Are The Rating Agencies Complicit In Another Massive Scandal: A WSJ Investigation Leads To Shocking Questions

Over the past two years, a key event many bears have cited as a potential catalyst for the next market crash, is the systematic downgrade of billions of lowest-rated investment grade bonds to junk as a result of debt leverage creeping ever high, coupled with the inevitable slowdown of the economy, which would lead to an avalanche of “fallen angels” – newly downgraded junk bonds which institutional managers have to sell as a result of limitations on their mandate, in the process sending prices across the corporate sector sharply lower.

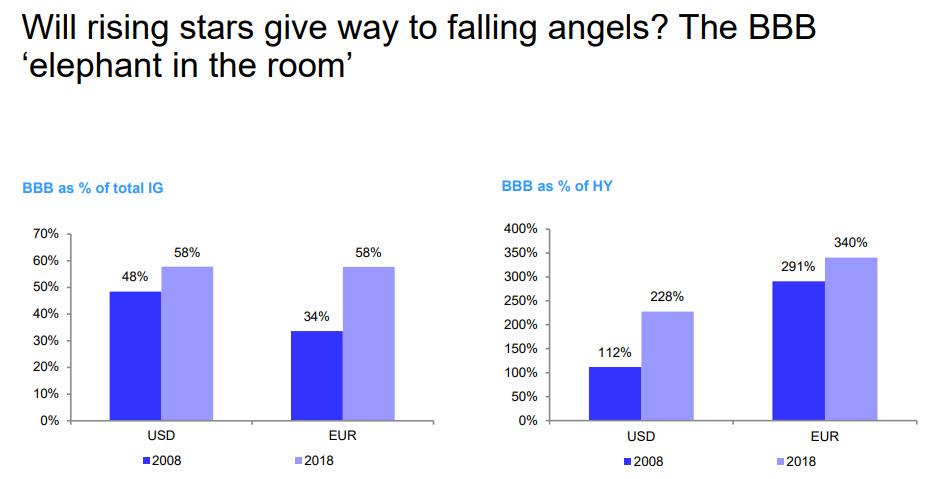

As we discussed in July, the scope of this potential problem is massive, with the the lowest-rated, BBB sector now nearly 60% of all investment grade bonds, and more than double the size of the entire junk bond market in the US, and 3.4x bigger than the European junk bond universe.

Yet after waiting patiently for years for the inevitable downgrade avalanche which would unleash a zombie army of fallen angels and potentially spark the next crash, with the occasional exception of a few notable downgrades such as PG&E and Ford, this wholesale event has failed to materialize so far, something which the bulls have frequently paraded as an indication that the economy is far stronger than the bears suggest.

But is it? And instead of the economy being stronger, are we just reliving the past where rating agencies pretended everything was ok until the very end, only to admit they were wrong all along, and then slash their rating retrospectively, too late however as the next financial crisis is already raging.

…click on the above link to read the rest of the article…