…click on the above link to read the rest of the article…

News and views on the coming collapse

Home » Posts tagged 'currency' (Page 5)

This article was adapted from our latest book, “Sharing Cities: Activating the Urban Commons.” Download your free pdf copy today.

The Brixton district in South London’s Lambeth borough has been a bastion of progressive thought and culture for decades. After the financial crisis of 2008, local businesses were struggling and had trouble securing loans from banks. An area that had once thrived began to stumble.

The Brixton Pound (B£) was launched in 2009 by Transition Town Brixton to support local businesses with a local currency that would “stick to Brixton.” The founders of the B£ wanted to create a mutual support system tying residents to local businesses and encouraging business to source locally.

The local borough government, Lambeth Council, was supportive of the B£ from the beginning. It recognized the local currency as a way to develop the community, build local economic resilience, and draw positive attention to the area. According to B£ Communications Manager, Marta Owczarek, “The council’s support has greatly helped the B£ start and develop — it would have been very difficult to do what we did without that support. In particular, it acted as a guarantee that the scheme was trustworthy, so local business owners and residents alike felt secure in exchanging their money into and accepting the brand-new local currency.”

Within the first six months of the launch of the B£, Lambeth conducted research that estimated the media coverage of the currency generated by the B£ volunteers was worth half a million pounds to the area.

Since 2012, the B£ has “been a live part of the Co-operative Council, working alongside the policy team,” according to Owczarek. As a result, the B£ has been able to play an active role in supporting the community while receiving council support. The B£ helped set up community spaces like the Impact Hub in the Town Hall.

…click on the above link to read the rest of the article…

…click on the above link to read the rest of the article…

The EM contagion is slamming currencies around the globe, and while the Turkish Lira remains relatively immune for the time being, traders are now focusing their attention on the South African rand and the Argentine peso, both of which are in freefall this morning.

The ZAR has plunged 3.2%, the most since Nov. 10, 2016 on a closing basis, after the country reported that it had unexpected slumped into recession, which in turn is reigniting concerns about a rating agency downgrade. At the same time, the yield on rand-denominated government bonds has jumped 24bps to 9.24%, the highest since Dec. 1.

The Argentine peso is the other EM currency in freefall this morning, dropping 5.5% to 39 per dollar (vs the Friday close dueo the Monday US holiday) when the market opened in Buenos Aires Tuesday following a new series of measures announced by the government on Monday, including new export tariffs to help close fiscal gap by 2019, a move which the market clearly finds insufficient.

As Bloomberg notes, NY-traded shares of Argentine companies opened down, with the Bank of New York Mellon Argentina ADR Index dropping 4.4 percent at the open. Bank stocks led declines with drops of as much as 13 percent.

The emerging market currency crisis is not over yet, and could yet morph into a broader contagion that threatens to drag down oil demand.

Last week, Argentina’s peso fell by around 20 percent in just a few days, taking year-to-date losses over 50 percent. The central bank frantically hiked interest rates from 45 to 60 percent in an effort to stem the losses, hoping to halt the peso’s spiraling descent. The peso regained a bit of ground, but now trades at over 37 pesos to the dollar, compared to 27 pesos per dollar in early August and 18 pesos at the start of the year.

This may seem like a problem for Argentines, but the currency turmoil is indicative of a broader malaise sweeping over emerging markets. A whole range of currencies have lost ground this year, rattling financial markets and forcing central banks to hike interest rates.

Another way of saying the same thing is that the dollar has strengthened on the back of rate tightening from the U.S. Federal Reserve, which has battered currencies across the globe. This underscores a deeper problem with the global economy: After a decade of near-zero interest rates, how does the U.S. central bank withdraw extraordinary monetary stimulus without wreaking havoc on the global economy?

The stronger dollar hits emerging markets in several ways. First, it directly knocks down emerging market currencies in terms of their value against the dollar. But, from there, the problem gets worse. A weaker currency makes dollar-denominated debt in these countries much more expensive and much harder to pay off. That can slow down the economy because businesses have to cut back, consumers have trouble paying off debt, the risk of default rises and everything slows down.

