The Fed Is Losing Control Over Rates Again, This Time In The Other Direction

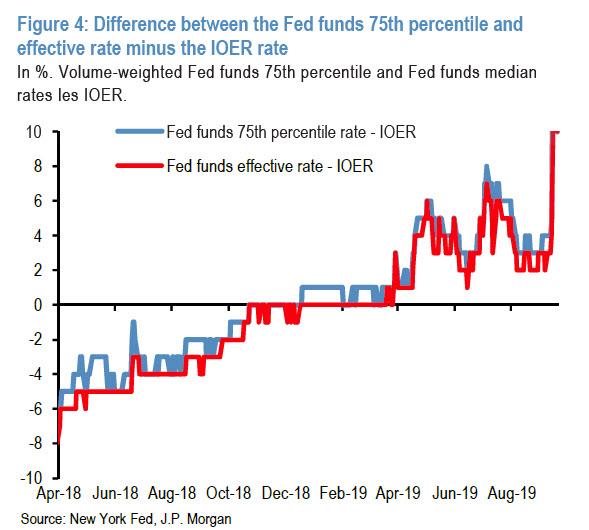

Starting in late March, something unexpected happened: as the Effective Fed Funds rate drifted higher, it broke above the implicit upper bound on the interest rate corridor defined by the Interest on Excess Reserves. It was not meant to do this.

This loss of control over the effective Fed Funds rate prompted many to speculate that reserves (i.e. liquidity) in the system was too low, and sure enough, it all culminated with the end of the Fed’s tightening cycle which was followed by 3 rate cuts in the past 4 months, but more importantly, resulted in the repo crisis in late September (which we had previewed in August) and which served as the catalyst for Powell to launch “NOT QE” in October, whereby the Fed is now injecting $60 billion per month in liquidity via monetization of T-Bills, a process that has promptly sent the Fed’s balance sheet back over $4 trillion, an increase of $280 billion in 7 weeks.

Yet while the Fed’s emergency response to the repo crisis helped restore a “normal” level of liquidity to the system, another unexpected consequence has emerged: the Fed is now losing control of rates again, only this time in the opposite direction!

As Bloomberg points out this morning, as a result of its recent interference with market liquidity levels, the Fed’s key effective fed funds rate – aka the “main interest rate” that the Fed controls – is getting close to the edge of the range the Fed is targeting.

As shown in the chart below, after the Effective Fed Funds rate kept drifting ever high during the period of reserve scarcity, we now find ourselves on the other side of the boat, and as a result of the Fed’s actions such as repo operations and T-bill purchases, the effective fed funds rates has been pushed to 1.55%, just shy of the Fed’s lower bound target of 1.50% (the upper is at 1.75%).