Home » Posts tagged 'debt' (Page 20)

Tag Archives: debt

Is The ‘Mother of all Bubbles’ About to Pop?

Is The ‘Mother of all Bubbles’ About to Pop?

When the New York Federal Reserve began pumping billions of dollars a day into the repurchasing (repo) markets (the market banks use to make short-term loans to each other) in September, they said this would only be necessary for a few weeks. Yet, last Wednesday, almost two months after the Fed’s initial intervention, the New York Federal Reserve pumped 62.5 billion dollars into the repo market.

The New York Fed continues these emergency interventions to ensure “cash shortages” among banks don’t ever again cause interest rates for overnight loans to rise to over 10 percent, well above the Fed’s target rate.

The Federal Reserve’s bailout operations have increased its balance sheet by over 200 billion dollars since September. Investment advisor Michael Pento describes the Fed’s recent actions as Quantitative Easing (QE) “on steroids.”

One cause of the repo market’s sudden cash shortage was the large amount of debt instruments issued by the Treasury Department in late summer and early fall. Banks used resources they would normally devote to private sector lending and overnight loans to purchase these Treasury securities. This scenario will likely keep recurring as the Treasury Department will have to continue issuing new debt instruments to finance continuing increases in in government spending.

Even though the federal deficit is already over one trillion dollars (and growing), President Trump and Congress have no interest in cutting spending, especially in an election year. Should he win reelection, President Trump is unlikely to reverse course and champion fiscal restraint. Instead, he will likely take his victory as a sign that the people support big federal budgets and huge deficits. None of the leading Democratic candidates are even pretending to care about the deficit. Instead they are proposing increasing spending by trillions on new government programs.

…click on the above link to read the rest of the article…

Global Debt Is Up To $188,000,000,000,000 – This Is Officially The Biggest Debt Bubble The World Has Ever Seen

Global Debt Is Up To $188,000,000,000,000 – This Is Officially The Biggest Debt Bubble The World Has Ever Seen

The world is now 188 trillion dollars in debt, and that number continues to grow rapidly each year. It is a form of enslavement that is deeply insidious, because most of those living on the planet do not even understand how the system works, and even if they did most of them would have absolutely no hope of ever getting free from it. The borrower is the servant of the lender, and the global financial system is designed to funnel as much wealth to the top 0.1% as possible. Of course throughout human history there has always been slavery, and the primary motivation for having slaves is to extract an economic benefit from those that are enslaved. And even though most of us don’t like to think of ourselves as “slaves” today, the truth is that the global elite are extracting more wealth from all of us than ever before. So much of our labor is going to make them wealthy, and yet most people don’t even realize what is happening.

Let’s start with a very simple example to help illustrate this.

When you go into credit card debt and you only make small payments each month, you can easily end up paying back more than double the amount of money that you originally borrowed.

So where does all that money go?

Well, of course it goes to the financial institution that you got your credit card from, and in turn that financial institution is owned by the global elite.

In essence, you willingly became a debt slave when you chose to go into credit card debt, and the hard work that it took to earn enough money to pay back that debt with interest ended up enriching others.

…click on the above link to read the rest of the article…

The World Has Gone Mad and the System Is Broken

The World Has Gone Mad and the System Is Broken

I say these things because:

- Money is free for those who are creditworthy because the investors who are giving it to them are willing to get back less than they give. More specifically investors lending to those who are creditworthy will accept very low or negative interest rates and won’t require having their principal paid back for the foreseeable future. They are doing this because they have an enormous amount of money to invest that has been, and continues to be, pushed on them by central banks that are buying financial assets in their futile attempts to push economic activity and inflation up. The reason that this money that is being pushed on investors isn’t pushing growth and inflation much higher is that the investors who are getting it want to invest it rather than spend it. This dynamic is creating a “pushing on a string” dynamic that has happened many times before in history (though not in our lifetimes) and was thoroughly explained in my book Principles for Navigating Big Debt Crises. As a result of this dynamic, the prices of financial assets have gone way up and the future expected returns have gone way down while economic growth and inflation remain sluggish. Those big price rises and the resulting low expected returns are not just true for bonds; they are equally true for equities, private equity, and venture capital, though these assets’ low expected returns are not as apparent as they are for bond investments because these equity-like investments don’t have stated returns the way bonds do. As a result, their expected returns are left to investors’ imaginations.

