Home » Posts tagged 'credit' (Page 3)

Tag Archives: credit

MacroView: The Next “Minsky Moment” Is Inevitable

MacroView: The Next “Minsky Moment” Is Inevitable

In 2007, I was at a conference where Paul McCulley, who was with PIMCO at the time, was discussing the idea of a “Minsky Moment.” At that time, this idea fell on “deaf ears” as the markets, and economy, were in full swing.

However, it wasn’t too long before the 2008 “Financial Crisis” brought the “Minsky Moment” thesis to the forefront. What was revealed, of course, was the dangers of profligacy which resulted in the triggering of a wave of margin calls, a massive selloff in assets to cover debts, and higher default rates.

So, what exactly is a “Minskey Moment?”

Economist Hyman Minsky argued that the economic cycle is driven more by surges in the banking system, and in the supply of credit than by the relationship which is traditionally thought more important, between companies and workers in the labor market.

In other words, during periods of bullish speculation, if they last long enough, the excesses generated by reckless, speculative, activity will eventually lead to a crisis. Of course, the longer the speculation occurs, the more severe the crisis will be.

Hyman Minsky argued there is an inherent instability in financial markets. He postulated that an abnormally long bullish economic growth cycle would spur an asymmetric rise in market speculation which would eventually result in market instability and collapse. A “Minsky Moment” crisis follows a prolonged period of bullish speculation which is also associated with high amounts of debt taken on by both retail and institutional investors.

One way to look at “leverage,” as it relates to the financial markets, is through “margin debt,” and in particular, the level of “free cash” investors have to deploy. In periods of “high speculation,” investors are likely to be levered (borrow money) to invest, which leaves them with “negative” cash balances.

…click on the above link to read the rest of the article…

China Central Bank Warns Downward Pressure On Economy Increasing

China Central Bank Warns Downward Pressure On Economy Increasing

Several weeks ago, the People’s Bank of China (PBOC) said it would “increase counter-cyclical adjustments” to prevent downward pressure on the economy. Now the PBOC is warning that it might not be able to ward off these downward pressures in the short term, reported Reuters.

The PBOC’s annual financial stability report said China would continue to deploy fiscal and monetary policies to support the economy but warned economic deceleration would continue through year-end.

Policy maneuvering by the PBOC will be limited as it will likely need to cut rates and the amount of money banks put down as reserves to promote credit growth.

The PBOC recognizes the rapid deterioration in the economy, along with the limitations of monetary policy to revive growth.

There Is a Lot of Appetite for Chinese Bonds: Bank Julius Baer’s Matthews

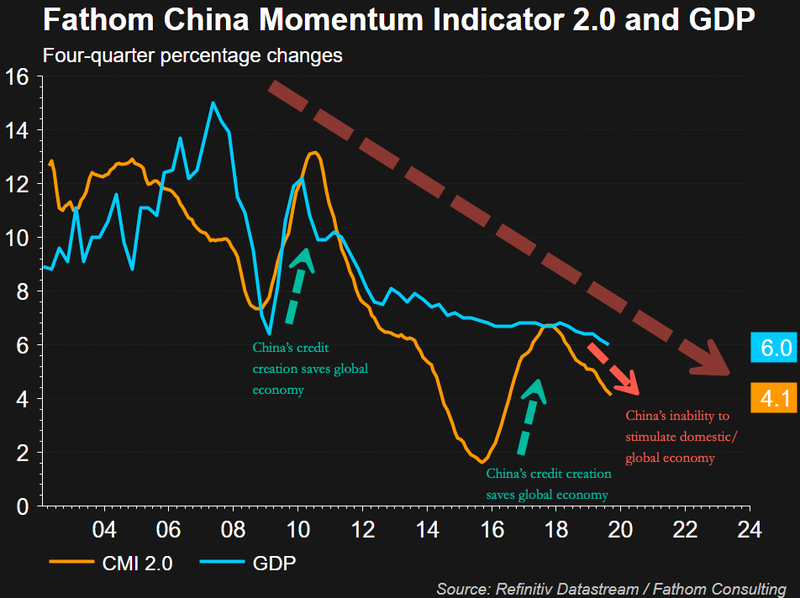

Likely, credit creation via the PBOC won’t be in magnitude seen in the last ten years used to save the world from escaping several deflationary crashes.

