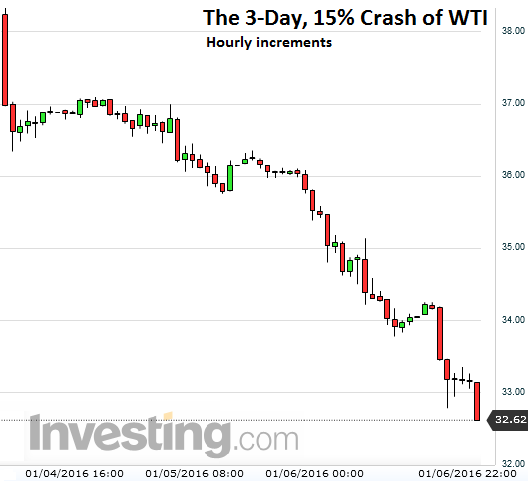

After having been through the greatest two-year loss on record, the price of oil plunged 9.6% on Wednesday and in evening trading. As I’m writing this, WTI hit $32.62 a barrel, a new low since the desperate depth of the Financial Crisis, when it very briefly kissed $30.28 a barrel on December 23, 2008, before bouncing off sharply.

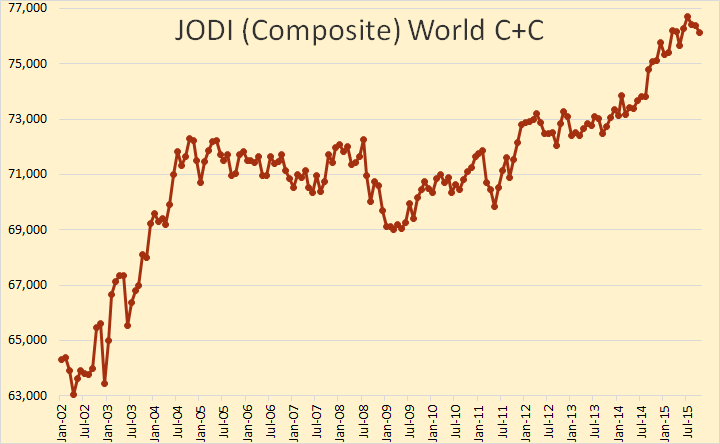

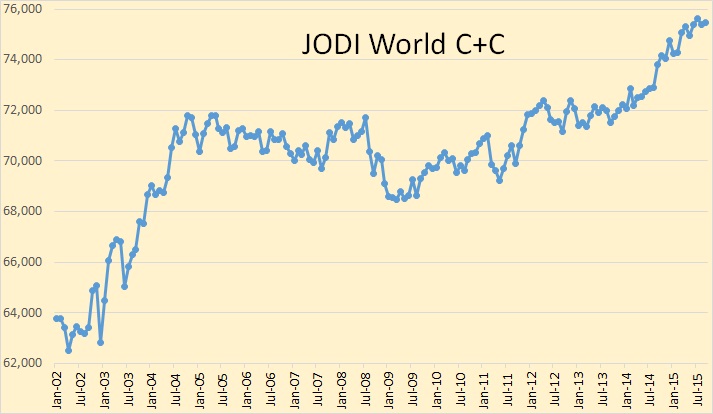

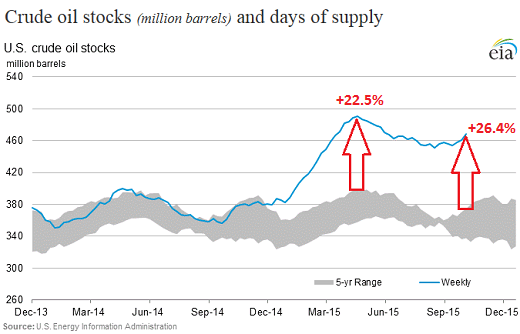

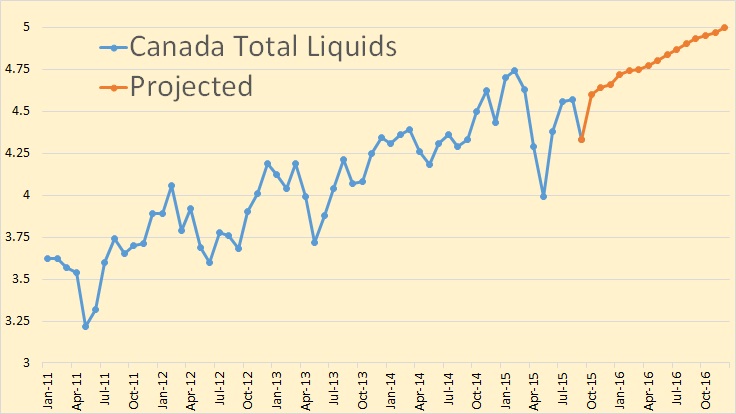

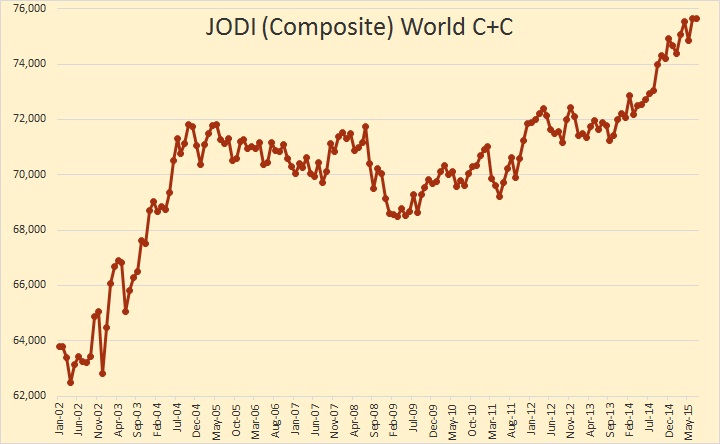

This time, it’s serious. Brent, the global benchmark, has crashed to $32.75, an 11-year low. This isn’t a quick scare that happens during a Financial Crisis. It’s the result of a persistently growing glut.

Since the oil price plunge began in July 2014, every rally, every “opportunity of a lifetime” to buy oil “for cents on the dollar” has turned out to be a falling knife.

This is what the three trading-day, 15% crash of WTI looks like:

