Home » Posts tagged 'imf' (Page 3)

Tag Archives: imf

Are the World Elite Using a Rise in Nationalism to Reassert Globalisation?

Are the World Elite Using a Rise in Nationalism to Reassert Globalisation?

Putting yourself in the mind of someone who commits an act of illegality is perhaps the only way we can begin to understand the motivation behind the transgression. A common reflex reaction to the most heinous of crimes is to simply call for the perpetrator to be removed from society and put in prison. Out of sight, out of mind. Whilst this is not an unreasonable expectation, it does not get to the root of why he or she became a criminal.

We can take a similar stance when it comes to globalism. If a self appointed elite who permeate institutions like the Bank for International Settlements and the IMF share a desire to concentrate world power through a centralised network of global governance, rather than simply rebel against this vision is it not equally as important to try and understand the vision from the perspective of those who created it? I would argue that to comprehend the minds of global planners it is necessary to mentally place yourself into their way of thinking.

A couple of years ago I published an article called, Order Out of Chaos: A Look at the Trilateral Commission, where I examined some of the key motivations behind this particular institution’s goals. I quoted past members of the Commission openly rejecting national sovereignty and championing the interdependence of nations. One of those quotes was from Sadako Ogata, a former member of the Trilateral Commission’s Executive Committee, who at an event to mark 25 years of the institution remarked how ‘international interdependence requires new and more intensive forms of international cooperation to counteract economic and political nationalism‘.

…click on the above link to read the rest of the article…

IMF Slashes Global GDP Forecast For 6th Consecutive Time, Warns “Climate Change” Will Hit Economy

IMF Slashes Global GDP Forecast For 6th Consecutive Time, Warns “Climate Change” Will Hit Economy