The government will likely stabilize its economy or at least create a softer landing through tax cuts and infrastructure spending, the annual report said.

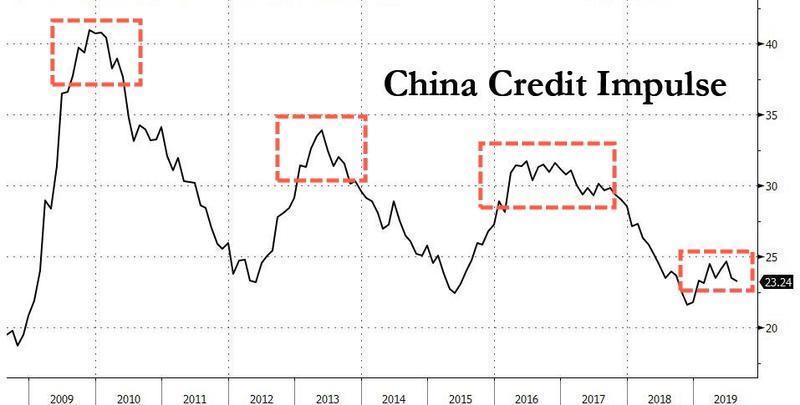

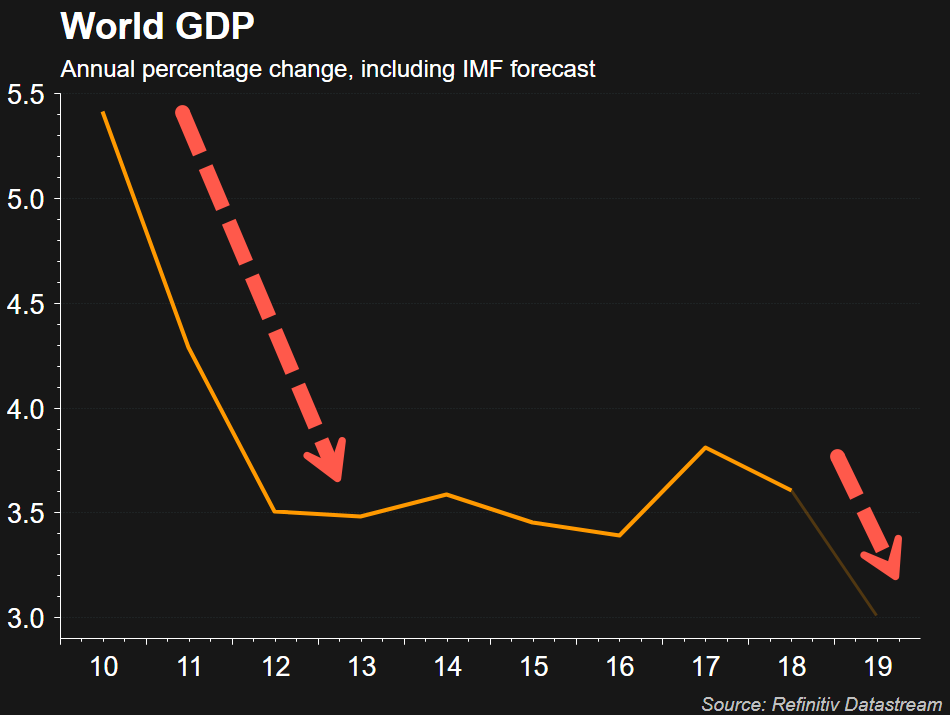

What this all means is that China’s economy isn’t going to save the world as it has done since 2008. China’s credit impulse has rolled over, the probabilities of a massive global economic rebound in the coming quarters are unlikely as China continues slow.

Fathom Consulting’s China Momentum Indicator 2.0 (CMI 2.0) provides a more in-depth view of China’s economic deceleration through alternative data as there’s no evidence at the moment that would suggest a trough in China’s economy.

