Corporate Debt Is At Risk Of A Flash Crash

While some countries are more indebted than others, very few are in good shape.

The entire world is roughly 225% leveraged to its economic output. Emerging markets are a bit less and advanced economies a little more.

But regardless, everyone’s “real” debt is likely much bigger, since the official totals miss a lot of unfunded liabilities and other obligations.

Debt is an asset owned by the lender. It has a price, which—like anything else—can go up or down. The main variable is the lender’s confidence in repayment, which is always uncertain.

But there are degrees of uncertainty. That’s why (perceived) riskier debt has higher interest rates than (perceived) safer debt. The way to win is to have better insight into the borrower’s ability to repay those loans.

If a lender owns debt in which his confidence is low, but you believe has value, you can probably buy it cheaply. If you’re right, you’ll make a profit—possibly a big one.

That is exactly what happens in a recession.

Investment-Grade Zombies

While it’s easy to point fingers at profligate consumers, households largely spent the last decade reducing their debt.

The bigger expansion has been in government and business. Let’s zoom in on corporate debt.

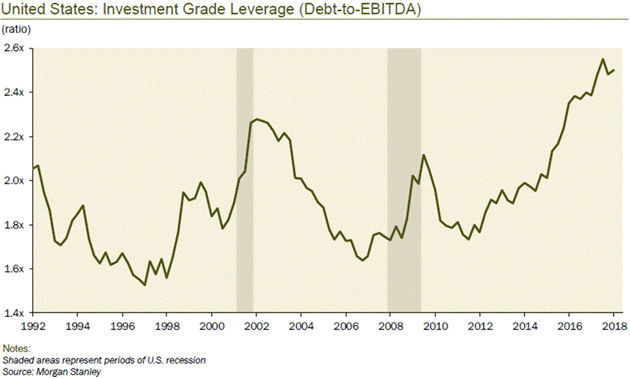

The US investment-grade bond universe is considerably more leveraged than it was ahead of the last recession:

Compared to earnings, US bond issuers are about 50% more leveraged now than in 2007. In other words, they’ve grown debt faster than profits.

Many borrowed cash not to grow the business, but to buy back shares. It’s been, as my friend David Rosenberg calls it, a giant debt-for-equity swap.

…click on the above link to read the rest of the article…