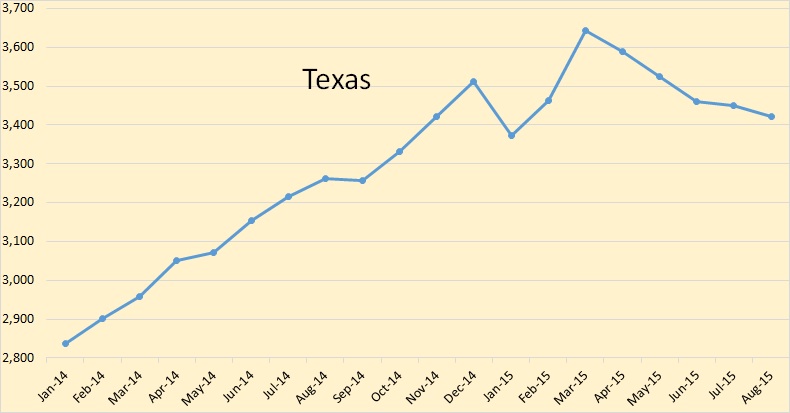

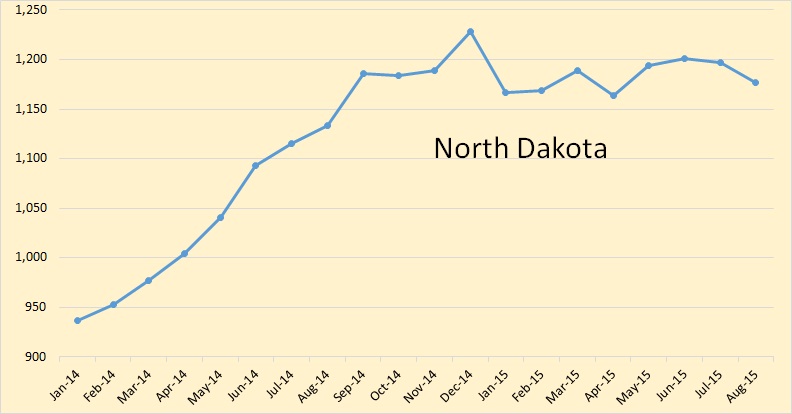

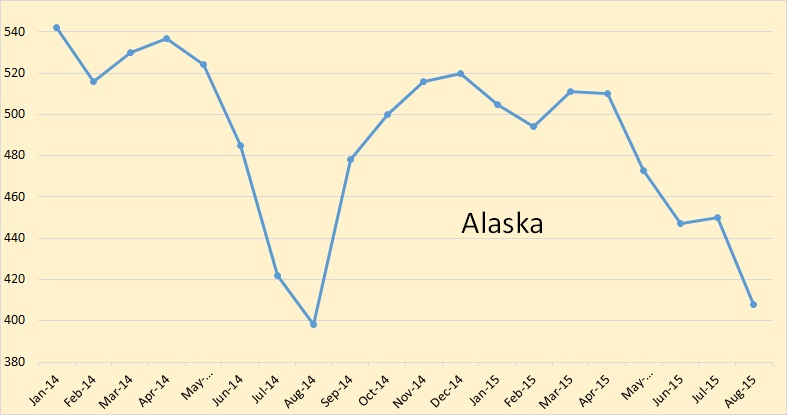

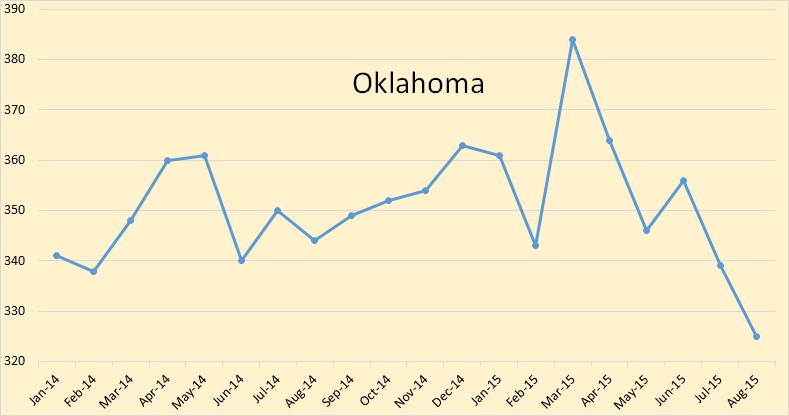

The contagion of the oil price plunge has been drifting into other sectors of the US economy, housing and office space in Houston, the state budget in Alaska, jobs, manufacturing…. Investments have gone up in smoke. Loans have gone bad. Defaults, restructurings, and bankruptcies are now a routine occurrence. Banks are looking over their shoulder. PE firms are licking their wounds from their mega-bets on fracking made in prior years, and they’re licking their new wounds from having tried to catch many falling knives.

