World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

Something happens to the world’s “really smart people” when the topic of debt is discussed: they become blabbering idiots.

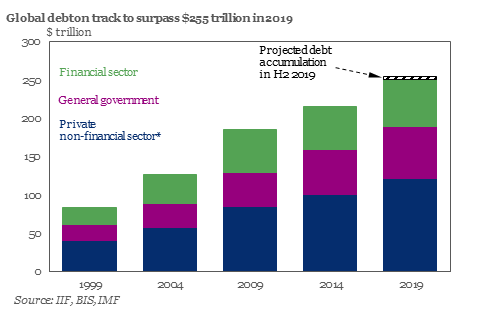

Consider that last month we reported that according to the Institute of International Finance, global debt has now hit $250 trillion and is expected to rise to a record $255 trillion at the end of 2019, up $12 trillion from $243 trillion at the end of 2018, and nearly $32,500 for each of the 7.7 billion people on planet. “With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year,” the IIF said in the report.

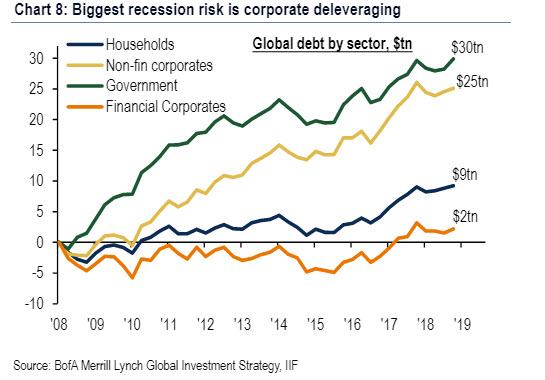

Separately, Bank of America recently calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that “the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging.”

Where the “really smart people” come in, is the periodic return every couple of years of the naive assumption that despite this relentless increase in global debt, central banks can tighten financial conditions and the world can sustain higher interest rates. What ends up happening is that after a few quarters of “reflation” – which ironically and circularly is critical to inflate the debt away – markets realize that higher rates on this mountain of debt are unsustainable, risk assets tumble and central banks are forced to unleash another wave of easing, in the process further Japanifying first Europe, and then the entire world.

…click on the above link to read the rest of the article…