Why Assets Will Crash

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees.

The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash.

Most of you are aware that the bottom 90% own very little other than their labor (tradeable only in full employment) and modest amounts of home equity that are highly vulnerable to a collapse of the housing bubble. (The same can be said of China’s middle class, only more so, as 75% of China’s household wealth is in real estate, more than double the percentage of wealth held in housing in U.S. households.)

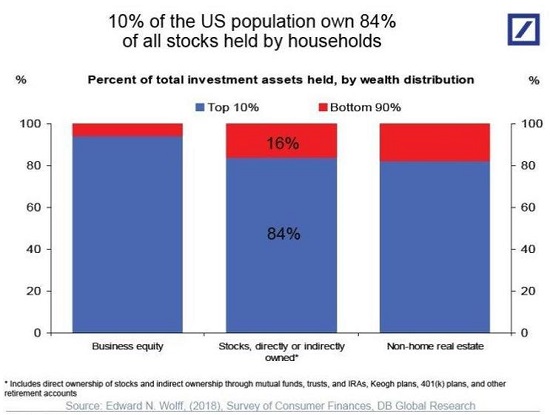

As the chart illustrates, the top 10% own 84% of all stocks, over 90% of all business equity and over 80% of all non-home real estate. The concentration of ownership of assets such as vintage autos, collectibles, art, pleasure craft and second homes in the top 10% is likely even greater.

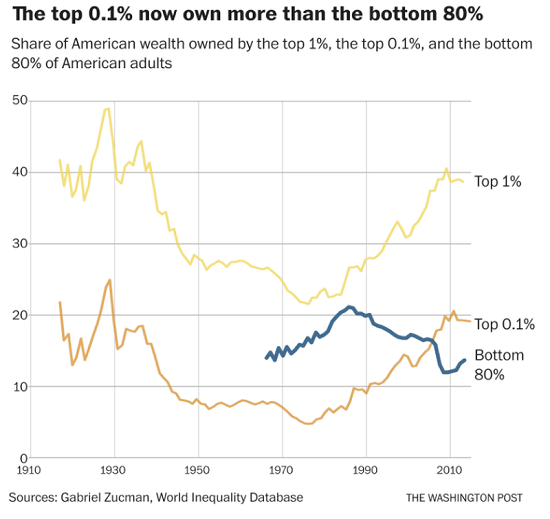

The more expensive the asset, the greater the concentration of ownership, as the top 5% own roughly 2/3 of all wealth, the top 1% own 40% and the top 0.1% own 20%. In other words, the more costly the asset, the narrower the ownership. (Total number of US households is about 128 million, so the top 5% is around 6 million households and the top 1% is 1.2 million households.)

This means the pool of potential buyers is relatively small, even if we include global wealth owners.

…click on the above link to read the rest of the article…