Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise.

When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn’t too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it’s like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man’s Curve.

The stock market is in the Pinto, and the smell of gasoline is so strong it’s overpowering the smell of old Cheetos and stale beer. The Federal Reserve is driving, and it’s got a crazy glint in its eyes that everyone dismisses– to their immense regret when the Pinto goes off the cliff and flames envelop the wreckage.

We’re talking metaphorically here. The pain of catastrophic financial losses isn’t physical. But that doesn’t mean it won’t hurt for years or even decades.

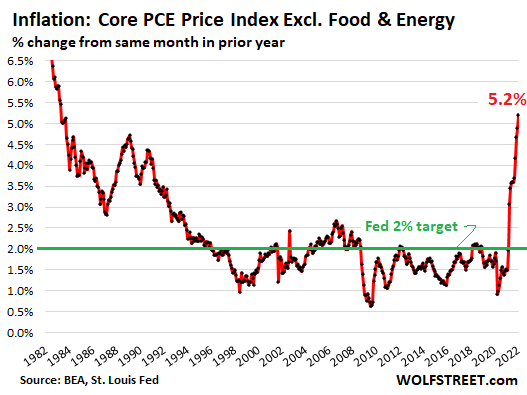

Here’s a brief recap: The Fed says inflation is under control, will soon subside, and is no biggie.

In other words, the Fed believed it wielded Jedi Mind Tricks (to convince the masses that there was nothing to worry about as “this isn’t the inflation you’re looking for”) and that it was living in a Wizard of Oz world in which it possessed supernatural powers: if we say inflation is declining, it will decline.

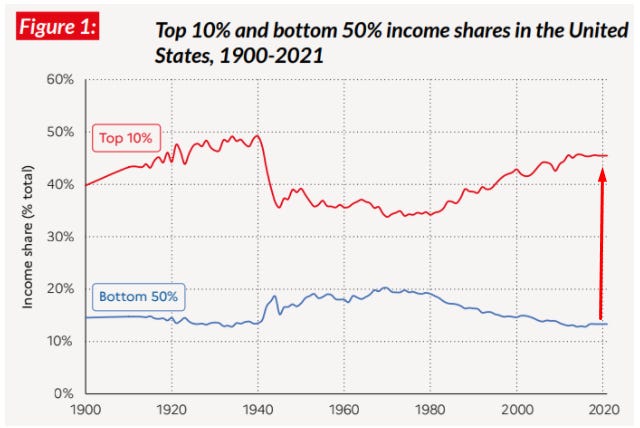

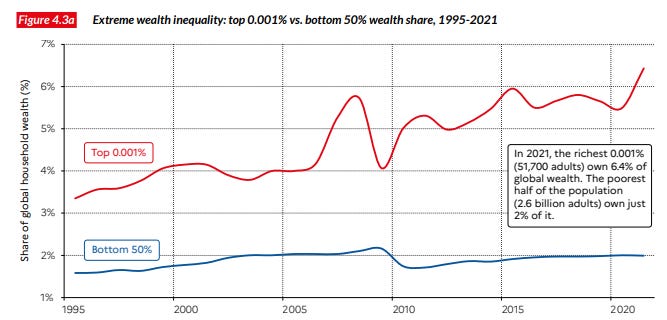

Put simply, the Fed is completely delusional. If you need more proof, consider their risible claim that Fed policies aren’t the cause of soaring wealth inequality, when the evidence that the Fed has destabilized society by boosting wealth inequality to new heights is incontestable to all but con artists and the delusional.

…click on the above link to read the rest of the article…

CHICAGO – Smart economic policymaking invariably requires trading off some pain today for greater future gains. But this is a difficult proposition politically, especially in democracies. It is always easier for elected leaders to indulge their constituents immediately, on the hope that the bill will not arrive while they are still in office. Moreover, those who bear the pain caused by a policy are not necessarily those who will gain from it.

That is why today’s more advanced economies created mechanisms that allow them to make hard choices when necessary. Chief among these are independent central banks and mandated limits on budget deficits. Importantly, political parties reached a consensus to establish and back these mechanisms irrespective of their own immediate political priorities. One reason why many emerging markets have swung from crisis to crisis is that they failed to achieve such consensus. But recent history shows that developed economies, too, are becoming less tolerant of pain, perhaps because their own political consensus has eroded.

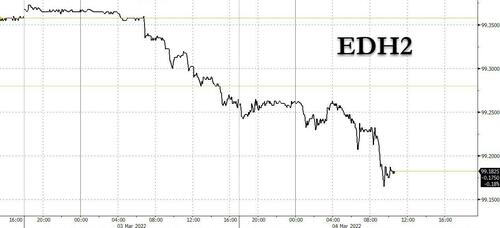

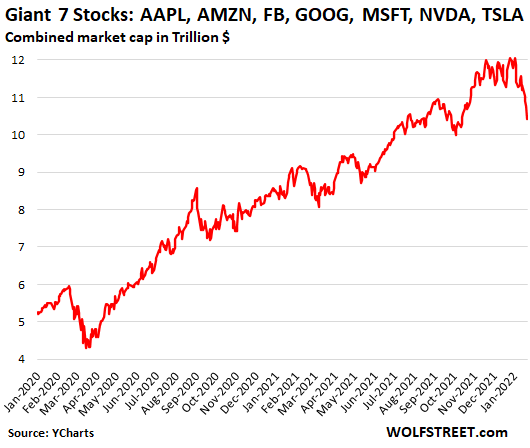

Financial markets have become volatile once again, owing to fears that the US Federal Reserve will have to tighten its monetary policy significantly to control inflation. But many investors still hope that the Fed will go easy if asset prices start to fall substantially. If the Fed proves them right, it will become that much harder to normalize financial conditions in the future.

Investors’ hope that the Fed will prolong the party is not baseless. In late 1996, Fed Chair Alan Greenspan warned of financial markets’ “irrational exuberance.”…

…click on the above link to read the rest of the article…