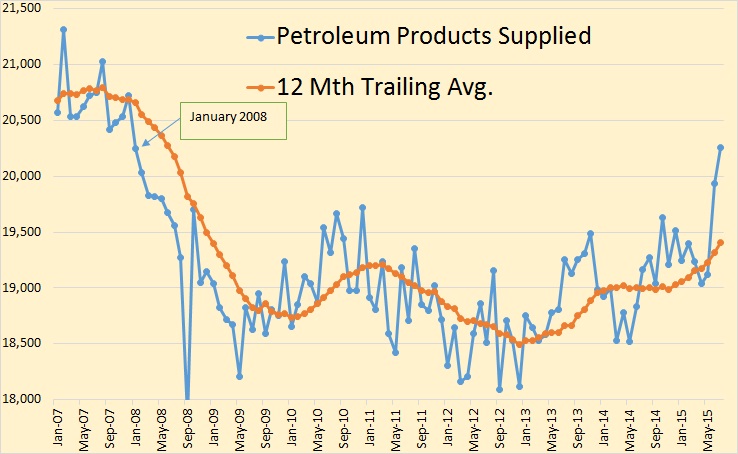

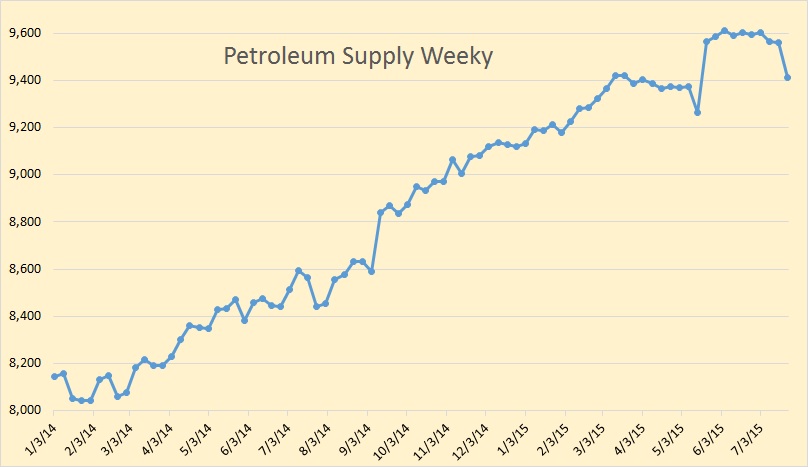

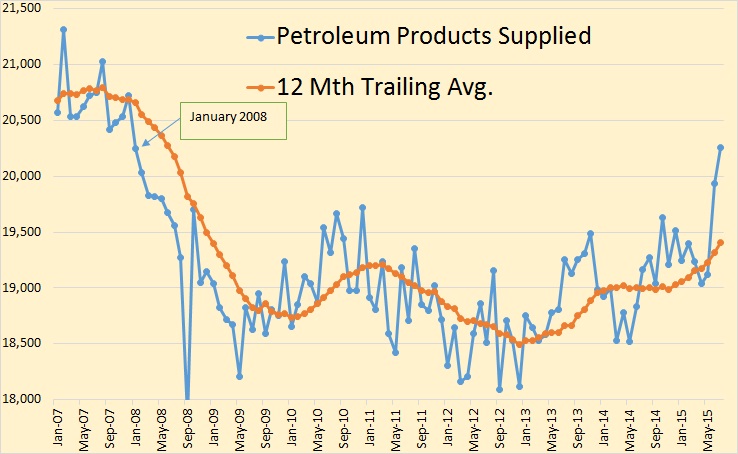

US consumption of total liquids, or as the EIA calls it, petroleum products supplied, reached 20,000,000 barrels per day for the first time since February of 2008.

Something I never noticed before, consumption started to drop in January 2008, seven months before the price, along with world production, started to drop in August 2008. This had to be a price driven decline. Could the current June and July increase in consumption be price driven also?

