Home » Posts tagged 'debt' (Page 18)

Tag Archives: debt

MacroView: The Next “Minsky Moment” Is Inevitable

MacroView: The Next “Minsky Moment” Is Inevitable

In 2007, I was at a conference where Paul McCulley, who was with PIMCO at the time, was discussing the idea of a “Minsky Moment.” At that time, this idea fell on “deaf ears” as the markets, and economy, were in full swing.

However, it wasn’t too long before the 2008 “Financial Crisis” brought the “Minsky Moment” thesis to the forefront. What was revealed, of course, was the dangers of profligacy which resulted in the triggering of a wave of margin calls, a massive selloff in assets to cover debts, and higher default rates.

So, what exactly is a “Minskey Moment?”

Economist Hyman Minsky argued that the economic cycle is driven more by surges in the banking system, and in the supply of credit than by the relationship which is traditionally thought more important, between companies and workers in the labor market.

In other words, during periods of bullish speculation, if they last long enough, the excesses generated by reckless, speculative, activity will eventually lead to a crisis. Of course, the longer the speculation occurs, the more severe the crisis will be.

Hyman Minsky argued there is an inherent instability in financial markets. He postulated that an abnormally long bullish economic growth cycle would spur an asymmetric rise in market speculation which would eventually result in market instability and collapse. A “Minsky Moment” crisis follows a prolonged period of bullish speculation which is also associated with high amounts of debt taken on by both retail and institutional investors.

One way to look at “leverage,” as it relates to the financial markets, is through “margin debt,” and in particular, the level of “free cash” investors have to deploy. In periods of “high speculation,” investors are likely to be levered (borrow money) to invest, which leaves them with “negative” cash balances.

…click on the above link to read the rest of the article…

The State of the Union: An Annual Reminder of Inevitable Default

The State of the Union: An Annual Reminder of Inevitable Default

Last night’s State of the Union was particularly noteworthy for its showmanship. Scholarships were given away, medals were awarded, families reunited. At a time when national politics is bad theater, President Trump is clearly its most gifted star.

Trump also knows what sells. As a political figure, he’s motivated not by any consistent ideology, but rather by transactional legislation. Following the performance, an MSNBC pundit noted that the speech was a “microtargeted ad” to various demographics aimed at expanding his base before next year’s election.

Combined with his Super Bowl ads highlighting criminal justice reform, his focus on charter schools and honoring a hundred-year-old Tuskegee airman are aimed at eroding away the Democrats’ 90 percent control of black voters. The cameo by Venezuela opposition leader Juan Guaidó was an appeal to Hispanic families who have fled communist regimes—perhaps a poke at Bernie Sanders. Paid family leave, a policy focus of his daughter, is intended to help him with suburban women.

What doesn’t sell? Fiscal responsibility.

The political equivalent of Crystal Pepsi, the Republican Party has given up its long-standing façade of budgetary restraint. As Donald Trump told donors earlier this year, “Who the hell cares about the budget?”

Of course, some people do care, particularly those who understand the real costs of runaway spending. Unfortunately, politics isn’t about the economic literacy of the few, but the prevailing ideology of the masses. As Jeff Deist noted in 2016, the implicit ideology of the American population is much closer to Bernie Sanders than it is to Ludwig von Mises. As such, it should be no surprise that the policies of the country align more closely with the “deficits don’t matter” vision of Modern Monetary Theorists than the sober analysis of Austrians economists.

…click on the above link to read the rest of the article…

Why Germany Is Going To War With Gold

Why Germany Is Going To War With Gold

Owning gold is a way to get out of this “debt trap”, but governments don’t want you to own gold, especially in Germany

Germans, like Indians and Chinese, love their gold – although their reasons for buying and keeping bullion are somewhat different.

In China and India, gold jewelry is a status symbol – a sign of wealth and success. In Germany, owning gold bars and coins, maybe a 24-karat necklace or two, is a means of preserving wealth, especially in times of war or economic crisis, something never far from Germans’ minds, considering their history.

Indeed the “war guilt” Germans experience over the atrocities of Nazi Germany is accompanied by fears that their government could again lose control of fiat money, as the Weimar Republic did in the 1920s, leading to devastating hyper-inflation.