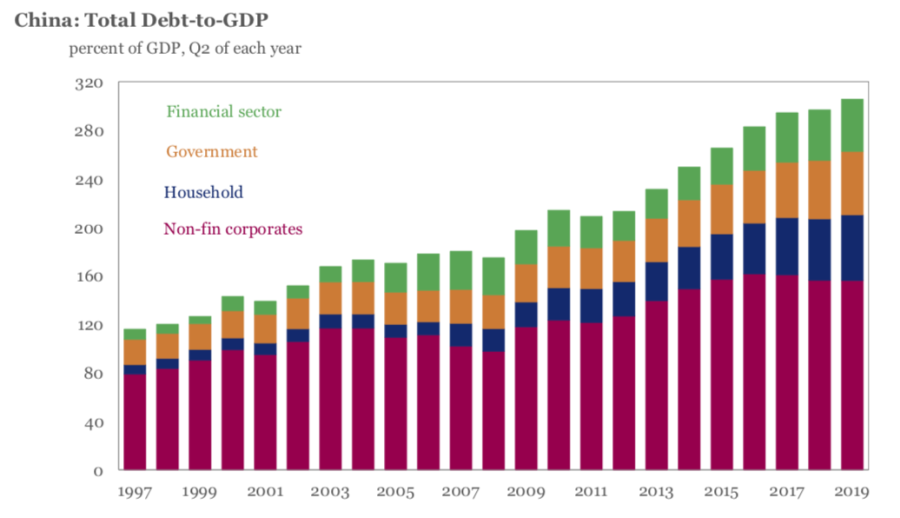

China’s economy over the last decade has created 60% of all new global debt. This means with China’s economy in freefall, the PBOC powerless over downside, GDP will likely fall to the 5-handle in early 2020. More importantly, this means a global economic rebound of massive proportions is unlikely to happen early next year.

Chinese Media Stunner: China Will Be The Next Country To Cut Rates To Zero

Chinese Media Stunner: China Will Be The Next Country To Cut Rates To Zero

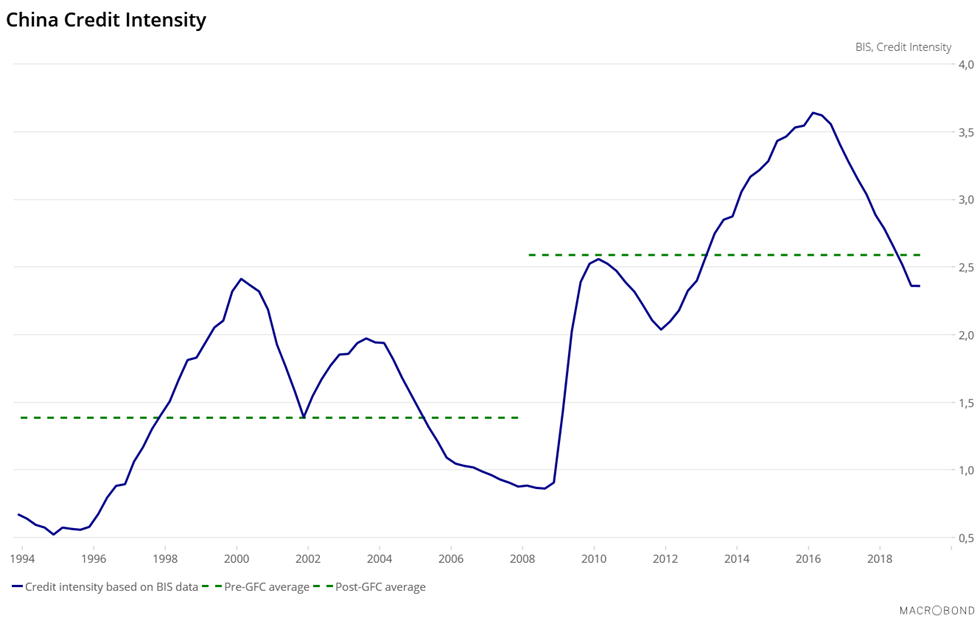

One week ago, we showed in one chart why the global economic recovery that so many expect is just a few months away, won’t happen: as the chart below shows, China’s credit intensity since 1994 has exploded. This means that before the Global Financial Crisis, China needed on average one unit of credit to create one unit of GDP. Since 2008, 2½ units of credit are required to create one unit of GDP. In other words, that China needs much more credit than 10 years ago to have the exact same amount of GDP. Injecting more credit in the economy is not the miracle solution it used to be, and the disadvantages of credit push tend to surpass the advantages.