…click on the above link to read the rest of the article…

Global Economy Paralyzed In Low-Growth Trap As QE Can’t Ward Off Next Crisis

Global Economy Paralyzed In Low-Growth Trap As QE Can’t Ward Off Next Crisis

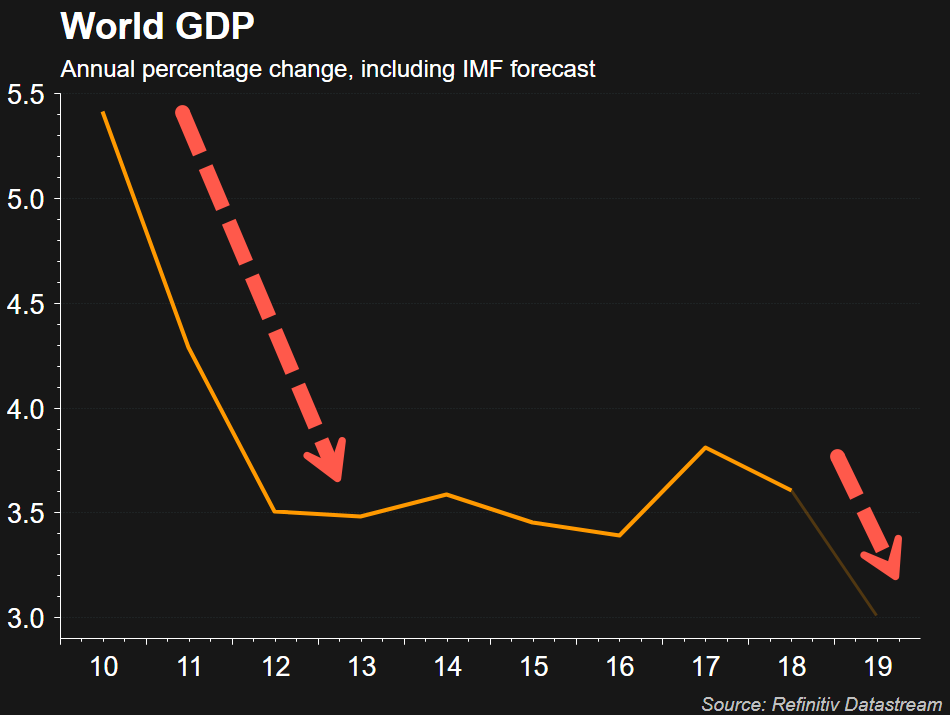

The global economy is paralyzed, now stuck in a low-growth trap where conventional monetary policy by global central banks is less effective than ever before.

The world is on the brink of a global trade recession, week by week, economic data from Asia, Europe, and the US continues to decelerate into the late year. Despite central banks lowering interest rates and expanding balance sheets, nothing at the moment seems to be working to trough global growth.

Former governor of the Bank of England Mervyn King recognizes that the global economic slowdown is happening because monetary policy isn’t the answer, and argues that other innovative strategies have to be developed to rebalance the world economy.

“The Great Depression was followed by political upheaval and, in economics, an intellectual revolution. This time around, we’ve got the political turmoil but no comparable questioning of the ideas underpinning economic policy. That needs to change.

Modern policymakers operate in a world of radical uncertainty. They simply do not know what might happen next — and under these conditions, economic models need to be seen in a new light. The question isn’t whether the models are right or wrong, but whether they’re helpful or unhelpful. Today, the key features of standard models lead us astray in judging how to get the world economy out of its low-growth trap, and how to prepare for the next financial crisis,” King wrote in a recent Bloomberg Opionion peice.

Astonishingly, central bankers always wait until after they quit their job to drop truth bombs about how their destructive policies are leading to the next financial crash.

The monetary lessons from Germany

The monetary lessons from Germany

Germany suffered two currency collapses in the last century, in 1920-23 and1945-48. The architect of the recovery from the former, Hjalmar Schacht, chose to cooperate with the Nazi successors to the Weimar Republic, and failed. In that of the second, Ludwig Erhard remained true to his free market credentials and succeeded. While they were in different circumstances, comparisons between the two events might give some guidance to politicians faced with similar destructions of their state currencies, which is a growing possibility.

