Margin Call: You Were Warned Of The Risk

I have been slammed with emails over the last couple of days asking the following questions:

“What just happened to my bonds?”

“What happened to my gold position, shouldn’t it be going up?”

“Why are all my stocks being flushed at the same time?”

As noted by Zerohedge:

“Stocks down, Bonds down, credit down, gold down, oil down, copper down, crypto down, global systemically important banks down, and liquidity down…

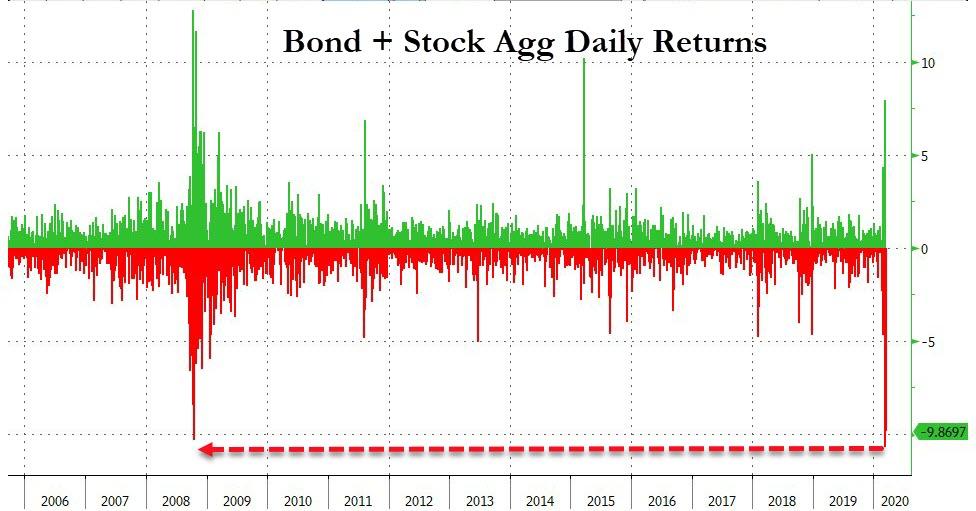

Today was the worst day for a combined equity/bond portfolio… ever…”

This Is What A “Margin Call,” Looks Like.

In December 2018, we warned of the risk. At that time, the market was dropping sharply, and Mark Hulbert wrote an article dismissing the risk of margin debt. To wit:

“Plunging margin debt may not doom the bull market after all, reports to the contrary notwithstanding.

According to research conducted in the 1970s by Norman Fosback, then the president of the Institute for Econometric Research, there is an 85% probability that a bull market is in progress when margin debt is above its 12-month moving average, in contrast to just a 41% probability when it’s below.

Why, then, do I suggest not becoming overly pessimistic? For several reasons:

1) The margin debt indicator issues many false signals

2) There is insufficient data

3) Margin debt is a strong coincident indicator.”

I disagreed with Mark on several points at the time. But fortunately the Federal Reserve’s reversal on monetary policy kept the stock market from sinking to levels that would trigger “margin calls.”

As I noted then, margin debt is not a technical indicator that can be used to trade markets. Margin debt is the “gasoline,” which drives markets higher as the leverage provides for the additional purchasing power of assets. However, that “leverage” also works in reverse as it provides the accelerant for larger declines as lenders “force” the sale of assets to cover credit lines without regard to the borrower’s position.

…click on the above link to read the rest of the article…