This explosion in China’s credit intensity in the past decade has directly fueled China’s debt engine, the same debt engine that single-handedly pulled the world out of a global depression in 2008/2009. Alas, this will not happen again: China’s public and household debts are at their highest historical levels, respectively at 51% of GDP and 53% of GDP, and the private sector debt service ratio is becoming a burden for many companies, reaching on average 19.7% This records an increase from 13% before the crisis. Overall, China’s debt to GDP is fast approaching an unprecedented 320%!

Which brings us to Saxo’s dour conclusion for all those who believe that the global economy is about to enjoy another period of sustainable growth (and has confused the Fed’s QE for economic resilience and fundamentals):

Contrary to previous periods of slowdown, notably in 2008-2010, 2012-2014 and in 2016, China is unlikely to save the global economy once again.

…click on the above link to read the rest of the article…

Is the Fed Secretly Bailing Out a Major Bank?

Is the Fed Secretly Bailing Out a Major Bank?

Prettifying Toxic Waste

The promise of something for nothing is always an enticing proposition. Who doesn’t want roses without thorns, rainbows without rain, and salvation without repentance? So, too, who doesn’t want a few extra basis points of yield above the 10-year Treasury note at no added risk?

Thus, smart fellows go after it; pursuing financial innovation with unyielding devotion. The underlying philosophy, as we understand it, is that if risk is spread thin enough it magically disappears. In other words, the solution to pollution is dilution.

With this objective, new financial products are fabricated into existence. The risk free rewards of several extra basis points are then packaged up into debt instruments and sold off to pension funds and institutional investors. The search for yield demands it.

Yet as an economic expansion progresses, especially one that has been extended and distorted with the Fed’s cheap credit, these derived financial securities are polluted with more and more toxic waste. Spreading the risk ultimately pollutes the entire pool of liquidity.

At this moment in the business cycle, after a lengthy bull market in stocks and bonds, countless manifestations of the greater fool theory have bubbled up to the surface. Bonds with negative yields epitomize this. Buyers accept a guaranteed coupon loss with the hopes of scoring capital appreciation as yields fall. But when yields rise, it is game over.

German Bund futures contract, weekly. The recent blow-off and subsequent reversal illustrates the convexity effect on bond prices… [PT]

Of course, the greater fool theory extends much deeper and wider than negative yielding debt. It also extends to the polluted world of corporate debt…

…click on the above link to read the rest of the article…

China’s Credit Creation Unexpectedly Collapses At The Worst Possible Time

China’s Credit Creation Unexpectedly Collapses At The Worst Possible Time

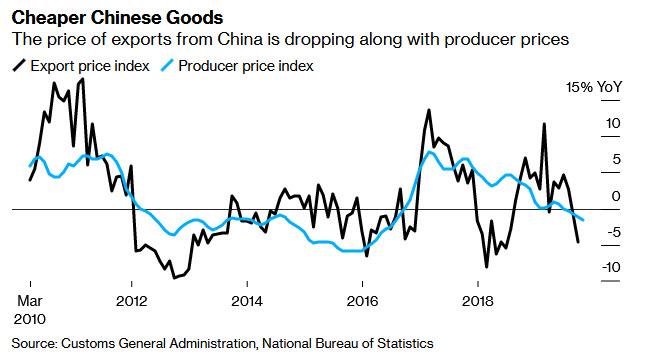

Over the weekend, we observed that China’s slumping wholesale inflation, or PPI, which is so critical for corporate profits and sparking benign, demand-driven inflation in the economy, and which in October tumbled to a three year low assuring that Chinese dumping and exports of deflation will only further depress global reflation efforts…

… will not reverse until Beijing injects another elephant-dose of credit into the Chinese financial system.