Introduction

Let us assume the next credit crisis is on its way. Given enhanced levels of government debt, it is likely to be more serious than the last one in 2008. Let us also note that it is happening despite the supposed stimulus of low and negative interest rates, when we would expect them to be at their maximum in the credit cycle, and that some $17 trillion of bonds are negative yielding, an unnatural distortion of markets. Let us further assume that McKinsey in their annual banking survey of 2019 are correct when they effectively say that 60% of the world’s banks are consuming their capital before a credit crisis. Add to this a developing recession in Germany that will almost certainly lead to both Deutsche Bank and Commerzbank having to be rescued by the German government. And note the IMF recently warned that $19 trillion in corporate debt is a systemic timebomb, and that collateralised loan obligations and direct exposure to junk held by the US commercial banks is approximately equal to the sum of their equity.

Then we can say with some confidence that a major credit crisis is developing, and that it will almost certainly be far greater than Lehman.

…click on the above link to read the rest of the article…

Putting Federal Debt In Perspective Against those Responsible In The Future

Putting Federal Debt In Perspective Against those Responsible In The Future

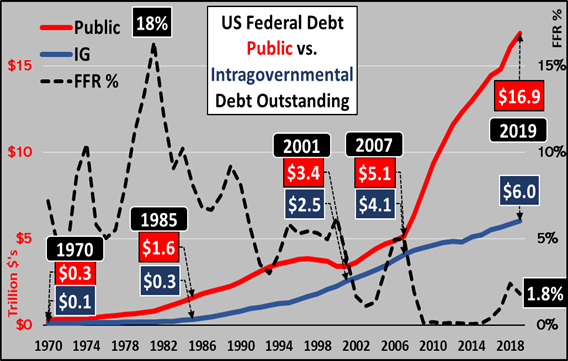

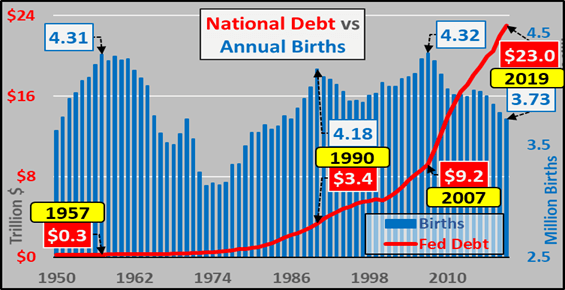

Since 2007, US federal debt has risen 150% while annual US births (legal and otherwise) have fallen almost 14%. Said otherwise, over the dozen years since 2007, federal debt has increased by $13.8 trillion while 5.2 million fewer births have occurred over the same period than the Census projected. This is probably worth a little closer look. Starting with…

US federal debt, split between publicly held debt and IG (Intra-Governmental holdings; aka Social Security trust fund, etc.). Clearly, publicly held debt is skyrocketing since 2007 while IG growth is decelerating and will turn to net declines (as SS turns to a net seller) within the decade. Relatively soon, all debt issued will be marketable and significantly more debt will be needed in order to pay for both the spiraling deficit alongside the declining IG holdings.

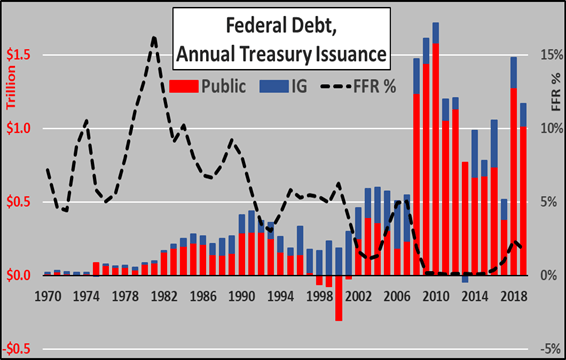

Next, looking at the annual issuance of federal debt, breaking out the annual issuance of publicly held marketable debt (red columns) versus IG (blue columns). ***Noteworthy, since August 1st of 2019, the Treasury has issued $920 billion in net new debt through October 23rd. The chart below is based on the assumption the Treasury will issue another $160 billion through the last two months plus the remainder of October (with a net issuance of $1.1 trillion for calendar year 2019).

Since debt is an obligation to be repaid or serviced in the future, I’ll put this in context with federal debt continuously divided by the future, the quantity of annual births. Below, annual births from 1950 through 2019 (blue columns) versus federal debt through 2019 (red line). ***Yes, I’m making a great leap to note that births will continue to fall in 2019…as they have been falling at an accelerating rate through Q1 of 2019, as noted by the CDC (HERE).

…click on the above link to read the rest of the article…

How QE has radically changed the nature of the West’s financial system.

