders that caused oil demand to plummet at alarming rates—and oil prices along with it.

It is the fewest number of active rigs since Baker Hughes started to keep in 1940.

The number of oil rigs decreased for the week by 33 rigs, according to Baker Hughes data, bringing the total to 292—a 513-rig loss year over year. It is the fewest number of active oil rigs since late 2009.

The total number of active gas rigs in the United States fell by 1 according to the report, to 80. This compares to 183 a year ago.

The EIA’s estimate for the week is that oil production in the United States fell to 11.9 million barrels of oil per day on average for week ending May 1, which is 1.2 million bpd off the all-time high and a substantial 300,000 bpd lower than the week prior. It is the fifth straight weekly production decline. It is the first sub-12 million bpd rate in the United States since February 2019.

Canada’s overall rig count decreased by 1 rigs this week, to 26 rigs. Oil and gas rigs in Canada are now down 37 year on year.

At 1:12 am, WTI was trading up 1.53% at $23.91, while the Brent benchmark was trading up 2.82% at $30.29.

Ignoring US Alarms, Alberta Meat Packers Spawned Canada’s Biggest Outbreak

Ignoring US Alarms, Alberta Meat Packers Spawned Canada’s Biggest Outbreak

As the virus gripped US plants, the union pleaded for a shutdown. They were rebuffed.

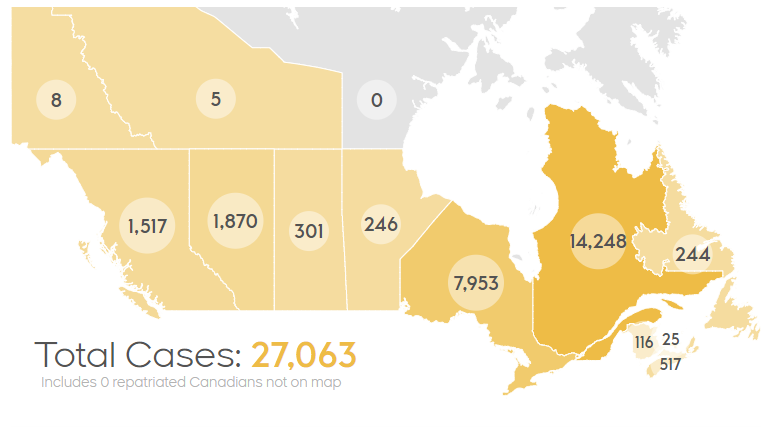

Canada’s largest outbreak of COVID-19 swept through two meat-packing plants in southern Alberta two weeks after the provincial government ignored union requests to temporarily close both of the plants.

And it mirrored a series of recent, well-documented hot-zone eruptions in meat plants in the United States.

More than 600 immigrant workers and community members have been infected while the disease has killed at least three people at Cargill’s High River plant and the JBS food plant in Brooks, Alta.

“The real issue here is a moral issue,” charged Thomas Hesse, president of the United Food and Commercial Workers Local 401, which represents workers at the plants. “How do we as a society want to bring food to our tables?”

Rachel Notley, the former premier of Alberta, has called for a full public inquiry.The Tyee is supported by readers like you Join us and grow independent media in Canada

“It is unconscionable that we now have a situation where hundreds of people have contracted a deadly virus,” said Notley, who leads the NDP Official Opposition. “What kind of concerns put the lives of workers so low?” she asked on CBC Radio yesterday.

Alberta’s growing outbreaks follow in the wake of deadly events in the U.S. where meat-packing plants have become COVID-19 incubators.

The U.S. recorded its largest single cluster of cases at a pork-processing facility in Sioux Falls, South Dakota in early April. By the time the Chinese-owned facility closed for two weeks there were nearly 900 cases.

…click on the above link to read the rest of the article…

For Oil and Its Dependents, It’s Code Blue

For Oil and Its Dependents, It’s Code Blue

The great price collapse of 2020 will topple companies and transform states.

If oil has been laid low by the coronavirus, then the nations whose economies most depend on it might soon be on ventilators. By any prognosis the great oil price collapse of 2020 has pushed the world’s most volatile commodity into Code Blue.

No one expects oil, its peddlers or consumers to emerge wealthier or wiser from this crisis. Oil company bankruptcies, already happening before the pandemic, will escalate. And more petro states will begin to stumble, like Venezuela, down the rabbit hole of collapse.

The pandemic, combined with suicidal overproduction and a brief price war between Russia and Saudi Arabia, has reduced oil consumption and revenues on a scale that is mindboggling.

Prior to the pandemic, the world gulped about 100 million barrels a day, filling the atmosphere with destabilizing carbon. Today it sips somewhere between 65 million and 80 million barrels.