…click on the above link to read the rest of the article…

On May 11, three days after Argentina secured a $50 Billion IMF bailout – the largest in the fund’s history – we jokingly noted that with the peso resuming its slide, an indication the market did not view the IMF backstop as credible, the ECB would need to get involved.

ARGENTINE PESO EXTENDS LOSS, HITS NEW ALL-TIME LOW AT 23.16/USD

Time to add ECB to IMF bailout

In retrospect, it now appears that this may not have been a joke, because with the Peso plummeting, and surpassing the Turkish Lira as the worst performing currency of 2018 having lost half its value YTD…

… with the bulk of the collapse taking place in August…

… Christone Lagarde had some very bad news for Buenos Aires and Argentina president Mauricio Macri: the IMF now insists that after burning through billions in central bank reserves, Argentina should stop using funds to support the peso, and float it freely.

According to Infobae, the Argentine foreign currency reserves have declined below the level demanded by the IMF, with Argentine authorities selling $2.5BN to support the peso in August; meanwhile the overall level of reserves has slumped even more, approaching the levels before the IMF bailout and failing to prop up the peso which, as shown below, has collapsed in a move reminiscent of what is taking place in hyperinflating Venezuela.

Worse, the Argentine Peso suffered its latest sharp drop in the days after the central bank unexpectedly hiked rates to 60% – the highest in the world – and another indication that the market is firmly convinced that not even the IMF backstop will force Argentina into a painful, and politically destabilizing structural program.

…click on the above link to read the rest of the article…

“All bets are off” in Argentina” – as Bloomberg puts it – where the value of the local peso has plummeted, falling 20% this week alone. It is now 50$ weaker on the year versus the USD, making it the worst performing currency of 2018 and sending massive shockwaves through Argentina’s economy. The effect on business owners and anyone who transacts in local currency has been profound, according to Bloomberg.

“There’s no clear price reference after the peso plunge,” one business owner told Bloomberg. The price plunge has created havoc for him and his surgical equipment business, where he buys in foreign currencies and sells in pesos.

Unlike hyperinflating economic basket case Venezuela, Argentina is a sizable $640 billion economy that is now being put to the test to see how much strain it can truly endure.

The peso crippling could also be a precursor to political unrest, as President Mauricio Macri’s chances of being reelected are reportedly falling, despite being known as a leader who has been friendly to the markets over the course of his tenure. However, as a result of the recent turmoil, he’s “struggling” to restore investor confidence in the Argentinian peso.

Argentina and its Central Bank have taken a number of decisive steps to try and halt the plunge, yesterday hiking interest rates to the world’s highest 60%. Previously, the country had requested quicker payouts from the International Monetary Fund, which promptly granted the collapsing country’s request.

And speaking of Argentina $50 billion loan agreement in place with the IMF – the largest ever in IMF history – this isn’t that too different from the country’s 2001 default, when it was on a similar IMF loan program. Since then, the country underwent a “decade of budget-busting left-populist government – and isolation from world financial markets”.

The result appears to be the country coming full circle.

…click on the above link to read the rest of the article…

Foreign currencies – especially the Emerging Markets – are having one of their worst years on record.

And investor anxieties aren’t easing up. . .

I wrote two weeks ago about the strong dollar and the chaos it’s creating for the Emerging Markets. But many don’t realize just how bad things have gotten. And it’s all thanks to the Federal Reserve’s tightening and quantitative tightening.

For starters, let’s just take a look at some of the worse performing currencies this year. . .

I wrote a very bearish assessment of Turkey and their currency – the Lira – back in early March.

And since then, the crisis in Turkey has dominated the news stream.

A big reason for Turkey’s currency crisis stems from the fact that their external debt burden has soared over the last few years. This means that Turkey borrowed significant amounts of U.S. dollar denominated debts (and euros).

Remember: when the dollar gets stronger – and when the Federal Reserve raises rates – the external debt burden gets harder to service.

And because the country has had a plaguing inflation problem over the last couple of years – this caused the Lira to slowly depreciate on foreign exchange markets.

But due to the U.S. dollar’s shocking rally since March 2018, the Lira really started to collapse. For instance, more than a third of its value got wiped out in just the last 30 days.

Making matters worse – the Turkish Central Bank Deputy Governor is rumored to resign. And Moody’s just downgraded the credit ratings of 20 Turkish financial institutions – such as banks.

