Back in 2018 leading up to Christmas the Federal Reserve began publicly flirting with the notion of ending asset purchases, reducing their balance sheet and committing to an all around taper of stimulus. I wrote about it extensively at the time along with my position that the Fed could and would taper, at least for a short period, which would lead to an accelerated crash of stocks. This did in fact happen, but as we all know the Fed reversed course not long after.

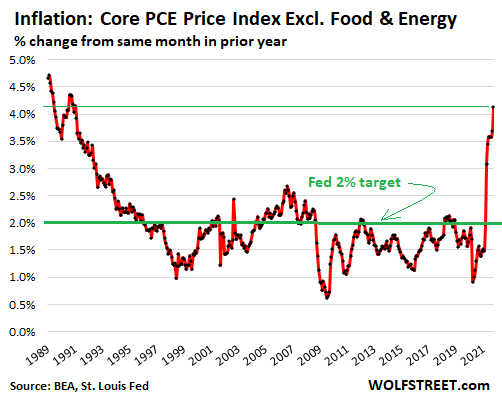

This reversal was seen by many as proof that the Fed would “never” actually pursue a full blown taper and that stimulus measures would go on forever. I believed it could be a dry run for a more aggressive taper event down the road. I argued that the fed would continue stimulus until stagflation became evident to the public, and then a careful game of scapegoating would have to be played and another taper would commence.

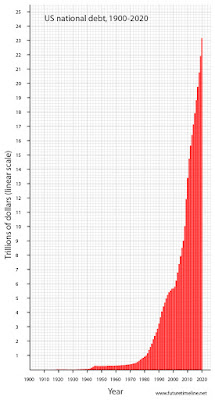

It is also important to understand that there were many in the economic media that also argued that because the dollar is the preeminent world reserve currency the central bank could print dollars perpetually without inflationary consequences. This notion became a basic fundamental of Modern Monetary Theory (MMT).

Of course, MMT is utter nonsense. There are ALWAYS consequences for overt money creation even for world reserve currencies. It doesn’t matter if you try to price your national currency without comparisons to foreign currencies; under globalism and economic interdependency the velocity of money matters. If a country is printing with wild abandon, those dollars are going to buy less labor, less production and less goods overseas. Nothing defeats the laws of supply and demand, not even strategic debt creation.

…click on the above link to read the rest of the article…

/types-of-inflation-4-different-types-plus-more-3306109-Final2-79a7abf4e9ed4d408e84f075d7029b07.png)