In India “a marriage is not a marriage without gold.” Indians find it auspicious to be-gift gold jewelry during the Diwali festival, which begins in October, and wedding season. Gold-shopping for the bride is thought to bring good fortune and invoke the blessings of a Hindu goddess. At nearly 20 million weddings a year, Indians’ annual demand for the precious metal exceeds 514 tonnes. Easy to see why the country’s private gold holdings are the largest in the world, a mind-boggling 24,000 tonnes. (almost as much as the world’s top 10 central bank holdings combined)

However in 2016 China overtook India as the world’s top buyer of gold jewelry. The country’s growing throng of affluent consumers is driving demand for gold rings, bracelets and necklaces, especially in January and February when many Chinese purchase gold jewelry as gifts for Chinese New Year. According to McKinsey & Company, by 2025 China will represent up to 44% of the global luxury jewelry market.

…click on the above link to read the rest of the article…

The Corporate Debt Bubble Is A Train Wreck In Slow Motion

The Corporate Debt Bubble Is A Train Wreck In Slow Motion

There are two subjects that the mainstream media seems specifically determined to avoid discussing these days when it comes to the economy – the first is the problem of falling global demand for goods and services; they absolutely refuse to acknowledge the fact that demand is going stagnant and will conjure all kinds of rationalizations to distract from the issue. The other subject is the debt bubble, the corporate debt bubble in particular.

These two factors alone guarantee a massive shock to the global economy and the US economy are built into the system, but I believe corporate debt is the key pillar of the false economy. It has been utilized time and time again to keep the Everything Bubble from completely deflating, however, the fundamentals are starting to catch up to the fantasy.

For example, in terms of stock markets, which are now meaningless as an indicator of the health of the real economy, corporate stock buybacks have been the single most vital mechanism for inflation. Corporations buy their own stocks, often using cash borrowed from each other and from the Federal Reserve, in order to reduce the number of shares on the market and artificially boost the value of the remaining shares. This process is essentially legal manipulation of equities, and to be sure, it has been effective so far at keeping markets elevated.

The problem is that these same corporations are taking on more and more debt through interest payments in order to maintain the facade. Over the period of a decade, corporate debt has skyrocketed back to levels not seen since 2007, just before the credit crisis. The official corporate debt load now stands at over $10 trillion, and that’s not even counting derivatives exposure.

…click on the above link to read the rest of the article…

Hubris

Hubris

One day this bull market will end and the age of the central banking enabled debt bubble will be exposed for the hubris that it is and all the sins of “potential side effects” that central bankers warn about but never do anything about will come back to haunt all of us. It’ll be the age of the great unwind. Nobody will tell us in the moment when it peaks and I suspect it will not start with a bang, rather a whimper, but only end with a bang.

And this great unwind will not last a month or a year, but many years as all the excesses will have to work themselves through the system and all the systematic buy programs will turn into systematic sell programs that will be just as relentless on the way down as they were on the way up.

They very notion of the permanent can kicking we are witnessing now will reveal itself to have been a fantasy. People forget that 2019 and into 2020 came about because of systemic failure of epic proportions. The single one time central bankers tried to tighten blew up in their faces. And the Fed’s forced re-expansion of their balance sheet has now bestowed this blow-off top that has pushed asset prices the farthest distance above the underlying size of the economy that we’ve ever seen. A perversion of the financial system that has created wealth for the few not seen since the 1920s.

I can’t know when this process begins. Nobody can. For all I know it begins today. Or it could be months from now. The price action will tell us. Economically, technically, structurally it’s all set up for it.

…click on the above link to read the rest of the article…

Are Consumers Nearing the End of Their Road of Debt?

Are Consumers Nearing the End of Their Road of Debt?

Are consumers getting close to the end of their road of debt?

There are some indications that they might be and that’s not good news for an economy built on consumers spending money they don’t have.

Total consumer debt grew and set yet another new record in November, according to the most recent data released by the Federal Reserve. But the rate of growth slowed and credit card debt contracted slightly for the third month out of the last four.