How QE has radically changed the nature of the West’s financial system.

Because they are so ensconsed in their little bubble and because they profit so much from maintaining the status quo, Western mainstream media pundits don’t – or perhaps can’t – admit how Quantitative Easing policies have so quickly and so radically changed the financial system of the West and their satellites.

I imagine that most everyone reading this is already aware of what has transpired economically across the West over the last decade:

- Elite-class asset (stuff rich people own – stocks, real estate, financial derivatives, luxury goods, etc.) prices have ballooned to pre-2008 levels.

- Debt (which is, of course, another elite-owned asset), mainly to pay for banker bailouts and their usurious interest levels, has ballooned national accounts to incredible levels.

- The “real” economy has only weakened, as proven by endemic low economic growth across the West and Japan.

As a pro-socialist who has no faith that capitalism seeks anything but inequality, I believe that creating and compounding these issues has been the unstated goal of Western policy over the last decade. But that’s not the main point: what cannot be denied is that those ARE the economic results of the West’s “easy money” policies – i.e., QE and ZIRP (Zero percent interest rate policy) for the 1%, and austerity for the 99% (all coins have two sides).

Similarly, I imagine that everyone reading this is generally aware of what will happen should the West stop easy money: obviously, once artificial demand is no longer being fabricated then these assets will plummet in value, with huge ripple effects in the “real” economy. The West will be right back to dealing with most of the same toxic assets they had back in 2007, but now compounded by a decade of more debt, more interest payments, and a “real” economy which was made weaker via austerity.

…click on the above link to read the rest of the article…

Warning! Interest Rates, Inflation, And Debt Do Matter

Warning! Interest Rates, Inflation, And Debt Do Matter

With our national debt blowing past 23 trillion dollars nothing is as sobering as looking at future budgets. We should be worried. Central banks across the world claim the lack of inflation is the key force driving their QE policy and permitting it to continue, however, the moment inflation begins to take root much of their flexibility will be lost. This translates into governments being forced to pay higher interest rates on their debt. For years the argument that “This Time Is Different” has flourished but history shows that periods of rapid credit expansion always end the same way and that is in default. This also underlines the reality that any claims Washington makes about the budget deficit being under control is a total lie.

| Click (Here) To View National Debt Clock |

America is not alone in spending far more than it takes in and running a deficit. This does not make it right or mean that it is sustainable. Much of our so-called economic growth is the result of government spending feeding into the GDP. This has created a false economic script and like a Ponzi scheme, it has a deep relationship to fraud.

Global debt has surged since 2008, to levels that should frighten any sane investor because debt has always had consequences. Much of the massive debt load hanging above our heads in 2008 has not gone away it has merely been transferred to the public sector where those in charge of such things feel it is more benign. A series of off-book and backdoor transactions by those in charge has transferred the burden of loss from the banks onto the shoulders of the people, however, shifting the liability from one sector to another does not alleviate the problem.

…click on the above link to read the rest of the article…

Market Commentary: China Watch

Market Commentary: China Watch

I’ve held the view that Chinese finance has been at the epicenter of international market unease. The U.S./China trade war was not the predominant global risk. However, it has had the potential to become a catalyst for Chinese financial instability. And there remains a high probability for an eruption of Chinese disorder to quickly reverberate through global markets and economies. To be sure, rapidly deteriorating U.S./China relations were a major contributor to this summer’s global yield collapse and bond market dislocation.

At this point, I’ll assume some “phase 1” deal gets drafted and then signed by Presidents Trump and Xi next month in Chile. In the grand scheme of things, little will have been resolved. It appears many of the most critical issues between the world’s two rival superpowers have been excluded from the initial compromise, I’ll assume tabled for some time to come. Short-term focused markets are content with a “truce,” welcoming a period of reduced risk of a rapid escalation of tensions.

Perhaps near-term financial risks have subsided in China. A counter argument would point out that Beijing’s push to improve its negotiating position forced officials to once again hit the Credit accelerator. Did Beijing push its luck too far? I would point to the $1 TN of additional household (chiefly mortgage) debt accumulated over the past year. China’s Household borrowings were up 15.9% in one year, 37% in two, 69% in three and 138% in five years. Importantly, Beijing’s stimulus efforts stoked China’s historic mortgage finance and apartment Bubbles already well into “Terminal Phase” excess. How deeply have fraud and shenanigans permeated Chinese housing finance? Similar to P2P and corporate finance?

