Quantitative Tightening Is the Biggest Economic Threat in 2018

In response to the 2008 financial crisis, the Fed and other central banks deployed zero or near-zero interest rates, quantitative easing, and assorted other interventions.

These may have averted an even worse disaster, but their impacts were far from ideal. Nonetheless, the economy slowly lifted off as consumers rebuilt their balance sheets and asset values rose.

The asset values climbed in large part because the Fed practically forced everyone with money to invest it in risk assets: stocks, real estate, corporate bonds, etc. But as my long-time Thoughts from the Frontline readers know, the Fed’s trickle-down monetary policy hasn’t really worked.

The resulting wealth effect theoretically enabled more spending, at least by those in the top income quintile. But the recovery has been slow and ugly, and too many people still don’t feel the progress.

QE Benefits Were Not Evenly Distributed

Those who gripe about income inequality actually have points to make.

Even if you filter out the top one half of 1% (the tech billionaires, Warren Buffett, et al.), there is still a large imbalance in how much the top and bottom earners have benefited from the Fed’s lopsided monetary policy.

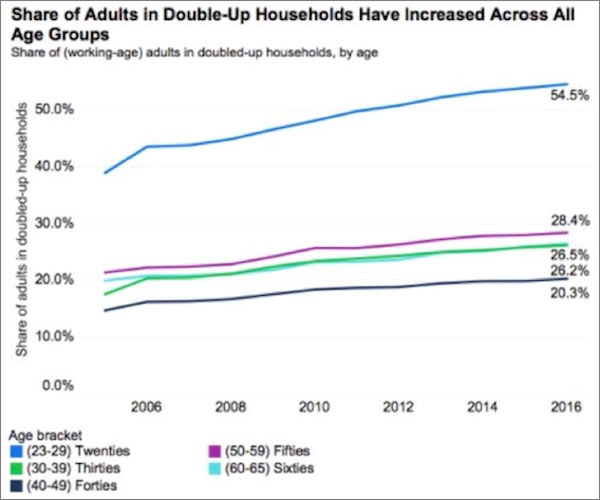

The chart below shows that the share of unmarried adults in double-up households has increased in all age brackets, and especially among Millennials.

Source: Zillow

Having a few Millennials in my own family, and even some young Gen Xers, the need to double up is readily apparent to me. Rents are just too high for the average person. Also notice that nearly one in three people between ages 50 and 59 is living with someone else in order to save on rent and other expenses.

…click on the above link to read the rest of the article…