Total consumer debt grew by $12.5 billion to $4.176 trillion. (Seasonally adjusted). That represents an annual growth rate of 3.6%, down from 5.5% in October.

The Fed consumer debt figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt.

Revolving credit outstanding, primarily credit card debt, fell by $2.4 billion, a 2.7% decline. That was offset by a healthy increase of $14.9 billion (5.8%) in non-revolving credit, including student loans, automobile loans and financing for other big-ticket purchases.

Even with the decline in revolving credit card debt, Americans still owe nearly $1.1 trillion on their plastic.

But the overall trend in borrowing has fallen over the last six months and credit card borrowing has taken a noticeably steep downturn.

Some are taking the sagging level of borrowing as a warning sign. As one analyst put it in an article on Seeking Alpha:

It could be that the consumer end of the economy has reached the point at which it cannot add any more debt. Unlike the federal government which has sovereign dollars to print, the consumer has a fixed amount they can spend including paying back any loans.”

Generally, consumer spending and consumer debt tend to move in the same direction. In other words, the drop in borrowing could indicate consumers are shutting their wallets.

…click on the above link to read the rest of the article…

China’s Growing Economic Miracle…(Collapse). Or… Everyone Pays the Piper!

China’s Growing Economic Miracle…(Collapse). Or… Everyone Pays the Piper!

In emulating the American economic raison d’etre, China has attempted to develop its unique capitalist model while ignoring that it too will soon suffer the same fate for the same reason: Unsustainable debt. When examining the recent realities of Chinese banking and finance over the past year it seems the steam that president Xi Jinping touts as powering the engine of his purported economic miracle of a master-planned economy is only a mirage, now almost completely evaporated before his eyes.

Like the many other similarly foolish western nations, China seeks only one path out of this fiscal death spiral, one that will likely spell doom and/or revolution in many countries soon: More debt.

China is becoming increasingly unable to continue to pay into the base of the world’s largest pyramid scheme of an economy and the cracks in the bubble are showing. This past year, saw three of the 4,279 Chinese lenders almost fail, if not for the massive intervention by the People’s Bank of China (PBoC) of immediate liquidity via more debt. The Chinese economic miracle is built on unsustainable debt-based infrastructure projects over the past two decades that have provided China with a face of prosperity to show the world, but this is only a mask to hide the limited countrywide success of the Chinese miracle into the rural areas. The injection of $Trillions in capital has seen China distribute these sums across the base of its economy creating a GDP that hit a high of 14.2 % in 2007 then averaged nearly 9% for the next decade before dropping yearly to 6.1% in 2018. All this growth had produced a personal affluence to a sub-set of Chinese society that has stoked this appearance of a flourishing economy.

…click on the above link to read the rest of the article…

2020 Will Be A Crucial Year For Oil

2020 Will Be A Crucial Year For Oil

It’s the start of a new year and a new decade, and the oil market is as unpredictable as ever.

Will OPEC+ extend its cuts? Will U.S. shale finally grind to a halt? Is this the “year of the electric vehicle”? Here are 10 stories to watch in 2020.

Shale debt, shale slowdown. The debt-fueled shale drilling boom is facing a reckoning. Around 200 North American oil and gas companies have declared bankruptcy since 2015, but the mountain of debt taken out a few years ago is finally coming due. Roughly $41 billion in debt matures in 2020, which ensures more bankruptcies will be announced this year. The wave of debt may also force the industry to slam on the breaks as companies scramble to come up with cash to pay off creditors.

Year of the EV. Some analysts say that 2020 will be the “year of the EV” because of the dozens of new EV models set to hit the market. In Europe, available EV models will rise from 100 to 175. The pace of sales slowed at the end of last year, but the entire global auto market contracted. EVs may struggle to keep the pace of growth going, but EVs are capturing a growing portion of a shrinking pie.

Climate change. 2020 starts off with hellish images from the out-of-control Australian bushfires. 2019 was one of the warmest years on record and the 2010s was the warmest decade on record. As temperatures rise and disasters multiply, pressure will continue to mount on the oil and gas industry. As Bloomberg Opinion points out, climate change has surged as a point of concern for publicly-listed companies. Oil executives are betting against climate action, but they are surely aware of the rising investment risk. In the past two months, the European Investment Bank is ending financing for oil, gas and coal, and Goldman Sachs cut out financing for coal and Arctic oil. More announcements like this are inevitable.