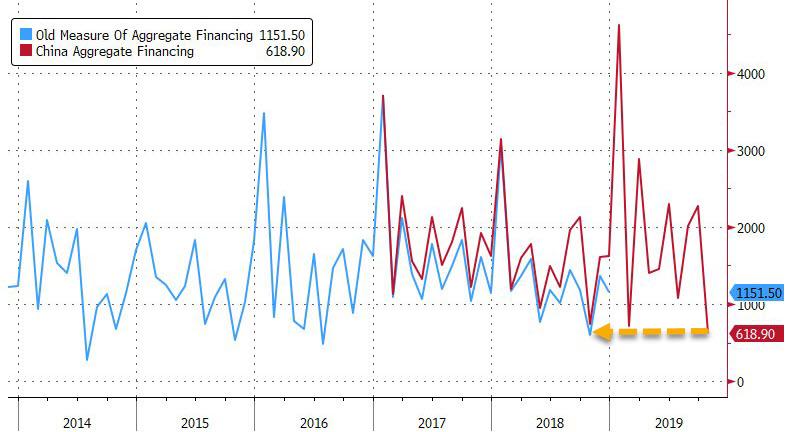

Just 48 hours later we can confirm that there is zero risk of either a sharp spike in Chinese inflation, or of China flooding the financial system with cheap credit – as it has been known to do during key economic inflection points – because according to the PBOC, China’s credit growth slowed far more than expected in October to the weakest pace since at least 2017 as a continued collapse in shadow banking, weak corporate demand for credit and seasonal effects all signaled that efforts to prop up the economy through bank lending still aren’t working.

The central bank reported that Aggregate Financing, China’s revised version of the old Total Social Financing, was a paltry 618.9 billion yuan ($88 billion), missing the median conservative estimate of 950 billion yuan, and down a whopping 72% from the 2.27 trillion yuan in September and 737.4 billion yuan in the same month of 2018. Today’s print was the lowest in the revised series history which goes back to the start of 2017, and only a slightly lower print in the old series prevents today’s total credit injection from being the lowest since 2016!

New CNY loans of 661.3 billion yuan also missed the consensus print of 800 billion yuan, resulting in outstanding CNY loan growth of 11.9% annualized in October, well below the September 13.3% annualized print. As has been the case recently, two thirds of yuan-denominated bank loans were borrowed by households in the month, while the borrowing by non-financial companies was the least in amount since August 2016.

…click on the above link to read the rest of the article…

Global Debt Is Up To $188,000,000,000,000 – This Is Officially The Biggest Debt Bubble The World Has Ever Seen

Global Debt Is Up To $188,000,000,000,000 – This Is Officially The Biggest Debt Bubble The World Has Ever Seen

The world is now 188 trillion dollars in debt, and that number continues to grow rapidly each year. It is a form of enslavement that is deeply insidious, because most of those living on the planet do not even understand how the system works, and even if they did most of them would have absolutely no hope of ever getting free from it. The borrower is the servant of the lender, and the global financial system is designed to funnel as much wealth to the top 0.1% as possible. Of course throughout human history there has always been slavery, and the primary motivation for having slaves is to extract an economic benefit from those that are enslaved. And even though most of us don’t like to think of ourselves as “slaves” today, the truth is that the global elite are extracting more wealth from all of us than ever before. So much of our labor is going to make them wealthy, and yet most people don’t even realize what is happening.

Let’s start with a very simple example to help illustrate this.

When you go into credit card debt and you only make small payments each month, you can easily end up paying back more than double the amount of money that you originally borrowed.

So where does all that money go?

Well, of course it goes to the financial institution that you got your credit card from, and in turn that financial institution is owned by the global elite.

In essence, you willingly became a debt slave when you chose to go into credit card debt, and the hard work that it took to earn enough money to pay back that debt with interest ended up enriching others.

…click on the above link to read the rest of the article…

Global Economy Paralyzed In Low-Growth Trap As QE Can’t Ward Off Next Crisis

Global Economy Paralyzed In Low-Growth Trap As QE Can’t Ward Off Next Crisis

The global economy is paralyzed, now stuck in a low-growth trap where conventional monetary policy by global central banks is less effective than ever before.

The world is on the brink of a global trade recession, week by week, economic data from Asia, Europe, and the US continues to decelerate into the late year. Despite central banks lowering interest rates and expanding balance sheets, nothing at the moment seems to be working to trough global growth.