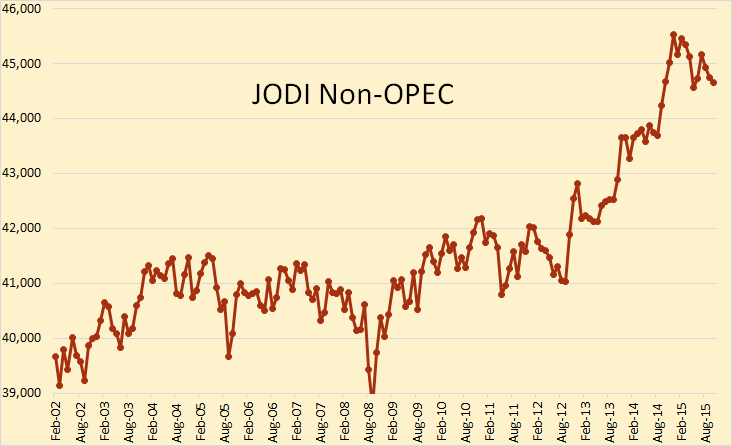

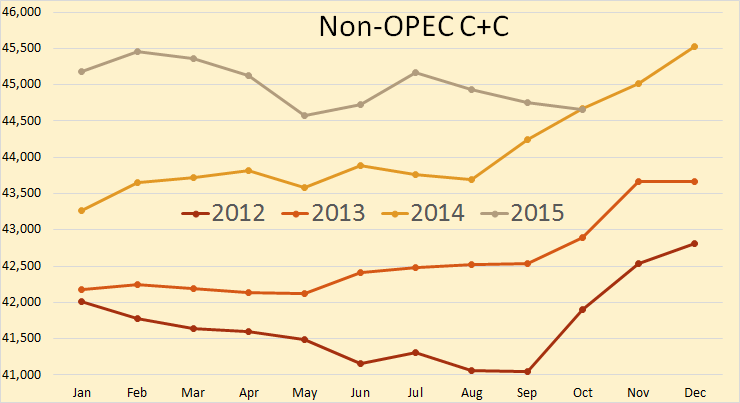

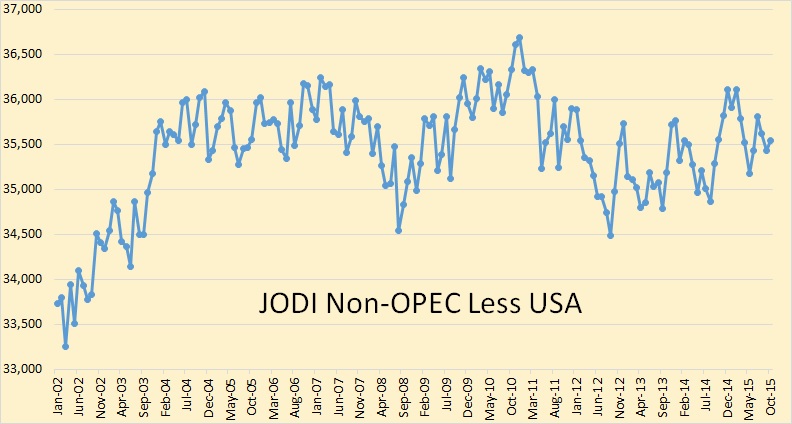

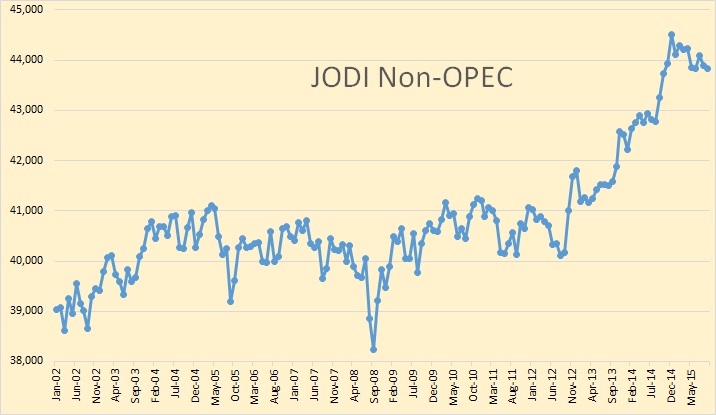