…click on the above link to read the rest of the article…

Prelude to Crisis

Prelude to Crisis

Simple Conceit

Radical Actions

Ballooning Balance Sheet

Merry Christmas and the Happiest New Year

Ignoring problems rarely solves them. You need to deal with them—not just the effects, but the underlying causes, or else they usually get worse. The older you get, the more you know that is true in almost every area of life.

In the developed world and especially the US, and even in China, our economic challenges are rapidly approaching that point. Things that would have been easily fixed a decade ago, or even five years ago, will soon be unsolvable by conventional means.

There is almost no willingness to face our top problems, specifically our rising debt. The economic challenges we face can’t continue, which is why I expect the Great Reset, a kind of worldwide do-over. It’s not the best choice but we are slowly ruling out all others.

Last week I talked about the political side of this. Our embrace of either crony capitalism or welfare statism is going to end very badly. Ideological positions have hardened to the point that compromise seems impossible.

Central bankers are politicians, in a sense, and in some ways far more powerful and dangerous than the elected ones. Some recent events provide a glimpse of where they’re taking us.

Hint: It’s nowhere good. And when you combine it with the fiscal shenanigans, it’s far worse.

Simple Conceit

Central banks weren’t always as responsibly irresponsible, as my friend Paul McCulley would say, as they are today. Walter Bagehot, one of the early editors of The Economist, wrote what came to be called Bagehot’s Dictum for central banks: As the lender of last resort, during a financial or liquidity crisis, the central bank should lend freely, at a high interest rate, on good securities.

…click on the above link to read the rest of the article…

Jim Rickards Warns that Tsunami of Debt Could Upend the Economy

Jim Rickards Warns that Tsunami of Debt Could Upend the Economy

At some point, an economic problem deepens so much that the piper has to be paid. Both in the U.S. and globally, one of those problems appears to be mountains of debt.

Jim Rickards recently issued a dire proclamation about the global debt situation:

Current global debt levels are simply not sustainable. Debt actually is sustainable if the debt is used for projects with positive returns and if the economy supporting the debt is growing faster than the debt itself. But neither of those conditions applies today.

In other words, most of the global debt we’re racking up isn’t being used for productive purposes. Instead it’s being used to service “benefits, interest and discretionary spending,” according to Rickards.

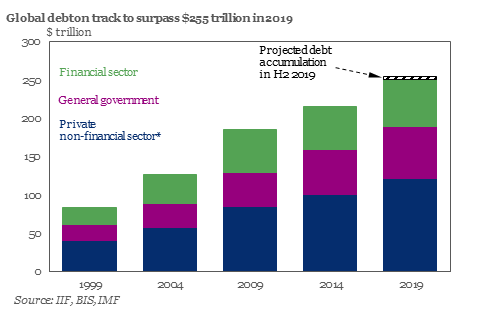

This debt growth should continue. According to the Institute of International Finance (IIF), global debt is expected to pass $255 trillion by the end of this year, and they don’t see the pace of debt accumulation slowing down.

In fact, you can see below how the official global debt has already skyrocketed from about $80 trillion in 1999 to this new record:

Zero Hedge reports that, by year’s end, the global debt will be “roughly equivalent to a record 330% of global GDP.”

With debt outpacing growth by such a large margin, we are fast approaching a day of reckoning. And when that day arrives, it could be disastrous.

Rickards: “It’s a Catastrophic Global Debt Crisis Waiting to Happen”

Another Zero Hedge artjcle reports:

The world bank looked at the four major episodes of debt increases that have occurred in more than 100 countries since 1970 — the Latin American debt crisis of the 1980s, the Asian financial crisis of the late 1990s and the global financial crisis from 2007 to 2009.

…click on the above link to read the rest of the article…

Shattering the Overton Window

Shattering the Overton Window

Aim your rocks at glass houses.