Former governor of the Bank of England Mervyn King recognizes that the global economic slowdown is happening because monetary policy isn’t the answer, and argues that other innovative strategies have to be developed to rebalance the world economy.

“The Great Depression was followed by political upheaval and, in economics, an intellectual revolution. This time around, we’ve got the political turmoil but no comparable questioning of the ideas underpinning economic policy. That needs to change.

Modern policymakers operate in a world of radical uncertainty. They simply do not know what might happen next — and under these conditions, economic models need to be seen in a new light. The question isn’t whether the models are right or wrong, but whether they’re helpful or unhelpful. Today, the key features of standard models lead us astray in judging how to get the world economy out of its low-growth trap, and how to prepare for the next financial crisis,” King wrote in a recent Bloomberg Opionion peice.

Astonishingly, central bankers always wait until after they quit their job to drop truth bombs about how their destructive policies are leading to the next financial crash.

Pondering the Collapse of the Entire Shadow Banking System

Pondering the Collapse of the Entire Shadow Banking System

What’s behind the ever-increasing need for emergency repos? A couple of correspondents have an eye on shadow banking.

Shadow Banking

- The shadow banking system consists of lenders, brokers, and other credit intermediaries who fall outside the realm of traditional regulated banking.

- It is generally unregulated and not subject to the same kinds of risk, liquidity, and capital restrictions as traditional banks are.

- The shadow banking system played a major role in the expansion of housing credit in the run up to the 2008 financial crisis, but has grown in size and largely escaped government oversight since then.

The above from Investopedia.

Hey It’s Not QE, Not Even Monetary

Yesterday, I commented Fed to Increase Emergency Repos to $120 Billion, But Hey, It’s Not Monetary.

Let’s recap before reviewing excellent comments from a couple of valued sources.

The Fed keeps increasing the size and duration of “overnight” funding. It’s now up $120 billion a day, every day, extended for weeks. That is on top of new additions.

Three Fed Statements

- Emergency repos were needed for “end-of-quarter funding“.

- Balance sheet expansion is “not QE“. Rather, it’s “organic growth“.

- This is “not monetary policy“.

Three Mish Comments

- Hmm. A quick check of my calendar says the quarter ended on September 30 and today is October 23.

- Hmm. Historically “organic” growth was about $2 to $3 billion.

- Hmm. Somehow it takes an emergency (but let’s no longer call it that), $120 billion “at least” in repetitive “overnight” repos to control interest rates, but that does not constitute “monetary policy”

…click on the above link to read the rest of the article…

How Fractional Reserve Banking Contributes to Increases in Money Supply

HOW FRACTIONAL RESERVE BANKING CONTRIBUTES TO INCREASES IN MONEY SUPPLY

Some commentators consider fractional reserve banking as a major vehicle for the expansion in the money supply growth rate. What is the nature of this vehicle?

We suggest that fractional reserve banking arises because banks legally are permitted to use money placed with them in demand deposits. Banks treat this type of money as if it was loaned to them. However, is this really the case?

When John places $100 in a safe deposit box with Bank One he does not relinquish his claim over the $100. He has an unlimited claim against his money. Likewise, when he places $100 in a demand deposit at Bank One he also does not relinquish his claim over the deposited $100. Also in this case John has an unlimited claim against his $100.

Now let’s assume that Bank One takes $50 out of John’s demand deposit without getting any consent from John in this regard and lends this to Mike. By lending Mike $50, the bank creates a deposit for $50 that Mike can now use.

Remember that John still has an unlimited claim against the $100 while Mike has now a claim against $50. What we have here that the Bank One has generated an extra spendable power to the tune of $50. We can also say that Bank One has $150 deposits that are Bank’s One liabilities, which are supported by $100 cash, which are Bank’s One reserves. Note that the reserves comprise 66.7% of Bank’s One deposit liabilities. This example indicates that Bank One is practicing fractional reserve banking.

Although the law allows for this type of practice, from an economic point of view, this results in money out of “thin air” which leads to consumption that is not supported by production, i.e., to the dilution of the pool of real wealth.

