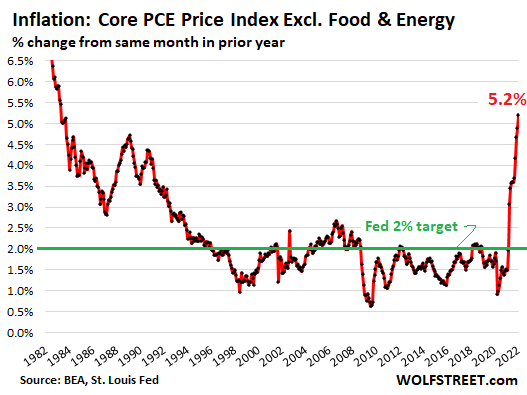

In its effort to contain inflation, the Federal Reserve has begun what many expect to be a series of interest rate boosts, which are already taking a toll on stock and housing markets, with job losses likely to follow. While Americans grow weary of record high gas and grocery prices, however, another round of price increases is making its way through the food supply chain and is expected to reach consumers this fall.

“People don’t realize what’s fixing to hit them,” Texas farmer Lynn “Bugsy” Allen said. “They think it’s tough right now; you give it until October. Food prices are going to double.”

The 8.8 percent increase in food prices that Americans have already seen doesn’t take into account the dramatically higher costs that farmers are now experiencing. That’s because farmers pay upfront and only recoup their expenses at the point of sale, months later.

“Usually, what we see on the farm, the consumer doesn’t see for another 18 months,” said John Chester, a Tennessee farmer of corn, wheat, and soybeans. But with the severity of these cost increases, consumers could feel the effects much sooner, particularly if weather becomes a factor.

“Nothing that consumers are paying is going to bridge the gap for farmers right now,” according to Lorenda Overman, a North Carolina farmer who raises hogs and grows corn, soybeans, and sweet potatoes. She said the spike in fuel costs has put her farm into the red this year.

…click on the above link to read the rest of the article…

CHICAGO – Smart economic policymaking invariably requires trading off some pain today for greater future gains. But this is a difficult proposition politically, especially in democracies. It is always easier for elected leaders to indulge their constituents immediately, on the hope that the bill will not arrive while they are still in office. Moreover, those who bear the pain caused by a policy are not necessarily those who will gain from it.

That is why today’s more advanced economies created mechanisms that allow them to make hard choices when necessary. Chief among these are independent central banks and mandated limits on budget deficits. Importantly, political parties reached a consensus to establish and back these mechanisms irrespective of their own immediate political priorities. One reason why many emerging markets have swung from crisis to crisis is that they failed to achieve such consensus. But recent history shows that developed economies, too, are becoming less tolerant of pain, perhaps because their own political consensus has eroded.

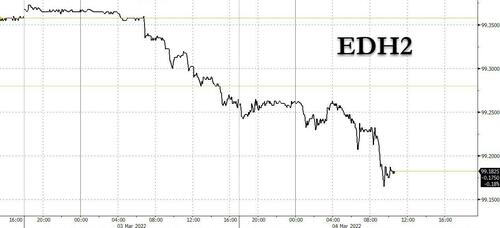

Financial markets have become volatile once again, owing to fears that the US Federal Reserve will have to tighten its monetary policy significantly to control inflation. But many investors still hope that the Fed will go easy if asset prices start to fall substantially. If the Fed proves them right, it will become that much harder to normalize financial conditions in the future.

Investors’ hope that the Fed will prolong the party is not baseless. In late 1996, Fed Chair Alan Greenspan warned of financial markets’ “irrational exuberance.”…

…click on the above link to read the rest of the article…