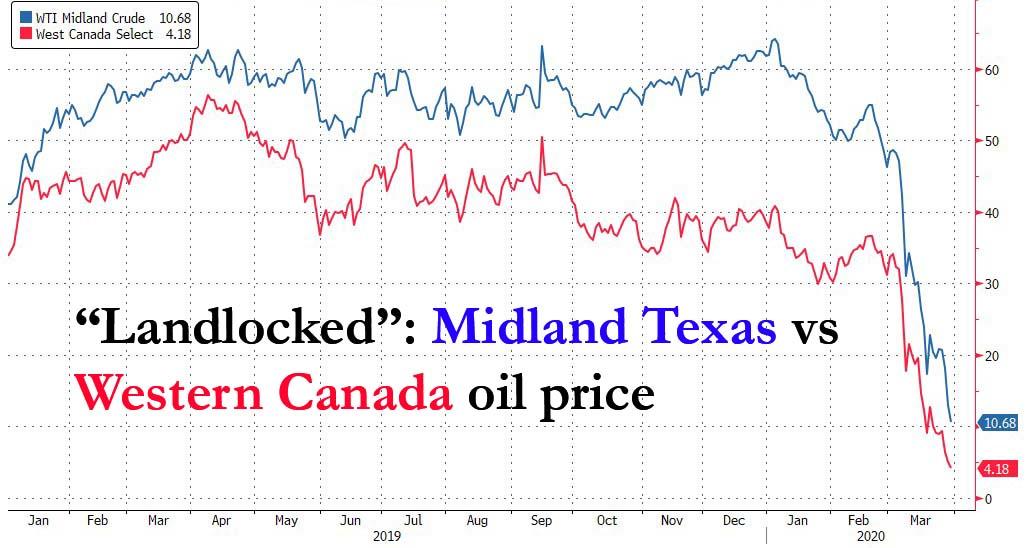

At least 20 to 30 per cent of global demand has vanished and nearly two dozen petro-producing countries including Canada have agreed to withhold nearly 10 million barrels from the market. Few expect this agreement will stop the price bleeding.

In fact, the price of Western Canadian Select or diluted bitumen remains below five dollars a barrel — cheaper than hand sanitizer. That’s a drop of more than 80 per cent compared to the month before.

Because the spending of oil fertilizes economic growth and expands national GDPs, most of the world’s economists now predict a long depression after the pandemic.

…click on the above link to read the rest of the article…

Pandemic ‘poses particular challenges’ for food processing plants: Freeland

Pandemic ‘poses particular challenges’ for food processing plants: Freeland

Agriculture Minister Marie-Claude Bibeau warns labour shortages could affect the food supply

Deputy Prime Minister Chrystia Freeland says the government is working on ways to support Canada’s food processing plants during the COVID-19 pandemic in response to concerns about labour shortages.

“I am so grateful to all of our farmers and ranchers and food processors, but you’re right that the coronavirus poses particular challenges to food processing facilities because of the dangers of contagion there,” Freeland said during her briefing with reporters today.

“That is something that our government has been working on, that I’ve been personally focused on over the past few days.”

Cases of COVID-19 have been confirmed at three Alberta meat packing plants, according to the union that represents plant workers.

United Food and Commercial Workers Canada Union local 401 president Thomas Hesse said three cases of COVID-19 have been confirmed at the JBS plant in Brooks, Alta.

At the Cargill plant in High River, there are 38 COVID-19 cases, and in March one worker at Harmony Beef in Balzac tested positive, he said.

Hesse said the union has reached out to those plants, and to the Olymel pork plant in Red Deer, to ask them to proactively shut down to keep their workers safe.

“They’ve all said no. But Cargill has in some ways done what we’ve asked because of pressure,” Hesse said, noting that the plant has reduced its operations.

Meanwhile, the Olymel hog slaughter and cutting plant in Yamachiche, Que., reopened Tuesday after shutting down for two weeks following an outbreak among employees there.

…click on the above link to read the rest of the article…

OPINION: Foxes in the henhouse – Who decides where bailout money goes?

OPINION: Foxes in the henhouse – Who decides where bailout money goes?

In the wake of the COVID-19 pandemic, trillions of bailout dollars in the U.S. and Canada are about to be fire hosed into particular areas of the economy. Given that this is public money held by governments, who decides where and to whom these funds should go?

It is logical that workers, professionals, small and medium businesses should have a central role in this, given their critical involvement in the creation of value in the economy and that they constitute almost the entire population of North America. But they don’t. Instead, key power and authority has been handed over to a small group of private mega-banks and financiers.