…click on the above link to read the rest of the article…

The Fed Created The Everything Bubble And A Liquidity Crisis – What Happens Next?

The Fed Created The Everything Bubble And A Liquidity Crisis – What Happens Next?

It’s an interesting dynamic that the Federal Reserve has conjured in the decade after the 2008 credit crash. They spent several years using artificial stimulus measures to inflate perhaps the largest financial bubble in the history of the US, and then a couple years ago something changed. They addicted markets and investors to easy cash only to then cut off the flow of monetary heroin. The system was so dependent on the Fed’s “China White” that all it took to give everyone the shakes was interest rate hikes to the neutral rate of inflation and a moderate balance sheet selloff. Now, the system is dying from shock and it’s too late for intravenous stimulus to save it.

For many this might seem unprecedented, but it’s really rather common. The Fed has a long history of inflating bubbles using easy liquidity and then imploding those bubbles with the tightening of credit. It also has a long history of pretending like it is trying to save the economy from crisis when it is actually the source of the crisis. As Congressman Charles Lindbergh Sr. warned after the panic of 1920:

“Under the Federal Reserve Act, panics are scientifically created; the present panic is the first scientifically created one, worked out as we figure a mathematical problem…”

In the latest theatrics of the Fed, a new trend has emerged – The “disappointing Fed”. In order to understand this disappointment, we have to define exactly what markets want from the central bank. Obviously, they want QE4; a massive liquidity program. For the past year at least they have been clamoring for it, and they still have yet to get it. But what does QE4 entail? In order to institute a new QE marathon the Fed would have to:

…click on the above link to read the rest of the article…

Weekly Commentary: Comeuppance

Weekly Commentary: Comeuppance

The Chinese Credit machine sputtered in July. Growth in Total Aggregate Financing dropped to $144 billion, almost 40% below consensus estimates. This was less than half of June’s $320 billion increase and the slowest expansion since February. The sharp slowdown was beyond typical seasonality, with the month’s growth in Aggregate Financing 18% below July 2018. Despite July’s weak growth, Total Aggregate Financing was still up 10.7% over the past year.

New Bank Loans fell to $150 billion from June’s $235 billion, with growth 28% below that from July 2018. At $2.331 TN, New Loans were still up 12.6% over the past year. Consumer Loans dropped to $74 billion, the weakest showing since February. Consumer Loans were nonetheless up 16.5% over the past year, 38% in two, 71% in three and 138% over five years.

Loans to the non-financial corporate sector collapsed in July to $42 billion, about a third June’s level. Somewhat offsetting this decline, Corporate bond issuance almost doubled in July to $32 billion.

The ongoing contraction in “shadow” finance accelerated in July, with declines in outstanding Trust Loans, Entrusted Loans, and Banker Acceptances. On a year-over-year basis, Trust Loans were down 4.3%, Entrusted Loans 10.0% and Bankers Acceptances 15.0%.

China’s July Credit data were alarming on multiple levels. For starters, the sharp Credit slowdown supports the view that financial conditions tightened meaningfully after the government takeover of Baoshang Bank (and attendant money market instability). It also raises the increasingly pressing question as to the willingness of the banking system to continue to take up the slack in the face of a broadly deteriorating backdrop. And in a new development, analysts have begun contemplating the possibility of waning Credit demand.

The sharp pullback in Consumer Loans raises the specter of an inflection point in household mortgage borrowings. Bubbling apartment markets have supported a resilient consumer sector along with an unrelenting housing construction boom. Government tightening measures may be having some impact. It is possible as well that market sentiment has begun to shift.

…click on the above link to read the rest of the article…

The Fed’s Dangerous Game: A Fourth Round of Stimulus in a Single Growth Cycle

The Fed’s Dangerous Game: A Fourth Round of Stimulus in a Single Growth Cycle

The longer the signals in capital markets go haywire under the influence of “monetary stimulus,” the bigger is the cumulative economic cost. That is one big reason why this fourth Fed stimulus — in the present already-longest (but lowest-growth) of super-long business cycles — is so dangerous.

True, there is nothing new about the Fed imparting stimulus well into a business cycle expansion with the intention of combating a threat of recession. Think of 1927, 1962, 1967, 1985, 1988, 1995, and 1998.