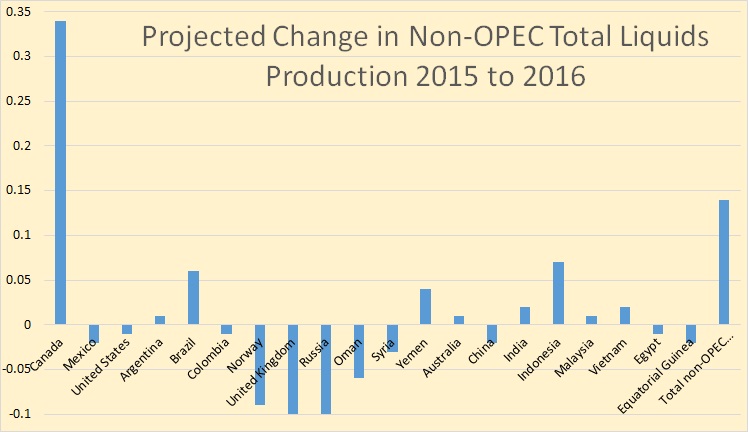

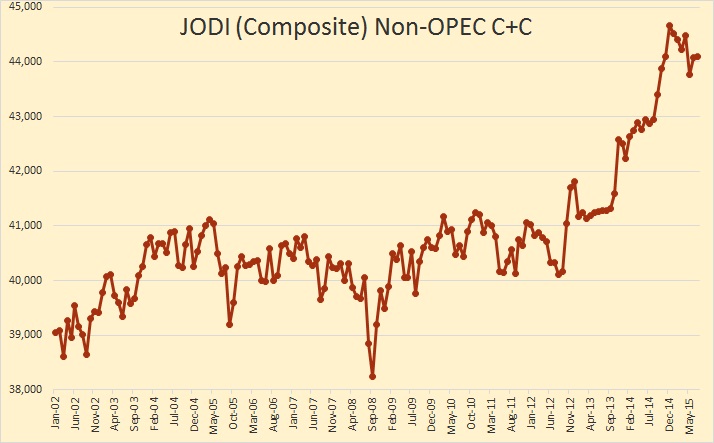

This isn’t going to be an easy bust to get through. It’s a US problem. And it’s a global problem.