Turkey’s increasingly fragile economy and currency signals that things are still far from over. . .

…click on the above link to read the rest of the article…

Despite four rate hikes by the Bank of Indonesia since May, the Indonesia’s rupiah slid to a two-decade low, falling to 14,750 per dollar, a level last hit during the Asian Financial Crisis of 1998, and just shy of an all time low, spurring yet another intervention from the central bank as the contagion from the collapse in Argentina and Turkey has turned the market’s attention on emerging markets with current account deficits.

Indonesia’s benchmark bond yields rose 10 basis points to the highest level since 2016, while the Jakarta Composite Index slipped as much as 1.3%.

The plunge took place despite a notice from the central bank that it was intervening in the foreign exchange and bond markets, according to Nanang Hendarsah, executive director for monetary management.

As a reminder, after Argentina and Turkey, Indonesia is next to be hit on this chart from JPM we first showed at the start of June, which plotted countries with a current account deficit and rising external debt.

The rupiah is down 7.8% this year, and first came under pressure from a resurgent greenback and climbing U.S. Treasury yields. The escalating trade war between the U.S. and China, followed by the Turkey turmoil then added to its woes. It’s the second-worst performing major Asian currency this year, after the Indian rupee.

Meanwhile, over in India, the rupee also fell to a new record low, trading 71.035 against the dollar, set for the biggest monthly decline in three years, although so far India’s capital markets excluding FX have barely been affected, with the Nifty trading just shy of all time highs.

As Bloomberg notes, as investors liquidated Turkish and Argentinian assets, countries with large current-account deficits such as Indonesia and India have also seen their currencies and bonds come under selling pressure.

…click on the above link to read the rest of the article…

In a barrage of headlines that sparked chaos in FX algo markets, The South African government proclaimed proudly that it is opposed to illegal land grabs (sparking a rally in the rand) before humans realized that this is mere statement of fact and that the entire reason for this process is to ‘legalize’ land grabs through reform.

As Deputy President David Mabuza said, the nation will “slide into catastrophe” if land reform doesn’t take place.

“The majority of our people are poor and homeless,” he told lawmakers in Cape Town Thursday.

“Our resources to carry out reform are limited.”

And the reaction is now getting real as the Rand nears two-week lows once again…

Notably, the rand is behaving more erratically this month than it did during the height of the power struggle between Jacob Zuma and Cyril Ramaphosa in December. The rand’s one-month historical volatility is now at its highest level since December 2016 and the currency is headed for its worst August performance against the dollar on record, on track for a 9 percent drop.

As Bloomberg notes, President Cyril Ramaphosa has embraced land expropriation without compensation as a means to achieve equality and racial justice, and in a bid to steal a march on populist opponents before elections in 2019. A planned amendment to the constitution is still a work in progress, with public hearings on the matter concluding next month.

Yesterday saw UK PM Theresa May confirm her support of Ramaphosa’s “land reforms” as long as they’re legal…

“The UK has for some time now supported land reform that is legal and transparent and generated through a democratic process. I discussed it with President Ramaphosa during his visit to Britain earlier this year and will discuss it with him again later today,” she said.

…click on the above link to read the rest of the article…

As Bloomberg notes, the offshore yuan has been more volatile than the euro all month after first overtaking the shared currency in July, according to 30-day realized data. And while euro uncertainty remains relatively bracketed between 6 and 8 for the last two years, yuan volatility has soared from 2 to almost 9 – the highest since 2015’s devaluation.

The narrow spread (lower pane) shows China is moving to a more “flexible arrangement” when it comes to managing its currency, Bank of America analysts wrote in a note, predicting the yuan will weaken more this year.

For now it appears the temporary respite from Yuan’s freefall, that ‘mysteriously’ occurred right before the US-China trade talks, has begun to lose momentum.

But while Yuan has become increasingly volatile, the realized volatility of gold (when priced in yuan) has collapsed to record lows…

Perhaps supporting the idea that the Chinese care more about the ‘stability’ of the yuan relative to gold then to the arbitrary US dollar fiat money.

So is China losing control? Or is this just as they planned?