This time, though, we’ve seen it four times (2010/11, 2012/13, 2016/17, 2019) in a single cycle. That is a record. Normally, a jump in recorded goods and services inflation, or concerns about rampant speculation, have trumped the inclination to stimulate after one — or at most two — episodes of stimulus.

Also we should recognize that the length of time during which capital-market signaling remains haywire, is only one of several variables determining the overall economic cost of monetary “stimulus.” But it is a very important one.

Haywire signaling is not just a matter of interest rates being artificially low. Alongside this there is extensive mis-pricing of risk capital. Some of this is related to the flourishing of speculative hypotheses freed from the normal constraints (operative under sound money) of rational cynicism. Enterprises at the center of such stories enjoy super-favorable conditions for raising capital.

There are also the giant carry trades into high-yielding debt, long-maturity bonds, high-interest currencies, and illiquid assets, driven by some combination of hunger for yield and super-confidence in trend extrapolation. In consequence, premiums for credit risk, currency risk, illiquidity, and term risk, are artificially low. Meanwhile a boom in financial engineering — the camouflaging of leverage to produce high momentum gains — adds to the overall distortion of market signals.

…click on the above link to read the rest of the article…

The Rich Get Richer when Central Banks Print Money

The Rich Get Richer when Central Banks Print Money

The Netherlands Central Bank has just published a fascinating new paper, titled “Monetary policy and the top one percent: Evidence from a century of modern economic history”. Authored by Mehdi El Herradi and Aurélien Leroy, (Working Paper No. 632, De Nederlandsche Bank NV: https://www.dnb.nl/en/binaries/Working%20paper%20No.%20632_tcm47-383633.pdf), the paper “examines the distributional implications of monetary policy from a long-run perspective with data spanning a century of modern economic history in 12 advanced economies between 1920 and 2015, …estimating the dynamic responses of the top 1% income share to a monetary policy shock.” The authors “exploit the implications of the macroeconomic policy trilemma to identify exogenous variations in monetary conditions.” Note: the macroeconomic policy trilemma “states that a country cannot simultaneously achieve free capital mobility, a fixed exchange rate and independent monetary policy”.

Per authors, “The central idea that guided this paper’s argument is that the existing literature considers the distributional effects of monetary policy using data on inequality over a short period of time. However, inequalities tend to vary more in the medium-to-long run. We address this shortcoming by studying how changes in monetary policy stance over a century impacted the income distribution while controlling for the determinants of inequality.”

They find that “loose monetary conditions strongly increase the top one percent’s income and vice versa. In fact, following an expansionary monetary policy shock, the share of national income held by the richest 1 percent increases by approximately 1 to 6 percentage points, according to estimates from the Panel VAR and Local Projections (LP). This effect is statistically significant in the medium run and economically considerable. We also demonstrate that the increase in top 1 percent’s share is arguably the result of higher asset prices.

…click on the above link to read the rest of the article…

All That’s Missing Is a Black Swan

All That’s Missing Is a Black Swan

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

– Ludwig von Mises

The Federal Reserve chart above only goes back to 1970, but its message is clear, nevertheless. The velocity of money has dropped below that which was necessary to maintain a productive economy in 2009 and has never recovered.

The velocity of money can be defined as, “the rate at which money circulates or is exchanged in an economy in a given period.” It’s generally measured as a ratio of gross national product (GNP) to a country’s total money supply.

No money turnover… no economy.

But, if that’s so – if the chart is correct and the money turnover is by far the lowest since 1970 – why did the economy recover after 2010 and why are we in a bull market? Surely, the quantitative easing programme initiated by the Fed corrected the problem and happy days are here again.

Well, actually, neither of those commonly-held assumptions is correct. Quantitative easing didn’t pump money back into the failing economy and, more to the point, it wasn’t intended to. Most of the money that was created through quantitative easing never actually hit the streets.

To back up a bit, in 1999, the Fed, then under Alan Greenspan, convinced the US government, then under President Bill Clinton, to repeal the Glass Steagall Act, an act created in 1933 to assure that banks would never again recklessly create loans to the public that could never be repaid.

…click on the above link to read the rest of the article…