If Oil Prices Are Surprising, Then That Can Only Mean Demand

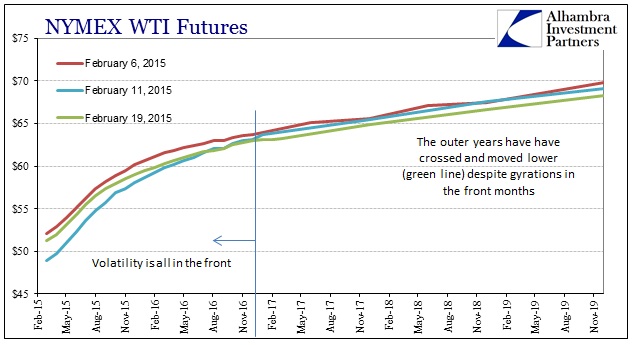

Crude oil futures have been quite volatile of late, particularly in the front months where even the slightest changes in expectations of whatever factor (rig counts, CEO comments, etc.) send WTI surging or tumbling by turn. Despite that, however, the outer years on the curve have seen not just more stability but a steady downward pressure of late. I think a lot of that has to do with futures investors reconciling actual contango options with the idea that demand is far more of not just a problem, but a longer-term problem.

At the front end, rig counts have gained most attention but only as they relate to the surge in inventory. The US is overflowing with oil and production remains at a record high, but the two of those factors together don’t actually count as much in terms of price as is made out by most commentary. It is far too difficult for many to discount the entire economics professions’ complete dedication to the US “booming” economy in order to see a huge demand problem in oil prices; far easier to simply repeat the words “record supply” and leave it at that.

If you actually view the futures curve of late, the curves of recent days has crossed in the outer years. In other words, where prices have moved around at the shorter end, out at the long end the curve has shifted significantly downward regardless of short term pricing. That relates to both contango, as noted above, but also I believe growing recognition that supply is overwrought and demand is what may be impaired – perhaps more permanently than anyone thought possible only a few months ago.

…click on the above link to read the rest of the article…