The Overton window is the range of policies politically acceptable to the mainstream population at a given time.[1] It is also known as the window of discourse. The term is named after Joseph P. Overton, who stated that an idea’s political viability depends mainly on whether it falls within this range, rather than on politicians’ individual preferences.[2][3] According to Overton, the window frames the range of policies that a politician can recommend without appearing too extreme to gain or keep public office given the climate of public opinion at that time.

CIAWikipedia

Heaven forbid anyone appear too extreme. Our rulers keep discourse safely within the Overton window by allowing debate about the details of what the government does or doesn’t do. However, those who question the necessity of particular government agencies or programs, or government in general, are beyond-the-pale extremists and cast into the Abyss of the Unacceptable, one zip code over from the Abyss of the Deplorable.

The Federal Reserve has been much in the news lately, The term “repo” is shorthand for a repurchase agreement. The repo market allows those who own securities to sell them to lenders and repurchase them on a set day at a higher price. The difference between the sale and the repurchase price is interest to the lender. The repo market is huge, providing short-term financing for hundreds of billions of dollars worth of transactions daily, primarily in government and agency debt.

On September 16 the repo market blew up. Short term repos usually carrying interest rates of 1 or 2 percent required rates approaching 10 percent for the market to clear. The Fed stepped in, offering massive fiat credit to push rates back down. It wasn’t just a one-time glitch. Since then, the repo market has required substantial and repeated injections of Fed fiat credit.

…click on the above link to read the rest of the article…

Negative Rates, The Destruction Of Money. Sweden Ends Its Experiment.

Negative Rates, The Destruction Of Money. Sweden Ends Its Experiment.

Negative rates are the destruction of money, an economic aberration based on the mistakes of many central banks and some of their economists who start from a wrong diagnosis: the idea that economic agents do not take more credit or invest more because they choose to save too much and therefore saving must be penalized to stimulate the economy. Excuse the bluntness, but it is a ludicrous idea.

Inflation and growth are not low due to excess savings, but because of excess debt, perpetuating overcapacity with low rates and high liquidity and zombifying the economy by subsidizing the low productivity and highly indebted sectors and penalizing high productivity with rising and confiscatory taxation.

Historical evidence of negative rates shows that they do not help reduce debt, they incentivize it, they do not strengthen the credit capacity of families, because the prices of non-replicable assets (real estate, etc.) skyrocket because of monetary excess, and the lower cost of debt does not compensate for the greater risk.

Investment and credit growth are not subdued because economic agents are ignorant or saving too much, but because they don’t have amnesia. Families and businesses are more cautious in their investment and spending decisions because they perceive, correctly, that the reality of the economy they see each day does not correspond to the cost and the quantity of money.

It is completely incorrect to think that families and businesses are not investing or spending. They are only spending less than what central planners would want. However, that is not a mistake from the private sector side, but a typical case of central planners’ misguided estimates, that come from using 2001-2007 as “base case” of investment and credit demand instead of what those years really were: a bubble.

…click on the above link to read the rest of the article…

World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

Something happens to the world’s “really smart people” when the topic of debt is discussed: they become blabbering idiots.

Consider that last month we reported that according to the Institute of International Finance, global debt has now hit $250 trillion and is expected to rise to a record $255 trillion at the end of 2019, up $12 trillion from $243 trillion at the end of 2018, and nearly $32,500 for each of the 7.7 billion people on planet. “With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year,” the IIF said in the report.

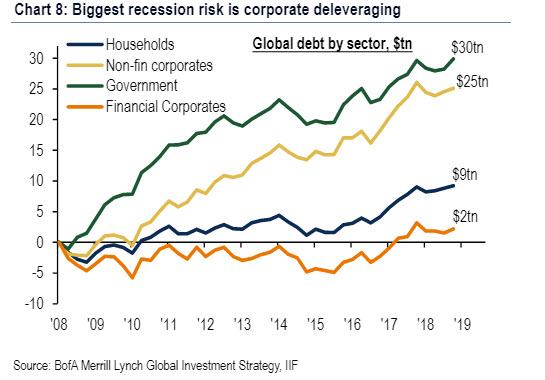

Separately, Bank of America recently calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that “the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging.”

