Global Economy Paralyzed In Low-Growth Trap As QE Can’t Ward Off Next Crisis

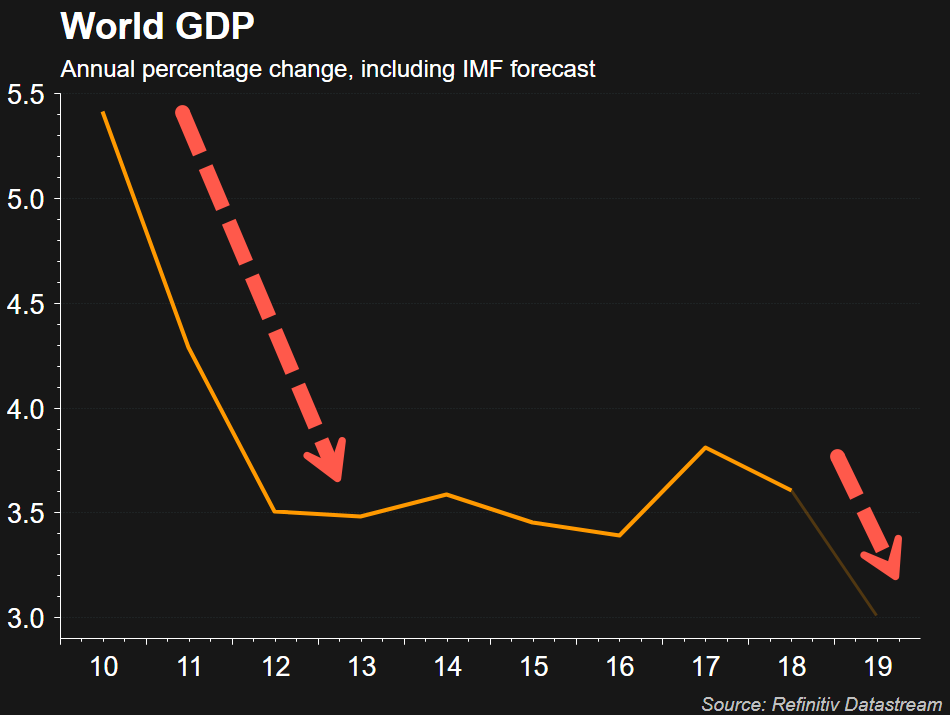

The global economy is paralyzed, now stuck in a low-growth trap where conventional monetary policy by global central banks is less effective than ever before.

The world is on the brink of a global trade recession, week by week, economic data from Asia, Europe, and the US continues to decelerate into the late year. Despite central banks lowering interest rates and expanding balance sheets, nothing at the moment seems to be working to trough global growth.

Former governor of the Bank of England Mervyn King recognizes that the global economic slowdown is happening because monetary policy isn’t the answer, and argues that other innovative strategies have to be developed to rebalance the world economy.

“The Great Depression was followed by political upheaval and, in economics, an intellectual revolution. This time around, we’ve got the political turmoil but no comparable questioning of the ideas underpinning economic policy. That needs to change.

Modern policymakers operate in a world of radical uncertainty. They simply do not know what might happen next — and under these conditions, economic models need to be seen in a new light. The question isn’t whether the models are right or wrong, but whether they’re helpful or unhelpful. Today, the key features of standard models lead us astray in judging how to get the world economy out of its low-growth trap, and how to prepare for the next financial crisis,” King wrote in a recent Bloomberg Opionion peice.

Astonishingly, central bankers always wait until after they quit their job to drop truth bombs about how their destructive policies are leading to the next financial crash.