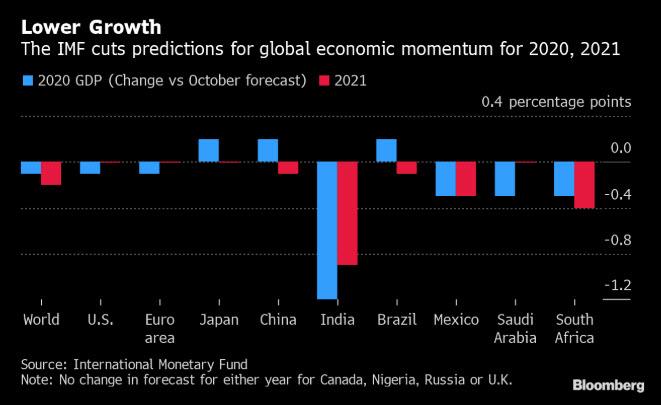

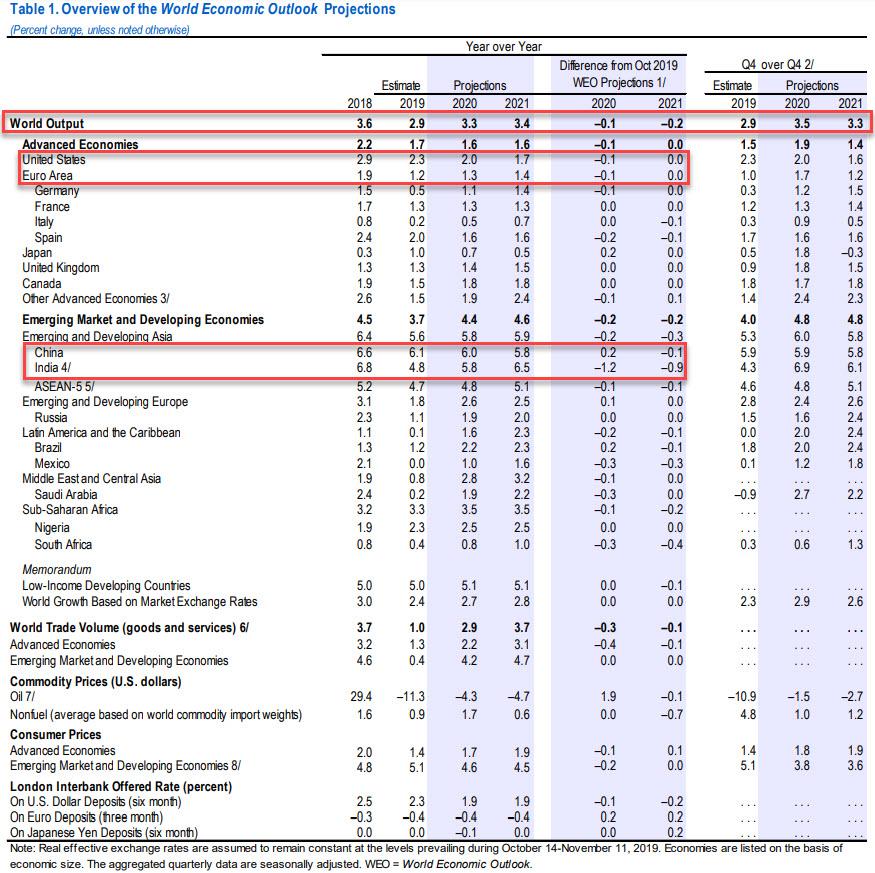

After the IMF cut its global economic outlook for 2019 to 2.9% in October, the lowest since the financial crisis, and warned that global trade growth would be “close to a standstill”, moments ago the IMF once again downgraded its forecast for global GDP for 2020 and 2021, its sixth straight reduction, although in a sliver of optimism, global GDP in 2020 is now expected to post a modest rebound from 2.9% to 3.3%, (down from 3.4% in October) and to 3.4% in 2021 (down from 3.6%) as the IMF says “there are now tentative signs that global growth may be stabilizing, though at subdued levels.”

According to the IMF, the downward revision primarily reflects negative surprises to economic activity in a few emerging market economies, most notably India, where 2020 GDP is now expected to rise just 5.8% down from 7.0%, which means that in 2020 China will regain the title of the world’s fastest growing economy. In a few cases, this reassessment also reflects the impact of increased social unrest.

Emerging market debacle aside, the IMF said that on the positive side, market sentiment “has been boosted by tentative signs that manufacturing activity and global trade are bottoming out, a broad-based shift toward accommodative monetary policy, intermittent favorable news on US-China trade negotiations, and diminished fears of a no-deal Brexit, leading to some retreat from the risk-off environment that had set in at the time of the October WEO.”

However, and this will be of particular interest to traders, even the IMF admitted that “few signs of turning points are yet visible in global macroeconomic data.”

And so, in addition to the collapse in India, the IMF also sees continued slowdown in the US and Europe in 2020, both of which were cut by 0.1% to 2.0% and 1.3%, while China saw a modest increase by 0.2% to 6.0%, which however drops to 5.8% in 2021.

IMF Chief Warns Global Economy Faces New “Great Depression”

IMF Chief Warns Global Economy Faces New “Great Depression”

How’s this for some New Years optimism?

The new head of the IMF, who took over from Christine Lagarde in November, warned that the global economy could soon find itself mired in a great depression.

During a speech at the Peterson Institute, IMF Chairwoman Kristalina Georgieva compared the contemporary global to the “roaring 20s” of the 20th century, a decade of cultural and financial excess that culminated in the great market crash of 1929.

According to the Guardian, this research suggests that a similar trend is already under way, and though the collapse might not be around the corner, when it comes, it will be impossible to avoid.

While the inequality gap between countries has closed over the last two decades, the gap within most developed countries has widened, leaving millions more vulnerable to a global downturn than they otherwise would have been.

In particular, she singled out the UK for criticism: “In the UK, for example, the top 10% now control nearly as much wealth as the bottom 50%. This situation is mirrored across much of the OECD (Organisation for Economic Co-operation and Development), where income and wealth inequality have reached, or are near, record highs.”

She also warned about the potential for climate change to become a bigger obstacle for humanity, while increased trade protectionism instills more volatility in markets.