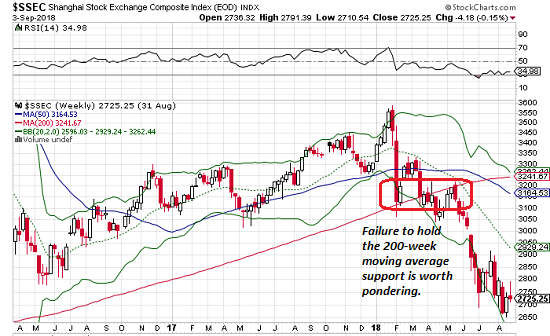

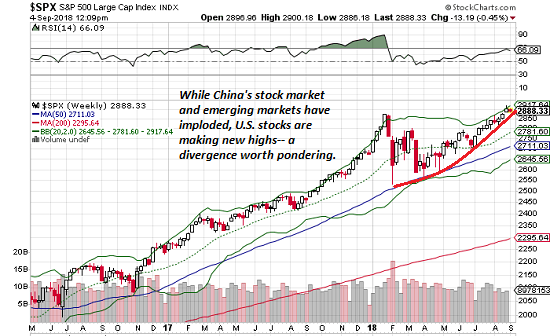

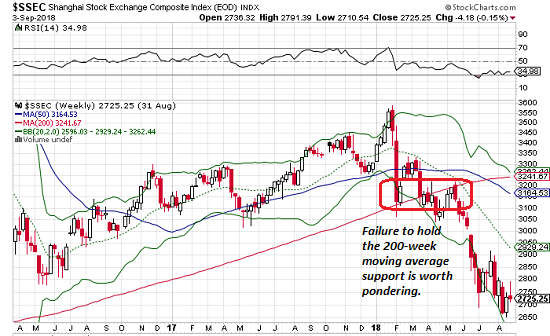

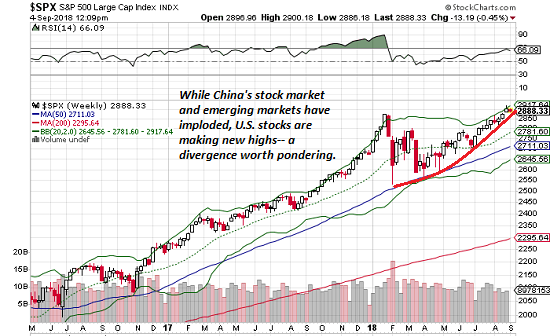

There are ample warning signs that another serious financial crisis is on the way.

These warning signs are being soundly ignored by the majority, though. Perhaps understandably so.

After 10 years of near-constant central bank interventions to prop up markets and make stocks, bonds and real estate rise in price — while also simultaneously hammering commodities to mask the inflationary impact of their money printing from the masses — it’s difficult to imagine that “they” will allow markets to ever fall again.

This is known as the “central bank put”: whenever the markets begin to teeter, the central banks will step in to prop/nudge/cajole the markets back towards the “correct” direction, which is always: Up!

It’s easy in retrospect to see how the central banks have become caught in this trap of their own making, where they’re now responsible for supporting all the markets all the time.

The 2008 crisis really spooked them. Hence their massive money printing spree to “rescue” the system.

But instead of admitting that Great Financial Crisis was the logical result of flawed policies implemented after the 2000 Dot-Com crash (which, in turn, was the result of flawed policies pursued in the 1990’s), the central banks decided after 2008 to double down on their bets — implementing even worse policies.

The Largest-Ever Monetary Experiment In Human History

It’s not hyperbole to say that the monetary experiment conducted over the past ten years by the world’s leading central banks (and its resulting social and political ramifications) is the largest-ever in human history:

(Source)

This global flood of freshly-printed ‘thin air’ money has no parallel in the historical records. All around the world, each of us is part of a grand experiment being conducted without the benefits of either prior experience or controls. Its outcome will be binary: either super-great or spectacularly awful.

…click on the above link to read the rest of the article…

Nowadays, trade and “prosperity” are dependent on currencies that are created out of thin air via borrowing or printing.

So here’s the story explaining why “free” trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the profits I reap from the move for myself. Yea for free trade, I’m now far wealthier than I was before.