For example, the U.S. Treasury, which will be providing the bailout funding in the U.S., is a public institution which is supposed to answer to Congress. Yet, for much of the bailout, the Trump administration has taken the authority away from the U.S. Treasury and given it to the private banks of the Federal Reserve. In turn, the Federal Reserve banks have appointed BlackRock, the largest private asset manager and “shadow bank” in the world, to oversee whole sections of the bailout and to decide which corporations and institutions are to live or die.

However, neither the Federal Reserve nor BlackRock will be liable for any of the risk associated with the bailout loans no matter their quality. All the risk and backstopping of corporate defaults will fall onto the U.S. Treasury and by extension the American people (1). This is not a minor issue. With BlackRock and other financial institutions at the helm, who is going to benefit from these bailouts to selected corporations which will amount to $4.5 trillion (or by some estimates even more)?

…click on the above link to read the rest of the article…

Canadian Meat Industry Warns Of “Immediate And Drastic” Impact To Supply

Canadian Meat Industry Warns Of “Immediate And Drastic” Impact To Supply

We have been covering the impact of coronavirus on meat processing facilities in the U.S. and now it looks as though Canada is feeling the shockwaves as well.

The country’s supply chain could come under pressure as industry leaders in Canada have warned of “immediate and drastic” effects from the closures of key North American meat processing facilities, according to CTV.

And in Canada, a number of facilities have been reduced, including one Cargill plant in Alberta where dozens of employees have tested positive for coronavirus.

Michelle McMullen, communications manager at the Canadian Cattlemen’s Association, said: “This single facility represents just over one-third of Canada’s total processing capability, so the impacts to the Canadian beef industry are expected to be immediate and drastic.”

CCA president Bob Lowe said North American production has been “severely limited” and has called on the Canadian government to implement measures to help out Canadian farmers. “The Canadian beef industry is facing a period of extraordinary uncertainty,” he said.

He continued: “Existing programs do not address the particular threats we are facing and in fact fall quite short. These are challenging times for all Canadians; it is together that we can implement solutions to ensure healthy and affordable food continues to be readily available.”

Recall, just yesterday we wrote about the biggest pork producer in the U.S., Smithfield, who shuttered one of its largest factories after a coronavirus outbreak.

Smithfield also issued a warning of its own, stating that meat supplies are “perilously close to the edge of shortfalls”.

The company shut down its Sioux Falls, SD plant, which accounts for 4% to 5% of U.S. production. The news comes after more than 200 cases of Covid-19 were reported among employees.

…click on the above link to read the rest of the article…

Canada: Police to Make Home Visits to Check Quarantine Compliance

Canada: Police to Make Home Visits to Check Quarantine Compliance

Violators face up to $1 million fine and three years in jail.

Police in Canada will visit the homes of people under coronavirus quarantine to check they are in compliance, with those who flout the law facing a fine of up to $1 million dollars and three years in jail.

Under the law, Canadians who have returned from abroad or are at risk of having been infected with COVID-19 are mandated to remain at home for 14 days.

Police say they will visit the homes of those under quarantine and advise them of the “potential consequences of non-compliance,” adding that violators could face “significant penalties, including fines and imprisonment.”

“The maximum fine for failing to comply with the quarantine is $750,000 and up to six months in prison, but those who put others at risk through could face harsher penalties: up to a $1-million levy and three years imprisonment,” reports Global News.ca.

The RCMP said that the checks would be facilitated through authorities first contacting persons by phone, text or e-mail and then having officers perform a “physical verification with the individual while maintaining physical distancing.”

Police say arrests of people flouting the law would be a last resort but that officers could issue them with a summons requiring them to appear in court.

Ontario to release ‘stark’ COVID-19 projections Friday

Ontario to release ‘stark’ COVID-19 projections Friday

Premier Doug Ford promising a ‘sobering discussion’ about the coronavirus

Provincial health experts are expected to provide a briefing Friday on modelling projections for the spread of COVID-19 in Ontario.

At a Thursday afternoon press conference, Premier Doug Ford promised health officials would explain “where this could go.” Ford said the people of the province “deserve to see” the same data about the pandemic that he sees.

“People are going to see some really stark figures,” Ford said.

“It’s going to be a real sobering discussion.”

Matthew Anderson, the head of Ontario Health, Adalsteinn Brown, dean of the University of Toronto’s public health department, and Dr. Peter Donnelly, who heads Public Health Ontario, will hold a news conference to explain the models. CBC news will stream that briefing live starting at around 12 p.m. E.T.

Most ICU beds full

The number of available intensive care beds in certain parts of the Greater Toronto Area is rapidly shrinking as the number of COVID-19 patients surges higher, according to data obtained by CBC News.