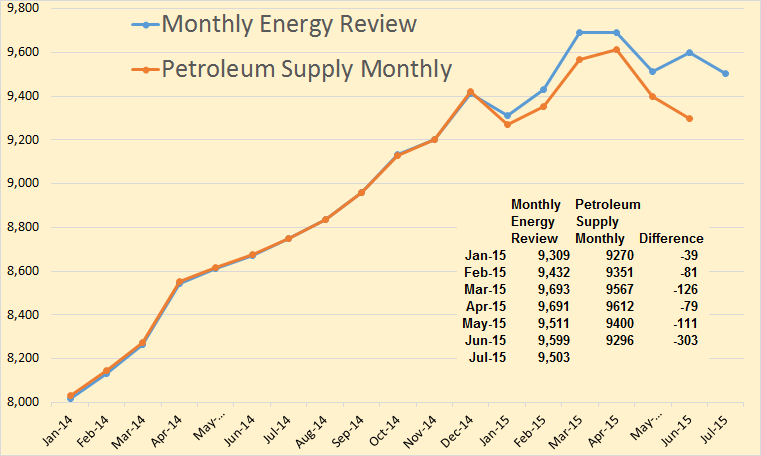

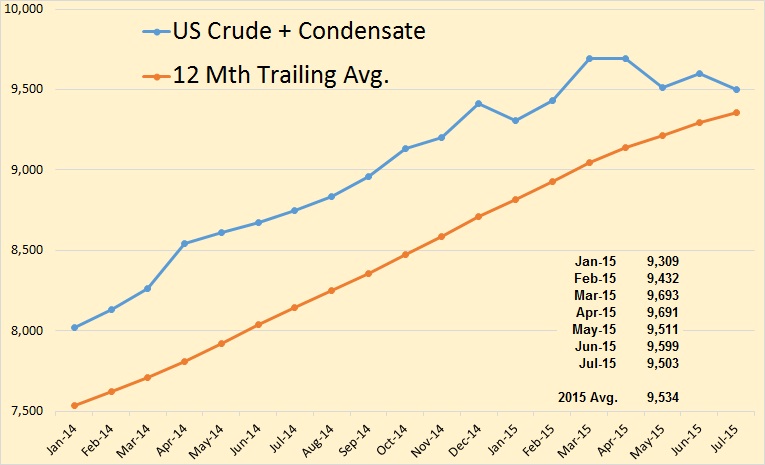

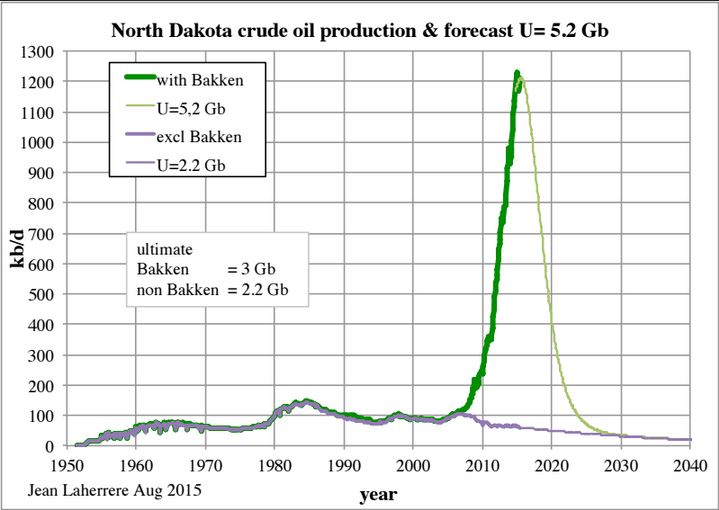

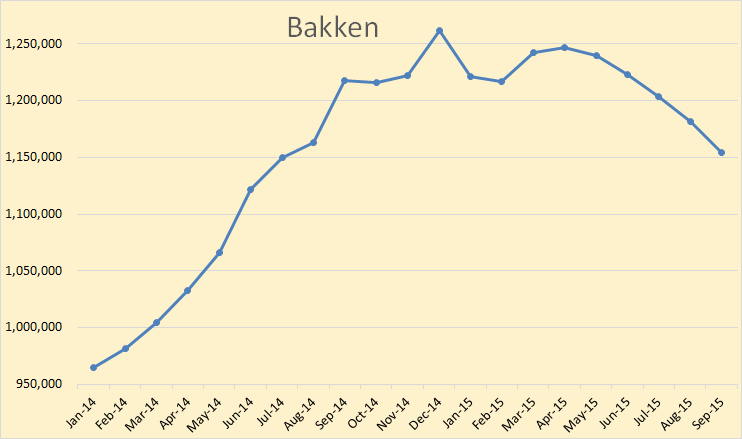