She added: “In some ways, this troubling trend is reminiscent of the early part of the 20th century – when the twin forces of technology and integration led to the first gilded age, the roaring 20s, and, ultimately, financial disaster.”

She warned that fresh issues such as the climate emergency and increased trade protectionism meant the next 10 years were likely to be characterised by social unrest and financial market volatility.

…click on the above link to read the rest of the article…

The Next Wave of Debt Monetization Will Also Be A Disaster

The Next Wave of Debt Monetization Will Also Be A Disaster

According to the IMF (International Monetary Fund) and the IIF (Institute of International finance) global debt has soared to a new record high. The level of government debt around the world has ballooned since the financial crisis, reaching levels never seen before during peacetime. This has happened in the middle of an unprecedented monetary experiment that injected more than $20 trillion in the economy and lowered interest rates to the lowest levels seen in decades. The balance sheet of the major central banks rose to levels never seen before, with the Bank Of Japan at 100% of the country’s GDP, the ECB at 40% and the Federal Reserve at 20%.

If this monetary experiment has proven anything it is that lower rates and higher liquidity are not tools to help deleverage, but to incentivize debt. Furthermore, this dangerous experiment has proven that a policy that was designed as a temporary measure due to exceptional circumstances has become the new norm. The so-called normalization process lasted only a few months in 2018, only to resume asset purchases and rate cuts.

Despite the largest fiscal and monetary stimulus in decades, global economic growth is weakening and leading economies’ productivity growth is close to zero. Money velocity, a measure of economic activity relative to money supply, worsens.

We have explained many times why this happens. Low rates and high liquidity are perverse incentives to maintain the crowding out of government from the private sector, they also perpetuate overcapacity due to endless refinancing of non-productive and obsolete sectors t lower rates, and the number of zombie companies -those that cannot pay their interest expenses with operating profits- rises. We are witnessing in real-time the process of zombification of the economy and the largest transfer of wealth from savers and productive sectors to the indebted and unproductive.

…click on the above link to read the rest of the article…

Innovation BIS 2025: A Stepping Stone Towards an Economic ‘New World Order’

Innovation BIS 2025: A Stepping Stone Towards an Economic ‘New World Order’

The IMF’s annual meetings held in Washington DC last week demonstrated that when the institution issues new economic projections or warnings of a downturn, the mainstream press are not averse to giving them prominent coverage. After the Fund was founded in 1944 (off the back of World War Two), it became part of what internationalists call the ‘rules based global order‘. For 75 years, the IMF has been regarded by the political establishment and banking elites as a lynch pin of the world financial system.

Contrary to what some may believe, the IMF was not the first global monetary institution. That accolade belongs to the Swiss based Bank for International Settlements, which predates the IMF by fourteen years. Its creation in 1930 was, according to the BIS, primarily to settle reparation payments ‘imposed on Germany following the First World War‘. Without WWI – a major crisis event – there would have been no mandate for the BIS to exist. Much as there would have been no mandate for the IMF to exist were it not for the spectre of WWII.

As well as settling German reparation payments, the BIS was also recognised from the outset as a forum for central bankers – the first of its kind – where they could speak candidly and direct the course of global monetary policy.

The board of directors at the BIS is taken up predominantly by the heads of the leading central banks in the world. Right now the governor of the German Bundesbank Jens Weidmann is chairman of the board. As public servants they gather in Basel every eight weeks or so for a series of bimonthly meetings, the discussions from which ordinary citizens are not privy to.

…click on the above link to read the rest of the article…

The Club & Why the Majority Must be Always Wrong

The Club & Why the Majority Must be Always Wrong

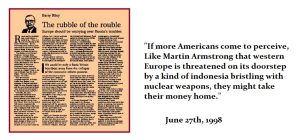

QUESTION: Mr. Armstrong; I did my own research on the 1998 Russian collapse. All the big names lost billions. Even the New York Times reported that George Soros lost $2 billion. You were the only one who made money so it made sense that you were named hedge fund manager of the year in 1998. My question is this. Since all the big names were involved in the Russia trade which took down Long-Term Capital Management, is this why you call them the “club” for they all do seem to be involved in the same trade?

