There’s Something Wrong With The World Today and It’s 1995

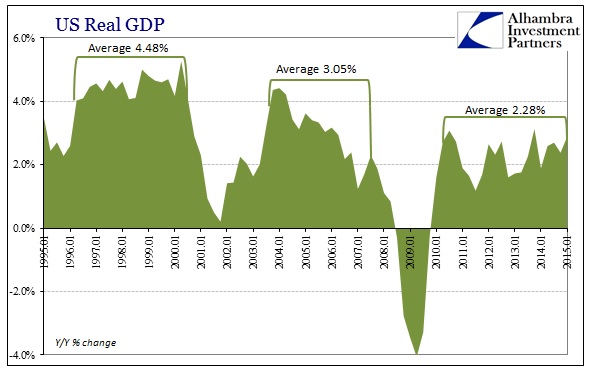

There weren’t any surprises in the “final” GDP update for Q1. Going back to -0.2%, the same interpretations still apply, especially and including the inventory contribution. Economists and policymakers want to talk particularly about how Q1 is prone to “residual seasonality” but that is missing the bigger part of the problem. Whether Q1 was -0.2% or +2% doesn’t really matter, as what truly makes this a dangerous economic situation is that Q1 and all the prior quarters were not a steady +4%.

To listen to economists today is to suggest that such an expectation amounts to wishful thinking, and that such “normal” growth is no longer. That sentiment may apply, but only to the narrow manner in which orthodox economics can integrate real world factors. In other words, “they” accept that there is something wrong but cannot answer the relevant and primary question as to what that might be.

This problem is obvious in every economic account, including GDP. Using year-over-year figures to harmonize among other economic systems, the lack of growth is striking post-crisis – made all the more so by the size of the huge hole left in the wake of the Great Recession itself. That means, even by this count, the opportunity cost of this non-recovery is severely understated.

I picked 1995 as a starting point for a reason, which I’ll get back to below. Suffice to say, in isolating only the growth periods of each economic cycle the current version is by comparison about half that of the late 1990’s. The middle cycle, the housing bubble age, shows what is plainly a transition from the first to the third. The primary opportunity cost is not simply the difference between them, but rather far more importantly the compounding nature of time. In other words, the longer these deficiencies drag the more costly in very real economic distortions that cannot be measured.

…click on the above link to read the rest of the article…