Where the “really smart people” come in, is the periodic return every couple of years of the naive assumption that despite this relentless increase in global debt, central banks can tighten financial conditions and the world can sustain higher interest rates. What ends up happening is that after a few quarters of “reflation” – which ironically and circularly is critical to inflate the debt away – markets realize that higher rates on this mountain of debt are unsustainable, risk assets tumble and central banks are forced to unleash another wave of easing, in the process further Japanifying first Europe, and then the entire world.

…click on the above link to read the rest of the article…

Rickards: World on Knife Edge of Debt Crisis

Rickards: World on Knife Edge of Debt Crisis

Herbert Stein, a prominent economist and adviser to presidents Richard Nixon and Gerald Ford, once remarked, “If something cannot go on forever, it will stop.”

The fact that his remark is obvious makes it no less profound. Simple denial or wishful thinking tends to dominate economic debate.

Stein’s remark is like a bucket of ice water in the face of those denying the reality of nonsustainability. Stein was testifying about international trade deficits when he made his statement, but it applies broadly.

Current global debt levels are simply not sustainable. Debt actually is sustainable if the debt is used for projects with positive returns and if the economy supporting the debt is growing faster than the debt itself.

But neither of those conditions applies today.

Debt is being incurred just to keep pace with existing requirements in the form of benefits, interest and discretionary spending.

It’s not being used for projects with long-term positive returns such as interstate highways, bridges and tunnels; 5G telecommunications; and improved educational outcomes (meaning improved student performance, not teacher pensions).

And developed economies are piling on debt faster than they are growing, so debt-to-GDP ratios are moving to levels where more debt stunts growth rather than helps.

It’s a catastrophic global debt crisis (worse than 2008) waiting to happen. What will trigger the crisis?

In a word — rates. Low interest rates facilitate unsustainable debt levels, at least in the short run. But with so much debt on the books, even modest rate increases will cause debt levels and deficits to explode as new borrowing is sought just to cover interest payments.

…click on the above link to read the rest of the article…

The State of the Canadian Debt Slaves, How They Compare to American Debt Slaves, and the Bank of Canada’s Response

The State of the Canadian Debt Slaves, How They Compare to American Debt Slaves, and the Bank of Canada’s Response

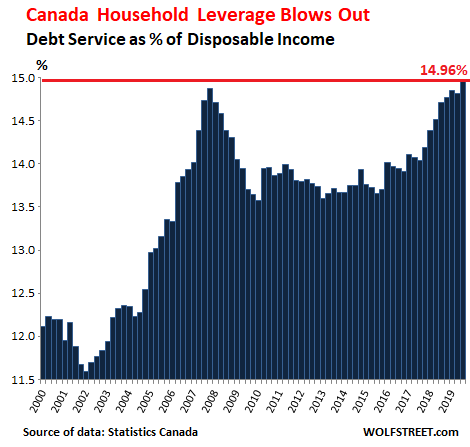

“The high household debt load is the most important risk facing the financial system”: Bank of Canada Governor Poloz, another central banker that bemoans the effects of this handiwork.

Canadian households, rated near the top of the most indebted in the world, accomplished something awe-inspiring: They got even more indebted and their leverage rose to a new record, according to data released today by Statistics Canada. The portion of their disposable income (total incomes from all sources minus taxes) that Canadian households spent on making principal and interest payments, including on mortgage debts and non-mortgage debts such as credit card balances, reached a new record of 14.96% in the third quarter, This record beat the prior record of 2007, and this happened despite still ultra-low interest rates:

Mortgage debt was the driver behind this new record, as the portion of disposable income that Canadians spent to make interest and principal payments on their mortgages rose to 6.74%, the highest ever.

But these are aggregate numbers, and for some individual households, the burden is a lot higher. Based on data from the 2016 census, 67.8% of Canadian households own their home, and the ratio has been dropping. The remaining households rent, and they do not have a mortgage. And a portion of those who own a home do not have a mortgage either because they’d already paid it off. And another portion of homeowners only carries a relatively small amount of mortgage debt.

But among the remaining homeowners, particularly those who bought in recent years, the burden of their mortgage is heavy.

…click on the above link to read the rest of the article…