DU

ANSWER: Correct. This is also why they try to prevent people from listening to me. They are convinced that the reason they lost was that I was too influential and had too many institutions listening to me. That absurdity is what they ran to the government with, so I was then accused of “manipulating” the world economy. They all lost after I warned them and refused to join in their takeover of Russia I believe I was given the nod by the Clintons. They told me they had the IMF in their back pocket and they would continue to fund Russia. I warned them that the IMF got their funding from governments and they were not going to back it.

The Russian financial crisis hit Russia on the 17th of August 1998. Our World Economic Conference was held in London that June. Our forecast was then published by the London Financial Times on the front page of the second section.

They did not give up. After they got the Federal Reserve to bail them out, they then focused on setting up Yeltsin and got him to divert $7 billion in IMF loans. Even CNN reported the money was stolen from the IMF.

CNN Theft of IMF Money – Sep. 1, 1999

…click on the above link to read the rest of the article…

Argentina Is Officially In Default Again: S&P Downgrades Credit Rating To SD

Argentina Is Officially In Default Again: S&P Downgrades Credit Rating To SD

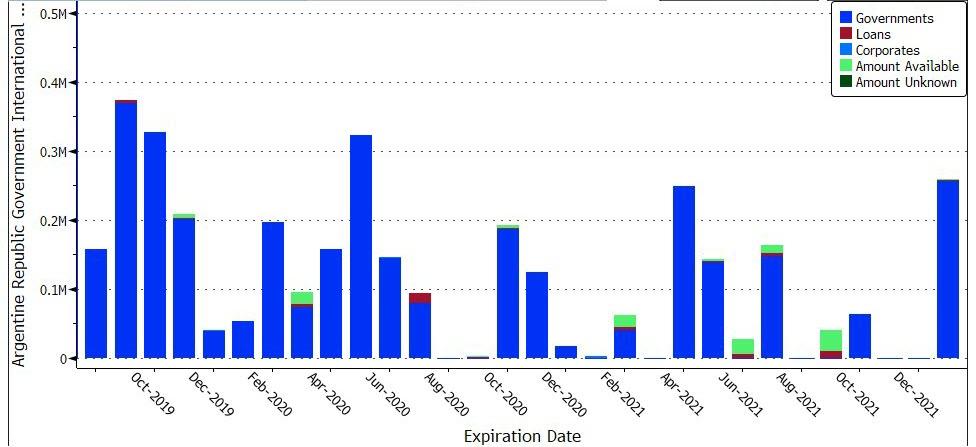

The IMF just broke its own record of incompetence: less than a year after its record, $57 billion bailout of Argentina was finalized, S&P just downgraded the country from B- to Selective Default – the equivalent to a default rating – following the government’s “reprofiling” of its debt on August 28, when it unilaterally extended the maturity of all short-term paper due to the continued inability to place short-term paper with private-sector market participants. Some $101 billion in debt is affected.

However, the selective default state will last for just one day, as only a few hours later, S&P will upgrade Argentina from SF to CCC-. As S&P explains, “under our distressed exchange criteria, and in particular for ‘B-‘ rated entities, the extension of the maturities of the short-term debt with no compensation constitutes a default. As the new terms became effective immediately, the default has also been cured. Therefore, we plan to raise the long-term ratings to ‘CCC-‘ and the short-term ratings to ‘C’ on Aug. 30, in line with our policies.”

Here is the full summary of today’s action, per S&P:

- Following the continued inability to place short-term paper with private-sector market participants, the Argentine government unilaterally extended the maturity of all short-term paper on Aug. 28. This constitutes default under our criteria, and we are lowering the local and foreign currency sovereign credit ratings to ‘SD’ and the short-term issue ratings to ‘D’.

- The administration is also sending legislation to Congress seeking support from the Argentine political class to engage in a re-profiling of the remaining debt, so we are lowering our long-term foreign and local currency issue ratings to ‘CCC-‘ on heightened risk of a default under our criteria.

