Global Central Banks “Are Trapped By Their Own Inflation Targets”

Negative Rates Would Lead To #Chaos

Central bankers attending the G-7 meeting are sounding remarkably coordinated in their message. The global economy is growing but inflation isn’t. And that, along with the oft-cited global headwinds, means they’re ready and able to add more liquidity to the system. In the case of the U.S. they have virtually promised that it’s underway. They can assure markets that they’re “ready.” But the far more important assertion is driving home that they’re still “able.”

Inevitably, and understandably, the question of whether they’re running out of ammunition to conduct further monetary easing has been the subject of debate. But the last thing they can afford to let happen is for investors, corporations or consumers to conclude that they’re near the end of the line.

Monetary policy is a transmission mechanism that largely works through expectations. Nothing will crater inflationary expectations, alter the spend-versus-save dynamic, affect capital-investment decisions and tighten financial conditions faster than the admission that little more is possible.

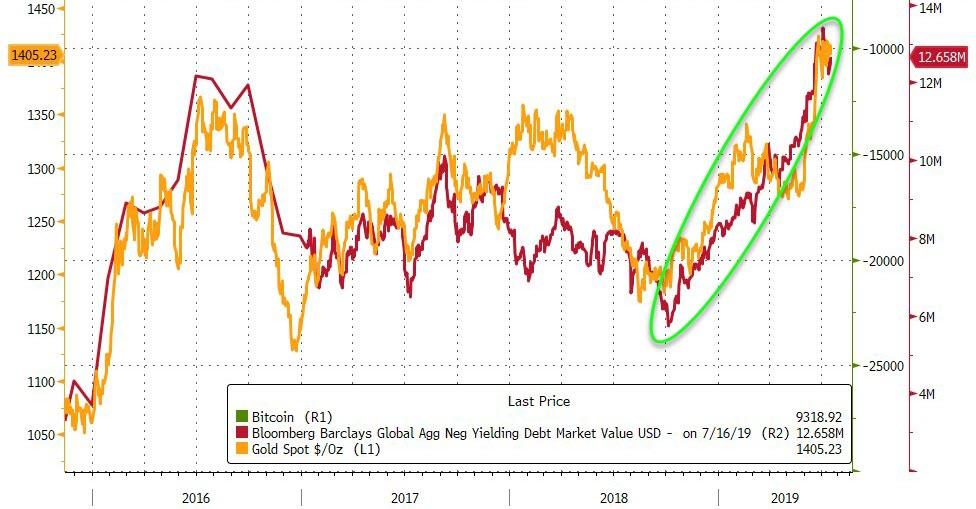

They’re in fact trapped by their own inflation targets. No one realized that it’s easier to get inflation down than up. Therefore, central bankers need to keep considering, and in some cases delivering, more and more extreme forms of easing.

Zero rates begot quantitative easing which led to negative rates. While financial markets give the appearance of stability through asset bubbles, higher asset prices haven’t led to them fulfilling their mandates.

There is a reason there’s so much academic interest in discussing the potential benefits of policies like helicopter money and modern monetary theory — ideas that would have previously been dismissed out of hand. Officials need to convince themselves of the potential efficacy of these notions in order to get the rest of us to believe they’re legitimate options. The truth is, they really don’t know why inflation has remained such a problem. Therefore the proper cure remains elusive.

…click on the above link to read the rest of the article…