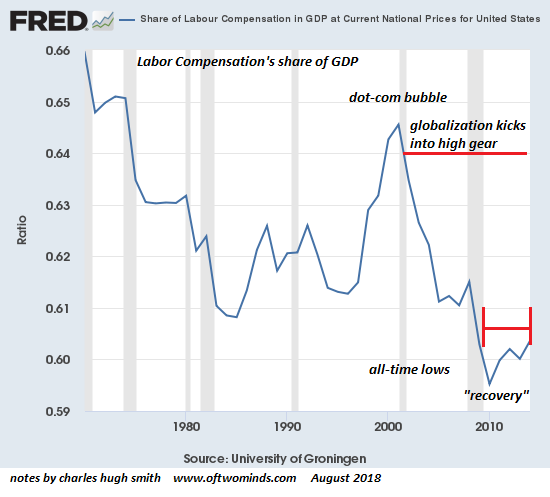

That’s the story. Feel better about “free” trade and globalization now? Oh wait a minute, there’s something missing–the part about “prosperity for all of us.” Here’s labor’s share of U.S. GDP, which includes imports and exports, i.e. trade:

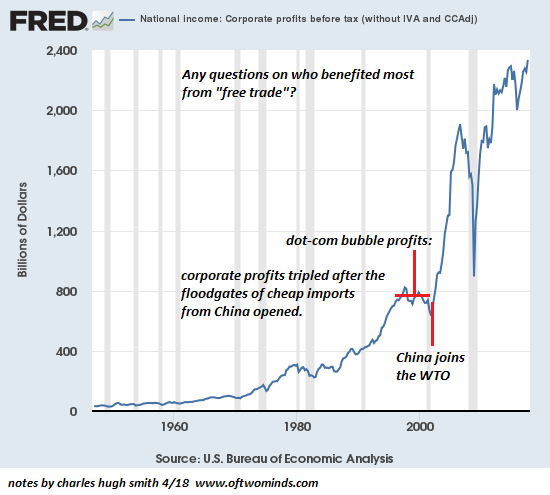

Notice how labor’s share of the economy tanked once globalization / offshoring kicked into high gear? Now let’s see what happened to corporate profits at that same point in time:

Imagine that–corporate profits skyrocketed once globalization / offshoring kicked into high gear. Explain that part about “makes us all prosperous” again, because there’s no data to support that narrative.

What’s interesting about all this is the way that politicians are openly threatening voters with recession if they vote against globalization. In other words, whatever “prosperity” is still being distributed to the bottom 80% is now dependent on a predatory version of globalization.

Let’s rewind to the era of truly free trade, from the late Bronze Age up to the Roman Era. In the late Bronze Age (circa 1800 to 1200 B.C.), vigorous trade tied together the ancient empires and states of the Mideast and the Mediterranean. In the Roman Era, trade in silk and other luxuries tied China, India, Africa, the Mideast and the Roman Mediterranean together in a vast trading network.

…click on the above link to read the rest of the article…

It happens every year around this time when I hold the annual Liberty and Entrepreneurship Camp that I’ve been sponsoring for the past nine years.

The event is incredible: I bring in top entrepreneurs and business executives, plus students from all over the world– places like Ivory Coast, Brazil, Singapore, Russia and the United States.

It’s five days of mentorship that seemingly goes round-the-clock. It’s exhilarating… but exhausting. And the Notes from the Field schedule always suffers as a result.

Did you know? You can receive all our actionable articles straight to your email inbox… Click here to signup for our Notes from the Field newsletter.

I’ll tell you more about the event later this week. But in the meantime, I thought it was more pressing to talk about the unbelievable situation currently unfolding in Turkey… because it’s pretty extraordinary what’s happening right now.

As you may know, Turkey has imprisoned a US pastor named Andrew Brunson for alleged terrorism and espionage.

Obviously the US government wants him back. So Uncle Sam has slammed Turkey with economic sanctions.

Turkey’s economy was already wobbly before the sanctions. The country is suffering the effects of debilitating debt and persistent recession.

Now the economy is getting absolutely destroyed.

Turkey’s currency, the lira, is down some 45% this year. Just yesterday the lira was down a whopping 7%.

If you don’t speculate in currencies very much, a 7% move in a single day is basically unprecedented. It almost never happens. So this is a pretty big deal.

…click on the above link to read the rest of the article…