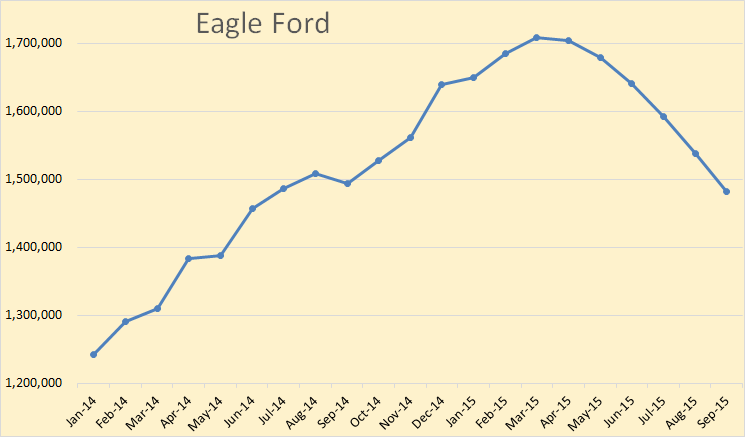

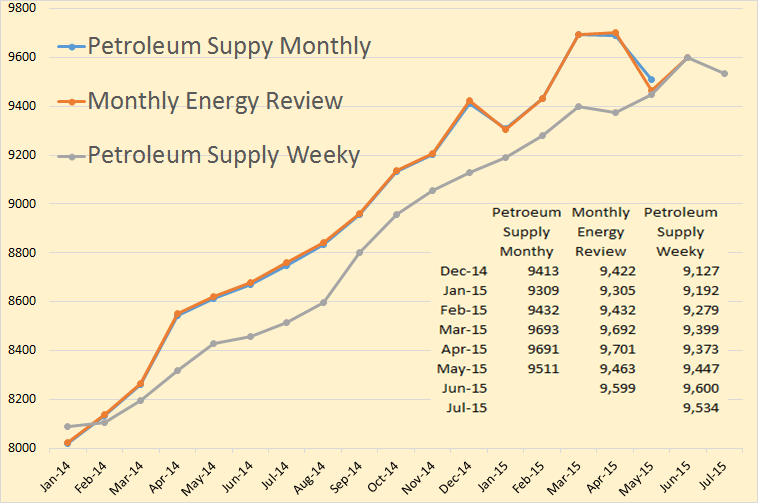

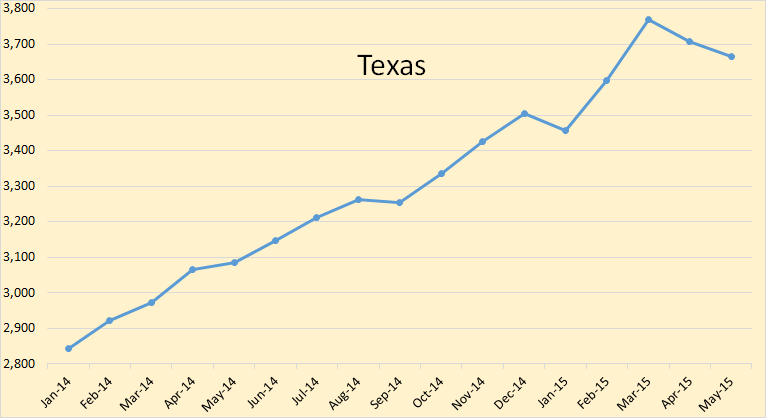

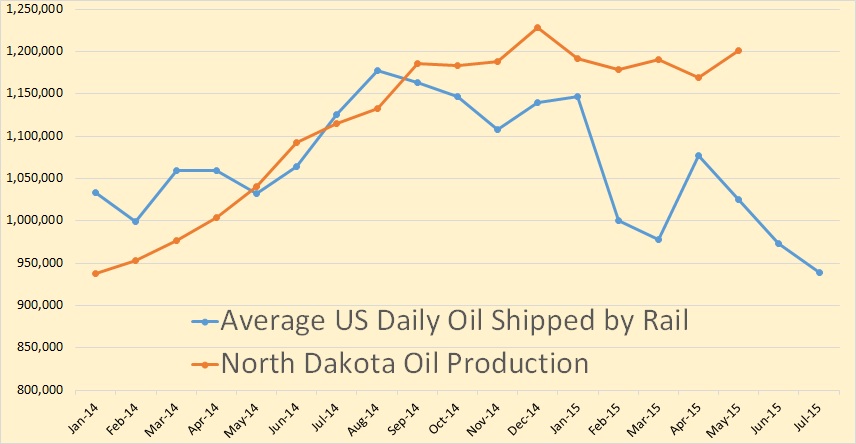

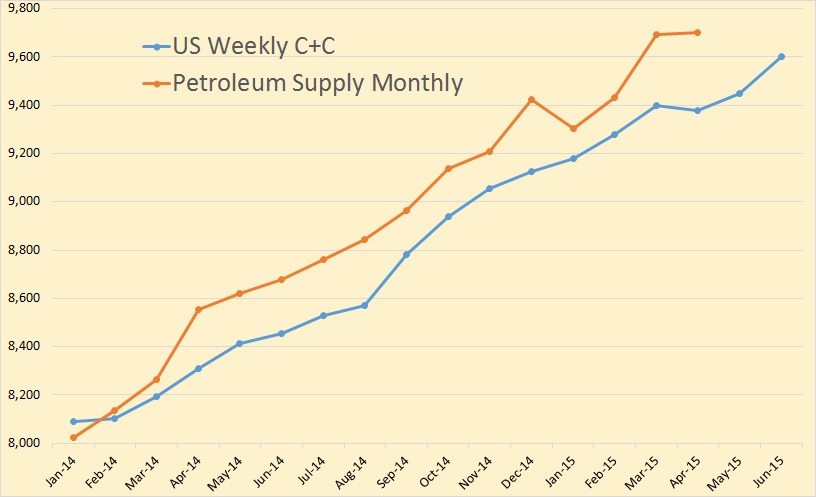

