And five SPVs expired, including the one that bought corporate bonds and bond ETFs.

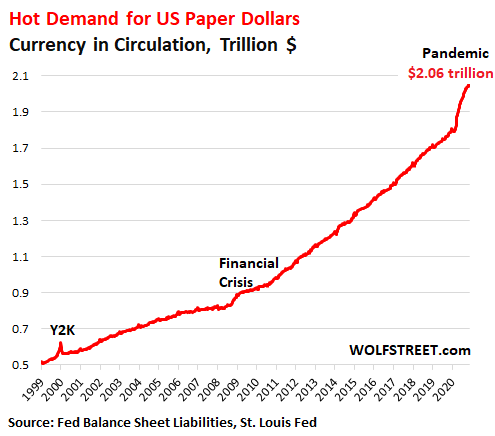

The Fed has now put on ice five of its SPVs (Special Purpose Vehicles) which had been designed back in March to bail out the bond market. It unwound its repo positions last June. Its foreign central bank liquidity swaps are now down to near-nothing except with the Swiss National Bank, which seems to have a need for dollars. The Fed has been adding to its pile of Treasury securities at the rate spelled out in its FOMC statements, thereby monetizing part of the US government debt. And it has been adding to its pile of Mortgage Backed Securities (MBS).

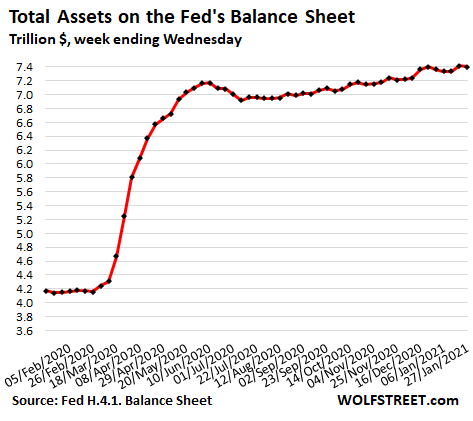

The result is that total assets on its weekly balance sheet through Wednesday, at $7.4 trillion, are roughly flat with the level in mid-December and are up by $200 billion from early June, with an average growth rate over the six-plus months of $30 billion a month.

And the crybabies on Wall Street that have for months been clamoring for more QE have been disappointed. It’s still a huge amount of QE, but for the crybabies on Wall Street, it’s never enough:

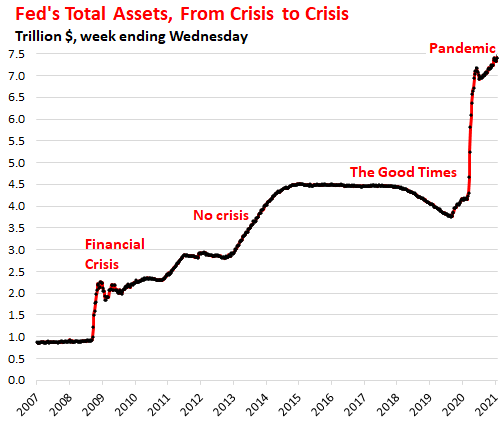

But the long-term chart shows just how hog-wild the Fed had gone, furiously trying to bail out and enrich the asset holders, which are concentrated at the very top, thereby creating in the shortest amount of time the largest wealth disparity the US has ever seen. From crisis to crisis, from bailout to bailout, and even when there is no crisis:

Repurchase Agreements (Repos) remained at near-zero:

…click on the above link to read the rest of the article…