Why We’re Doomed: Our Economy’s Toxic Inequality

Anyone who thinks our toxic financial system is stable is delusional.

Why are we doomed? Those consuming over-amped “news” feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency.

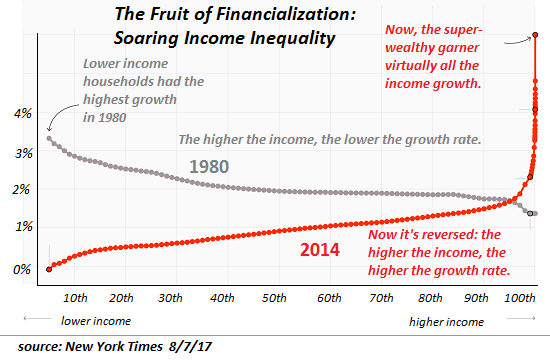

The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart.

While the essay’s title is our broken economy, the source of this toxic concentration of income, wealth and power in the top 1/10th of 1% is more specifically our broken financial system.

What few observers understand is rapidly accelerating inequality is the only possible output of a fully financialized economy. Various do-gooders on the left and right propose schemes to cap this extraordinary rise in the concentration of income, wealth and power, for example, increasing taxes on the super-rich and lowering taxes on the working poor and middle class, but these are band-aids applied to a metastasizing tumor: financialization, which commoditizes labor, goods, services and financial instruments and funnels the income and wealth to the very apex of the wealth-power pyramid.

Take a moment to ponder what this chart is telling us about our financial system and economy. 35+ years ago, lower income households enjoyed the highest rates of income growth; the higher the income, the lower the rate of income growth.

This trend hasn’t just reversed; virtually all the income gains are now concentrated in the top 1/100th of 1%, which has pulled away from the top 1%, the top 5% and the top 10%, as well as from the bottom 90%.

The fundamental driver of this profoundly destabilizing dynamic is the disconnect of finance from the real-world economy.

The roots of this disconnect are debt: when we borrow from future earnings and energy production to fund consumption today, we are using finance to ramp up our consumption of real-world goods and services.

…click on the above link to read the rest of the article…