…click on the above link to read the rest of the article…

Argentina Proposes IMF-Humiliating ‘Debt Re-Profile’ As It Soft-Defaults For 9th Time Since Independence

Argentina Proposes IMF-Humiliating ‘Debt Re-Profile’ As It Soft-Defaults For 9th Time Since Independence

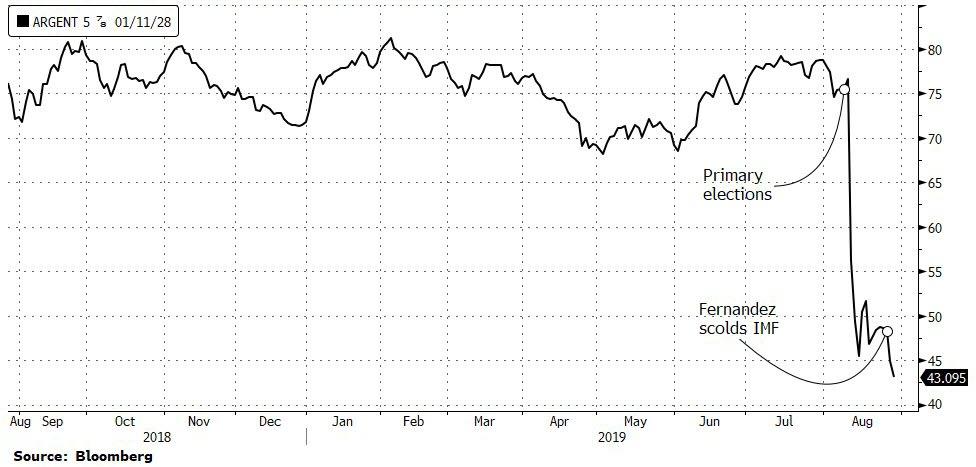

Less than a week after we suggested The IMF is in for humiliation over the collapse of Argentina – just months after its unprecedented $56 billion liquidity crisis bailout – it appears the South American nation is set to default for the ninth time since its independence in 1816.

Amid a 20% crash in the peso and a collapse in government bonds, which pushed the implied risk of default above 80%, IMF delegates arrived in Argentina on Saturday and, as Bloomberg reports, immediately began meetings with policy makers, facing a deja vu choice from two decades ago: risk making the turmoil even worse by withholding a $5.3 billion installment due next month – or cough it up, and risk even more losses with the IMF bailout program on the verge of collapse.

“The IMF has put a lot in – not just money, but prestige,” said Hector Torres, a former executive director at the Fund who represented South American countries.

“The fact that the arrangement is not performing well right now is an embarrassment,” he said. And the September installment is “going to be a difficult call.”

Then earlier today, things got worse as Argentina bond spreads widened to the most in 14 years after opposition leader Alberto Fernandez ripped the debt-laden country’s accord with the International Monetary Fund. Fernandez said much of the IMF loan had been wasted on financing capital flight out of the country.

In a statement following a meeting with IMF officials, Fernandez said he agreed with the objectives of the IMF deal, but added that the IMF and the current government generated the current crisis and are now responsible for reversing the “social catastrophe.”

IMF Recommends “DEEP” Negative Interest Rates as the Next Tool

IMF Recommends “DEEP” Negative Interest Rates as the Next Tool

The IMF has continued to assume that the zero-bound on interest rates can be a serious obstacle for fighting recessions on the part of the central banks. The IMF maintains that the zero-bound is not a law of nature; it is a policy choice. The latest in the IMF papers argue that tools are available to allow central banks to create deep negative rates whenever needed to reverse recessions. They claim that maintaining the power of monetary policy in the future to end recessions within a short time will require deep negative interest rates.

It is really quite astonishing how these people with NO REAL-WORLD EXPERIENCE keep trying to maintain the Marxist-Keynesian theory when more than 10 years of negative interest rates have failed. This is the same theory that dominated medicine for so long. They assumed there was a toxin in the blood, so the cure was to bleed you. If you died, they assumed the reason was that they did not bleed you sooner.