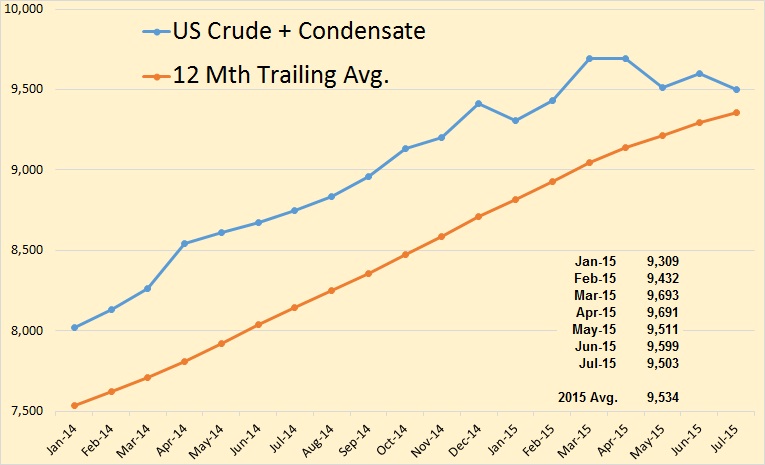

US Production was down 96,000 barrels per day in July to 9,503,000 bpd. That is 190,000 bpd below the March level of 9,693,000 bpd.