…click on the above link to read the rest of the article…

Blain’s Morning Porridge – October 21st 2019

Blain’s Morning Porridge – October 21st 2019

“If you wake up on a Casper mattress, work out with a Peloton before breakfast, Uber to your desk at a WeWork, order DoorDash for lunch, take a Lyft home, and get dinner through Postmates, you’ve interacted with seven companies that will collectively lose nearly $14 billion this year.”

It’s a big week for markets with the ECB meeting, some critical Q3 stock numbers and a host of things to worry about in terms of economic releases and the continuing slowing of the Chinese economy. Its all critical stuff for the bond market – which I reckon is a ticking time-bomb. But more about that later… For stock markets, the quote this morning sums it up – the mood is changing: forget the disruptive tech unicorns and focus on fundamentals. But, first up we really can’t ignore the Brexit mess in the UK. Saturday’s SNAFU gives investors another chance to load up on Sterling. At some point Brexit will be fixed. It might be messy.

Brexxxxxxiiiiitttt…..

I am sure foreign readers are wondering how the Mother of All Parliaments is making such a Horlicks of the Brexit negotiations. It really doesn’t look good does it? On the other hand, it does show the vibrancy of our political process, and the fact individuals can force it to change. It’s just a shame so many of these individuals seen to be self-seeking egotistical numpties of the worst kind – but even Oliver Letwin has a mother that probably loves him.

The reason Brexit is so messy is simple. It boils down to weak government – which is a recent thing here in the UK.

…click on the above link to read the rest of the article…

The Ghost Election Issue We Need to Get Real about: Personal Debt

The Ghost Election Issue We Need to Get Real about: Personal Debt

Canadians are so deep in the red it colours how we see vital issues.

Today we manufacture armored vehicles for the brutal regime in Saudi Arabia while fretting about domestic job losses if we don’t.

Conservative Leader Andrew Scheer pledges to slash Canada’s already paltry foreign aid budget by 25 per cent in favour of consumer tax cuts.

Climate change is the defining issue of this century, yet Canada has the highest per capita carbon emissions in the G20 and is far from a global leader in fighting fossil fuels.

What happened to the storied Canadian character?

The reason Canada cannot act in a more moral manner might lie in ballooning amounts of household debt. Canadians now owe an eye-watering $2.2 trillion or 178 per cent of disposable income — a measure that has doubled in the last 20 years. Personal bills now amount to more than our entire GDP, making us the most indebted citizenry in the G20 and fourth highest in the world.

Over half of Canadians report they are only $200 per month away from insolvency.

How can you care about climate change or global stability when your credit cards are maxed out or you are dodging debt collectors? Owing vast amounts of money seems now a defining Canadian characteristic and is increasingly enabled by indulgent political leaders. Andrew Scheer and Canada’s conservatives are unapologetic in pandering to those who gorged on cheap credit.

The belated Conservative campaign platform pledges to cut infrastructure investment by $18 billion in favour of reduced taxes. Scheer’s simple message is parsed for those most myopically interested in their pocketbook: “If you pay income tax, you will pay less under my government.”

…click on the above link to read the rest of the article…

Changes are Coming in 2020

Changes are Coming in 2020

QUESTION: I have a question, you wrote :

“Those in Europe who have a position in cash, it may be better to have shares or a private sector bond or US Treasury. Given the policy in Europe of no bailouts, leaving cash sitting in your account could expose you to risk in the months ahead.”

For example, if one has a trading account with a bank, is leaving cash in the bank’s trading account immune to potential seizure indicated in your comment?

Appreciate your clarification,

AP

ANSWER: The risk in Europe is that there is no true rule of law. On the one hand, there is this policy of no bailouts for that would mean money could cross borders. Then there is the rising socialism which is turning into real hatred of the rich.

There is no definitive answer. Europe will do whatever it has to do when the time comes shy of doing the right thing. I have written before when Italy could not meet its debts on short-term paper, they simply decreed that your 90-day paper was now a 10-year paper.

Governments can do whatever they desire. We have no recourse against governments. No private company could act in such a manner. This is one primary reason why I believe governments should be prohibited from borrowing. People are fools for buying their paper and always expecting that this time will be different.