These idiots fail to comprehend that negative interest rates have wiped out pensions. The instruction manual for life was to save for your retirement to be able to live off the interest of your savings. The problem was, those days were based on 8% interest rates. Moving negative will not force people to spend, it merely bankrupts the people.

Bretton Woods Is Dead: What Next?

Bretton Woods Is Dead: What Next?

French Finance Minister Bruno Le Maire has publicly admitted something normally reserved for backroom discussion in the circles of Europe’s governing elite at an event honoring the 75thanniversary of Bretton Woods (the conference which created the foundations for the post WWII world order).

At this event, Le Maire stated ever-so candidly that “the Bretton Woods order has reached its limits. Unless we are able to re-invent Bretton Woods, the New Silk Road might become the New World Order”.

He went onto state that “the pillars of that order have been the International Monetary Fund and its sister institution, the World Bank since their inception at the Bretton Woods conference in New Hampshire in 1944.”

Were a radical transformation not undertaken immediately, then Le Maire laments “Chinese standards on state and on access to public procurements, on intellectual property could become global standards”.

The finance minister’s statements reflect the growing awareness that two opposing systems operating on two conflicting sets of principles and standards are currently in conflict, where only one can succeed. Yet as much as he appears to be aware of the forces at play between two systems, Le Maire fails miserably to identify what the Bretton Woods System was meant to accomplish in the first place, or what type of “radical transformation” is needed to save Europe from the collapse of its own speculation-ridden system.

Le Maire dives so deeply out of reality that he actually believes that the radical transformation desperately needed in the west does not involve collaborating with the New Silk Road, but rather to strengthen the power of Brussels, while becoming more technocratic and more green (aka: de-industrialized, de-populated).

…click on the above link to read the rest of the article…

U.S. Economic Warfare and Likely Foreign Defenses

U.S. Economic Warfare and Likely Foreign Defenses

Photograph Source: Trending Topics 2019 – CC BY 2.0

Today’s world is at war on many fronts. The rules of international law and order put in place toward the end of World War II are being broken by U.S. foreign policy escalating its confrontation with countries that refrain from giving its companies control of their economic surpluses. Countries that do not give the United States control of their oil and financial sectors or privatize their key sectors are being isolated by the United States imposing trade sanctions and unilateral tariffs giving special advantages to U.S. producers in violation of free trade agreements with European, Asian and other countries.

This global fracture has an increasingly military cast. U.S. officials justify tariffs and import quotas illegal under WTO rules on “national security” grounds, claiming that the United States can do whatever it wants as the world’s “exceptional” nation. U.S. officials explain that this means that their nation is not obliged to adhere to international agreements or even to its own treaties and promises. This allegedly sovereign right to ignore on its international agreements was made explicit after Bill Clinton and his Secretary of State Madeline Albright broke the promise by President George Bush and Secretary of State James Baker that NATO would not expand eastward after 1991. (“You didn’t get it in writing,” was the U.S. response to the verbal agreements that were made.)

Likewise, the Trump administration repudiated the multilateral Iranian nuclear agreement signed by the Obama administration, and is escalating warfare with its proxy armies in the Near East. U.S. politicians are waging a New Cold War against Russia, China, Iran, and oil-exporting countries that the United States is seeking to isolate if cannot control their governments, central bank and foreign diplomacy.

* Keynote Paper delivered at the 14th Forum of the World Association for Political Economy, July 21, 2019.

…click on the above link to read the rest of the article…

Markets are being Lulled into a False Sense of Accommodation

Markets are being Lulled into a False Sense of Accommodation

Those who take an interest in the actions of central banks will know that the advent of Brexit and Donald Trump’s presidency has seen the direction of monetary policy gradually change in both the UK and the U.S.

Since the EU referendum, the Bank of England have raised interest rates twice, after initially cutting them and implementing a new round of quantitative easing in the aftermath of the vote. The first rate hike in November 2017 came over a decade since the bank last increased rates in July 2007.