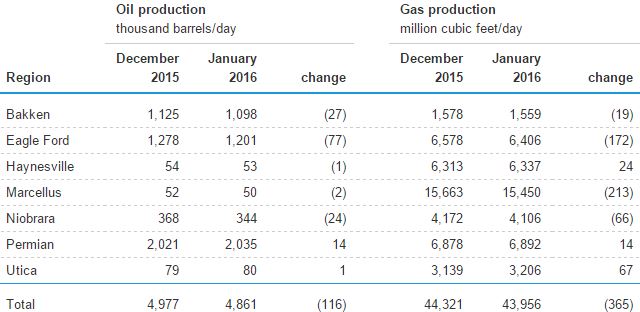

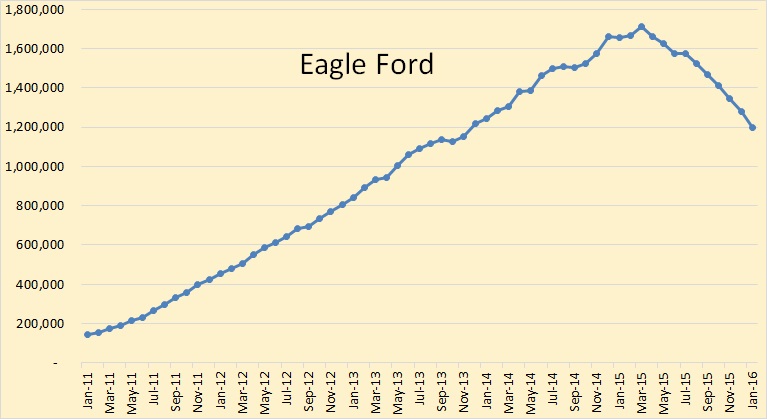

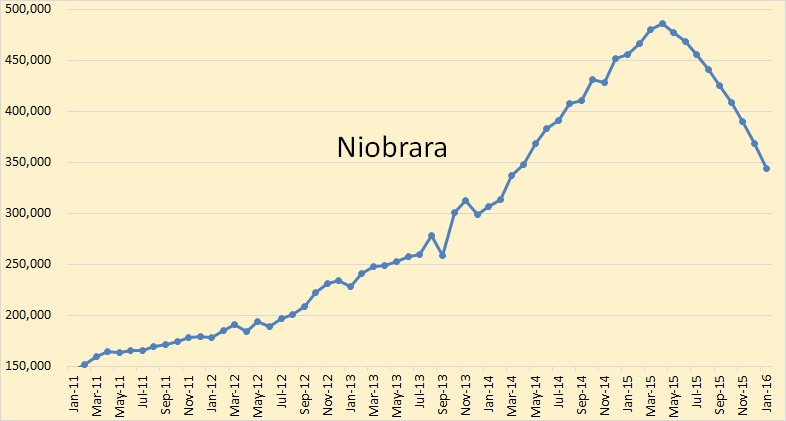

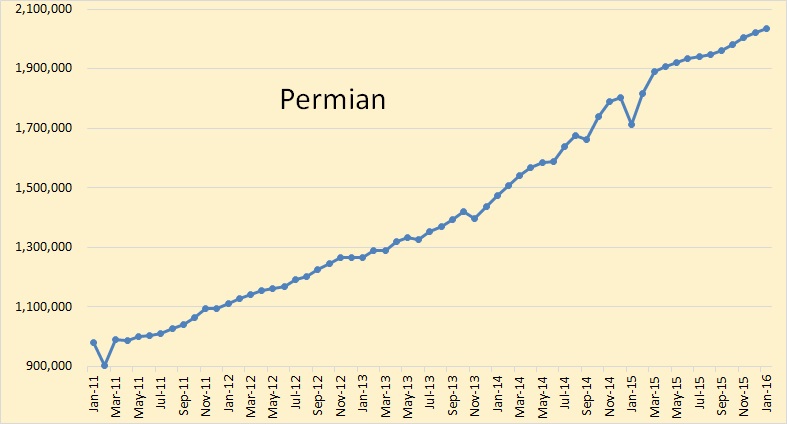

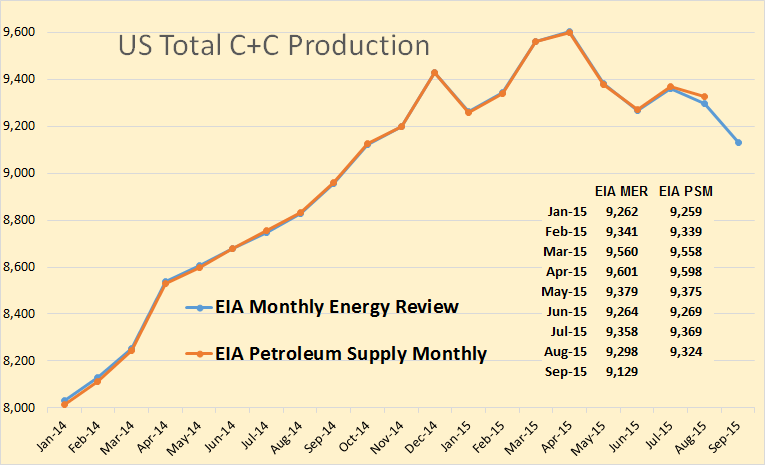

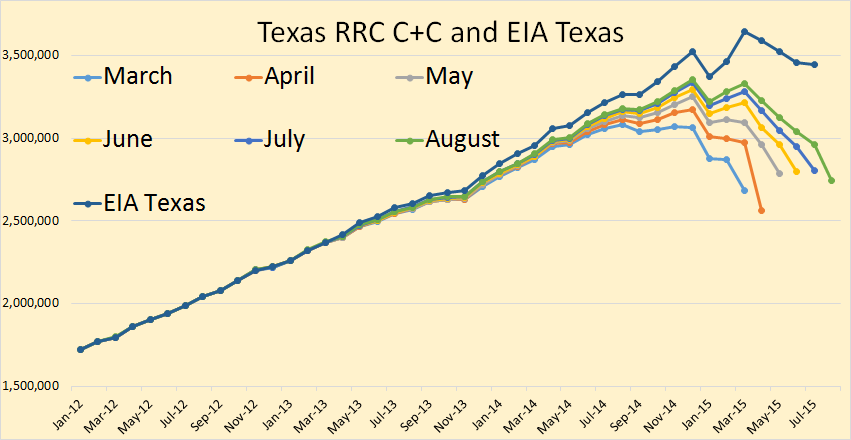

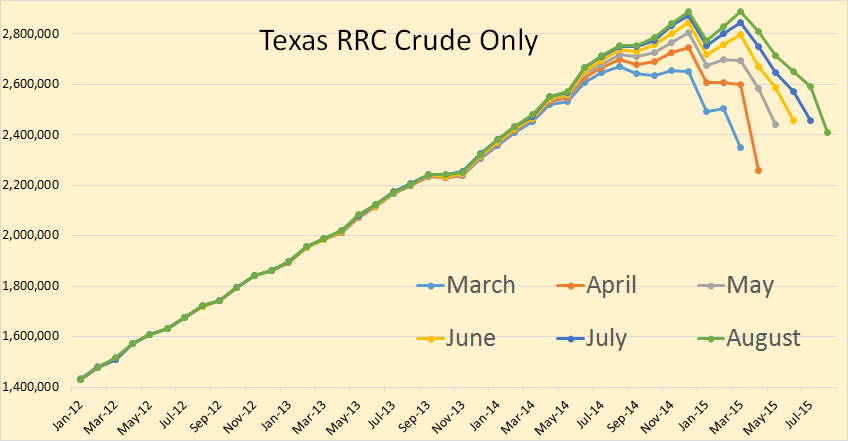

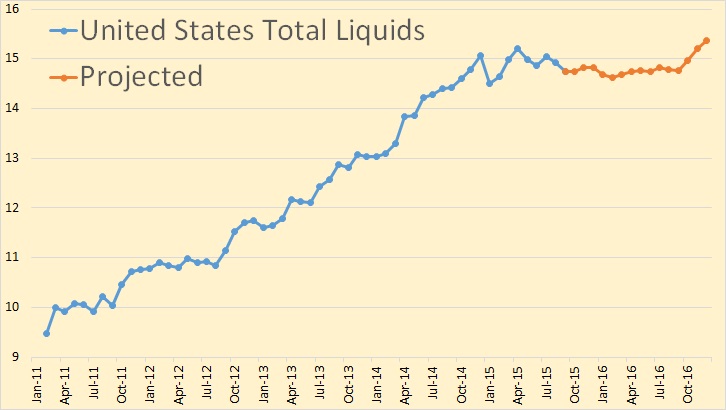

In the US, crude oil production started declining on a monthly basis in mid-2015, according to EIA estimates. But despite those monthly declines, production averaged 9.3 million barrels per day in 2015, the highest rate since 1972, and a 7% increase over 2014.

…click on the above link to read the rest of the article…