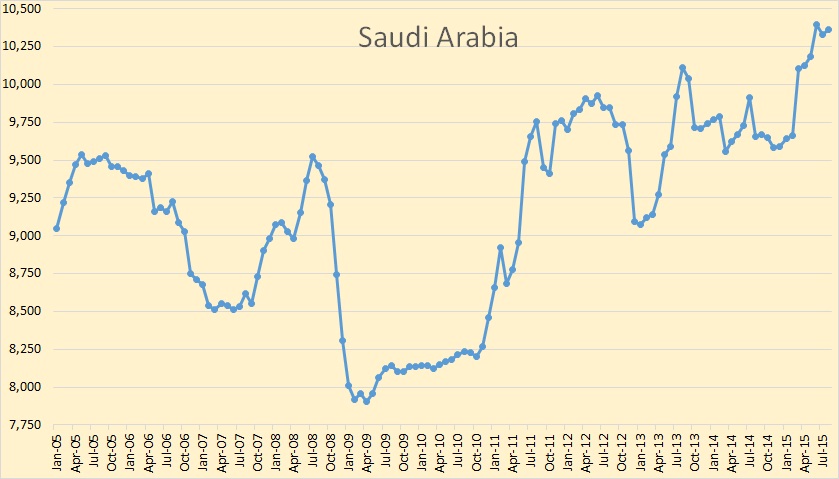

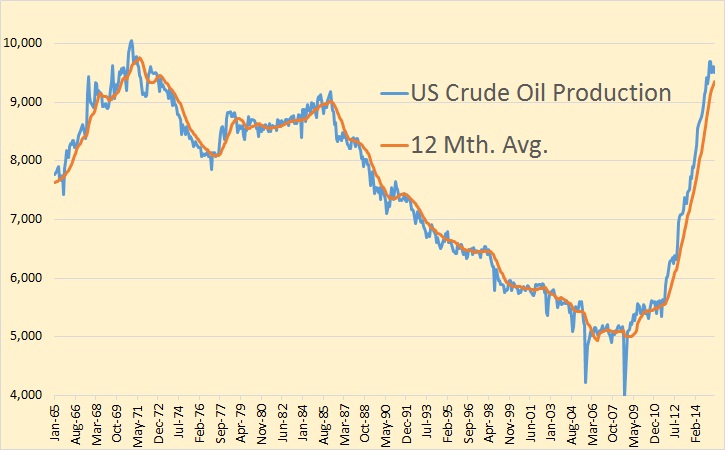

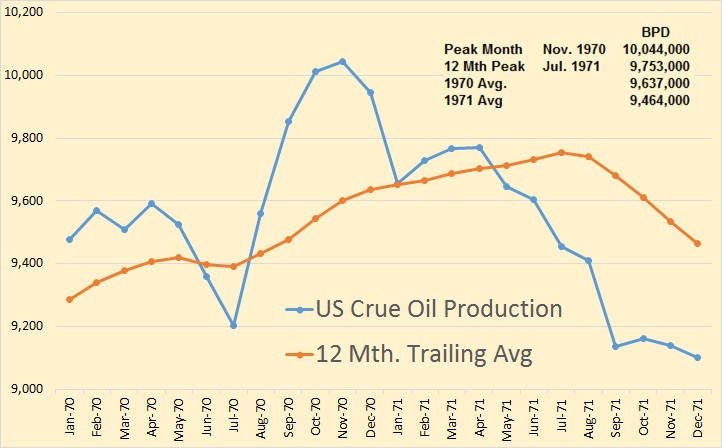

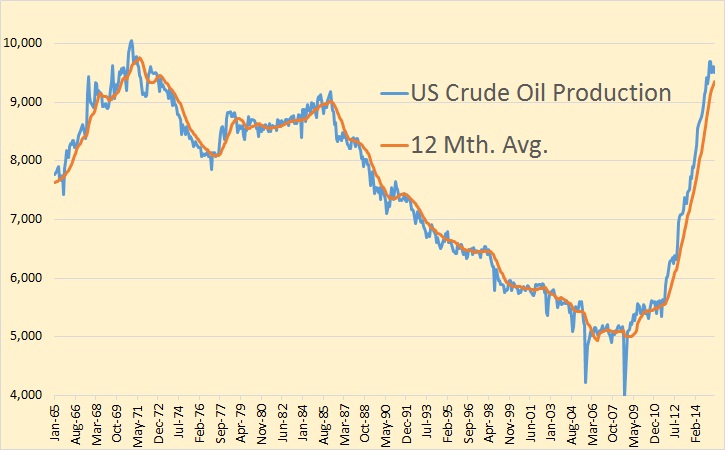

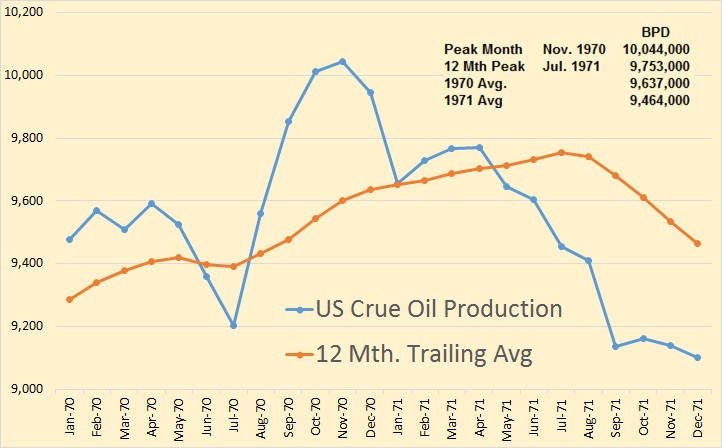

Here is what the last 50 years of US production looks like. The peak was in 1970 or 1971, depending on what you call the peak.

In March 2015 we were still 351,000 barrels per day below the peak month of 10,044,000 bpd in November of 1970. But right now we are headed in the wrong way to break that record. In July we were 541,000 bpd from that record. Right now the 2015 average, January through July, is 9,534,000 bpd. That is 103,000 barrels per day below the 1970 average. But the 2015 average is likely to get smaller as the year plays out.

I have another chapter from Peter Goodchild’s Tumbling Tide: Population, Petroleum, and Systemic Collapse. I really like this book. The author comes closest to matching my sentiments than anyone I have read to date.

Tumbling Tide Chapter 10

The Pollyanna Principle

The problem of explaining peak oil does not hinge on the issue of peak oil as such, but rather on that of “alternative energy.” Most people now have some idea of the concept of peak oil, but it tends to be brushed aside in conversation because of the common incantation: “It doesn’t matter if oil runs out, because by then everything will be converted to [whatever] power.” Humanity’s faith in what might be called the Pollyanna Principle—the belief that everything will work out right in the end—is eternal.

…click on the above link to read the rest of the article…