A month after Donald Trump was confirmed as the 45th American president, the Federal Reserve raised rates for only the second time in nine and a half years. Since Trump’s inauguration, they have gone on to hike a further seven times, and over the course of eighteen months (starting late 2017) the Fed have rolled off over $600 billion in assets from its balance sheet.

As the Fed continue to roll off assets until their balance sheet ‘normalisation‘ programme ends in September, the sentiment amongst traders is that the central bank will soon begin a course of rate cuts in order to stave off the threat of a recession as the prospect of a full blown trade conflict with China and other nation states gathers momentum.

A similar sentiment can be found in the UK over Brexit. With the British economy stagnant and manufacturing and construction sectors in decline, there exists an expectation that the Bank of England will ultimately reverse course if an economic downturn takes hold.

…click on the above link to read the rest of the article…

If Deutsche Bank Breaks $6.40 World in Trouble – Charles Nenner

If Deutsche Bank Breaks $6.40 World in Trouble – Charles Nenner

Renowned geopolitical and financial cycle expert Charles Nenner says if there was ever a global canary in the coal mine warning for the financial system, it is Germany’s Deutsche Bank (DB). Late last year, Nenner predicted if DB stock went below $8 a share, “You should be worried.” Recently, DB stock hit all-time lows and now sits around the $7.50 per share level.

Nenner warns, “I see it can hold up to late July, and then it can go to $6.50 (per share). If it breaks below $6.40, it can go out of business. So, it’s a very serious situation. . . . I think all the markets can have a bounce in a couple of days to the end of July. That’s why DB might hold up, but if it gets below $6.40, the world is in trouble.”

This is not a hyped prediction considering the IMF called DB the “most systemically dangerous bank” in the world in 2016. If DB does break $6.40, do we get a daisy chain of default around the world? Nenner says, “It is a very dangerous situation. I don’t think DB is the only one. They just got caught. I think if you look at the balance sheets very closely of other banks, especially Europe and Italian banks, you will see a lot of troubling signs also. I don’t think it’s only Deutsche Bank. It’s much more. . . . If it breaks $6.40, the downside price target is zero. If everybody watches my analysis and it does go below $6.40, everybody is going to run for the exits.”

If DB goes under with its massive book of derivatives, other banks would be in the same trouble as DB. Nenner says, “Yes, if they have to close their derivatives, who knows which bank is going to lose how much? It’s going to be a big problem.”

…click on the above link to read the rest of the article…

IMF’s Lagarde Laments “Highly Mysterious” Low Inflation, Says “Everybody” Would Like It To Be Higher

IMF’s Lagarde Laments “Highly Mysterious” Low Inflation, Says “Everybody” Would Like It To Be Higher

Without skipping a beat, IMF Director Christine Lagarde left President Xi’s Belt and Road initiative conference and traveled to sunny southern California to make an appearance at the Milken Institute Conference, where she sat for an interview with former WSJ editor-in-chief (now editor-at-large) Gerry Baker.

Given that Friday’s surprisingly robust (at least on the surface) GDP print has revived speculation among some economists about ‘divergence’ between the US and the global economy, Baker led with a question about whether Q1 GDP had impacted the view on US growth over at the IMF.

While the surprisingly large number will “certainly lead us to reassess our forecast for growth in the US,” which could in turn boost the global economy, Lagarde cautioned that one strong GDP print doesn’t make a trend, and that the global economy remains mired in what she called a “delicate moment.”

Earlier this month, the IMF again slashed its forecasts for global growth, this time to its weakest level in a decade.

Asked if we’re seeing more divergence now.

“We still think that it’s a delicate moment given the still synchronized slowdown for growth…you have about 70% of the global economy which is slowing – but still growing – and we are not expecting a recession and certainly not in our baseline. Everybody including the highest authorities were certainly surprised by the large number in the United States…that will certainly lead us to reassess our forecast for growth for the United States, and clearly given the size of the US economy it will have an impact overall.”

Looking ahead, the upcoming reading on US productivity will be important.

…click on the above link to read the rest of the article…