Just 13 critical care beds remain available among the 153 ICU beds in the hospitals of the Central Local Health Integration Network, which includes Mackenzie Richmond Hill, Markham Stouffville, Southlake, Humber River, and North York General hospitals.

Those hospitals are caring for 28 patients with confirmed cases of COVID-19 — double the number they were four days earlier.

…click on the above link to read the rest of the article…

Texas Or Canada: Where Will Oil Hit $0 First

Texas Or Canada: Where Will Oil Hit $0 First

Looking at the future of oil prices, Goldman was downright apocalyptic in its short-term forecast, when in a note published this morning, the bank’s chief commodity strategist Jeffrey Currie speculated that as the current production glut “shock” cripples the crude transportation networks, “a producer would be willing to pay someone to dispose of a barrel, implying negative pricing in landlocked areas.” To wit:

The global economy is a complex physical system with physical frictions, and energy sits near the top of that complexity. It is impossible to shut down that much demand without large and persistent ramifications to supply. The one thing that separates energy from other commodities is that it must be contained within its production infrastructure, which for oil includes pipelines, ships, terminals, storage facilities, refineries, and distribution networks. All of which have relatively small and limited spare capacity. We estimate that the world has around a billion barrels of spare storage capacity, but much of that will never be accessed as the velocity of the current shock will breach crude transportation networks first, which we are already seeing evidence of around the world. Indeed, given the cost of shutting down a well, a producer would be willing to pay someone to dispose of a barrel, implying negative pricing in landlocked areas.

A quick look at two of the most popular landlocked oil producing areas demonstrate that Goldman is spot on, and as the following chart shows as of this moment Texas Midland WTI was trading at just baove $10/barrel, while the price of oil produced in the notoriously landlocked Western Canada, as represented by Canada Western Selected index, was just above $4 per barrel, or a little more than what a gallon of gas costs in California.

‘This will not be contained’: Experts cast doubt that spread of COVID-19 can be stopped

‘This will not be contained’: Experts cast doubt that spread of COVID-19 can be stopped

Outside China, there have been more than 7,000 cases in 60 countries and more than 100 deaths

While the World Health Organization has said the risk of COVID-19 spreading worldwide is now “very high”, officials have suggested that efforts to combat the coronavirus are still in the containment phase.

But some medical experts believe that the containment stage has long since passed, that the spread of the COVID-19 is inevitable, and that living with the coronavirus could become a reality. COVID-19 is the respiratory illness caused by the new coronavirus.

“This will not be contained, this has not been contained,” said Isaac Bogoch, an infectious disease physician at Toronto General Hospital.

Massive public health efforts have been helpful in slowing down the spread of the infection and reducing the pace and frequency of exported cases from China to the rest of the world, but containment has not worked, Bogoch said.

‘Will continue to spread’

“This is spreading throughout the world and it will continue to spread throughout the world,” he said.

On Friday, WHO director-general Tedros Adhanom Ghebreyesus told a news conference that the Geneva-based health agency has “increased our assessment of the risk of spread and the risk of impact of COVID-19 to very high at a global level.”

China has seen more than 80,000 confirmed cases and almost 3,000 deaths. Outside China, there have been more than 7,000 cases in 60 countries, with more than 100 deaths.

…click on the above link to read the rest of the article…

RCMP Accused of Creating ‘Crisis of Press Freedom’ in Wet’suwet’en Raids

RCMP Accused of Creating ‘Crisis of Press Freedom’ in Wet’suwet’en Raids

Limits on reporters’ access, threats of arrest bring criticism from media, journalism groups.

The RCMP’s handling of the enforcement of an injunction in Wet’suwet’en territory has generated accusations that police unnecessarily interfered with reporters doing their jobs.

“This is them trying to control the media and block information getting out to the public, and that’s why it’s a misuse of police power,” said Karyn Pugliese, president of the Canadian Association of Journalists.

“Regardless of whether or not we get it perfect every time, we just can’t have a functioning democracy without media keeping an eye on the state and reporting back to the public on what they’re seeing so the public can make critical decisions about what kind of country they want to live in.”

An RCMP spokesperson says the police did what they needed to do to ensure safety as they enforced the injunction, and B.C. Premier John Horgan says anyone who feels their rights were infringed has recourse through law enforcement and the courts.

But Ethan Cox, an editor for Ricochet Media based in Montreal, said the police actions were an attack on journalists and the public’s right to know.

“This is a situation, a flash point, a very severe crisis of press freedom that’s happening in British Columbia,” he said. “This is a crisis, and we clearly have a police force that is not respecting the rights of the media and that’s a constitutional problem. That’s not some small potatoes issue.”

…click on the above link to read the rest of the article…