Underestimating Them & Overestimating Us

UNDERESTIMATING THEM & OVERESTIMATING US

“Do not underestimate the ‘power of underestimation’. They can’t stop you, if they don’t see you coming.” ― Izey Victoria Odiase

During the summer of 2008 I was writing articles a few times per week predicting an economic catastrophe and a banking crisis. When the biggest financial crisis since the Great Depression swept across the world, resulting in double digit unemployment, a 50% stock market crash in a matter of months, millions of home foreclosures, and the virtual insolvency of the criminal Wall Street banks, my predictions were vindicated. I was pretty smug and sure the start of this Fourth Turning would follow the path of the last Crisis, with a Greater Depression, economic disaster and war.

In the summer of 2008, the national debt stood at $9.4 trillion, which amounted to 65% of GDP. Total credit market debt peaked at $54 trillion. Consumer debt peaked at $2.7 trillion. Mortgage debt crested at $14.8 trillion. The Federal Reserve balance sheet had been static at or below $900 billion for years.

During 2007, a risk averse senior citizen couple (my parents) who had accumulated $200,000 of retirement savings over their lifetime of hard work, could generate $10,000 of interest income in a Vanguard money market fund yielding 5%. This supplemented their modest Social Security income of $20,000 to $30,000 per year. The interest rate on savings during normal economic times was generally 2% above inflation, which hovered around 3% in 2007 according to the data manipulators at the BLS.

As the summer of 2008 progressed, I felt more disconnected. I had been doing everything possible to support Ron Paul’s candidacy for president, but the masses weren’t ready for the truth or the reality of our situation. In my opinion the country was already off-course and headed towards a debt created disaster.

…click on the above link to read the rest of the article…

Central Banks Trapped by Their Theories

Central Banks Trapped by Their Theories

QUESTION: Hi Martin,

I can understand how JP and EU backed themselves into a corner with negative rates. Happy to give them the benefit of the doubt when this all started 3-4 years ago even though it was obvious this was not going to end well.

However, what I don’t understand is the thought process that reserve banks today need to perpetuate eternal growth when I would think their role should be to smooth out extremes (debatable this is even possible).

RBA is a case in point as while the Australian economy is slowing, it is nowhere near terrible. There is talk that they will now also look to lower rates to near zero and start QE. I get that all reserve banks are looking to maintain lower exchange rates and so they need to keep pace with the rest of the world but one would think they would learn better from mistakes of EU and JP.

My question is, is this a global conspiracy or just plain stupidity?

Thanks for all ….

David

ANSWER: The original theory was to smooth out the business cycle. The political governments turned to the central banks and argued that they were responsible for the money supply. Therefore, it was allegedly their duty to control inflation irrespective of the spending of politicians. This was an inconvenient economic truth.

The problem is that the ONLY theory they have is the Keynesian Model. They really have no other theory to rely on. So they keep lowering rates, hoping to stimulate demand and are oblivious to the economic reality that the political side is hunting taxes and becoming more aggressive in tax enforcement. The two sides are clashing and the central banks are now TRAPPED with no alternative.

…click on the above link to read the rest of the article…

More Black Swans Arrive As U.S. Debt Balloons $800 Billion In Two Months

More Black Swans Arrive As U.S. Debt Balloons $800 Billion In Two Months

The rate at which black swans are showing up in the world should scare the hell out of people. But, unfortunately, everyone seems to be lost in the highly complex technology of I-phones, computers, social media, and the telly to notice that something is definitely wrong. The current situation reminds me of a famous scene in the Monty Python movie, The Holy Grail, where a guy is banging a bell and saying, “Bring out your dead.” Let me explain.

The scene in the movie takes place in England or Europe during the Black Plague, and due to the staggering amount of deaths, carts were used to pick up the bodies throughout the city. Yes, this is indeed a macabre subject matter, but Monty Python takes a serious situation and turns it into a comedy. However, the point I am trying to make is this… death is a very tragic and emotional part of life that impacts family members, friends, and coworkers. But, in this Monty Python scene, there is so much death, that it almost becomes numb to everyone.

And, that is precisely what I see now in the public. There are so many warning signs, or black swans, that no one seems to notice. Everyone has become… QUITE NUMB to it all. So, when the U.S. Government adds $814 billion of new debt in a little more than two months, the public yawns as this is no big deal:

Since the beginning of August, the total U.S. federal debt has increased from $22,023 billion to $22,837 billion. Thus, the U.S. public debt has increased by nearly 4% in just two months! Here is the debt table from TreasuryDirect.gov website since August 1st:

…click on the above link to read the rest of the article…