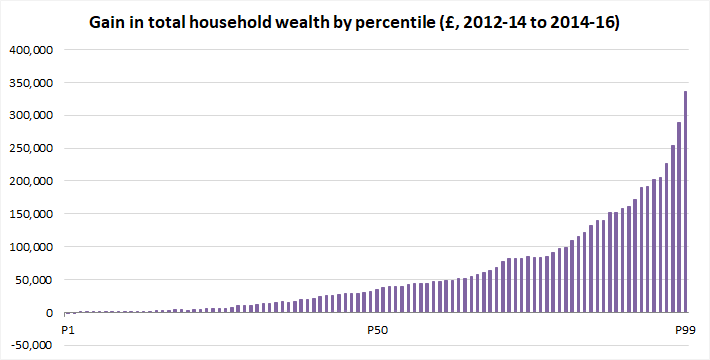

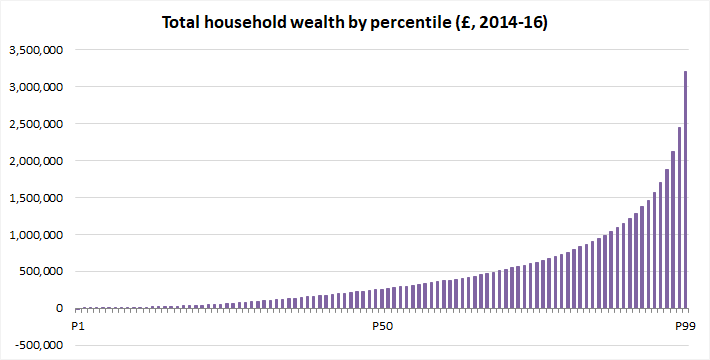

The latest ONS Wealth and Assets Survey, released last Thursday, once again showed the sheer extent of wealth inequality in the UK. A comparison of percentile figures with those from the previous wave suggests households in the wealthiest 10% gained on average nearly 700 times as much as the poorest 10% between 2012-2014 and 2014-2016.

The average total wealth of the of the bottom 10 percentile households rose by £330 between 2012-2014 and 2014-2016 (from £5,293 to £5623). The average total wealth of the top 10 percentile households increased by £229,541 over the same period (from £1,663,912 to £1,893,453).

The distribution of total wealth across UK households is extremely unequal. Naturally, so too are the gains in wealth in recent years.

The figures are significant because they are the latest to contradict the position taken by Bank of England governor Mark Carney in a 2016 speech, when he used the ONS data to claim that the “poorest have gained the most” from the Bank’s quantitative easing programme. As Positive Money showed in an analysis from October last year, the Bank painted a misleading picture by using relative rather than absolute figures. Data from the the 2006-08 to 2012-14 waves of the Wealth and Assets Survey showed an absolute gain for the wealthiest 10% almost 200 times greater than that for the poorest.

…click on the above link to read the rest of the article…

LONDON – Former US President Ronald Reagan once quipped that, “The nine most terrifying words in the English language are: I’m from the government and I’m here to help.” Put another way, policymakers often respond to problems in ways that cause more problems.

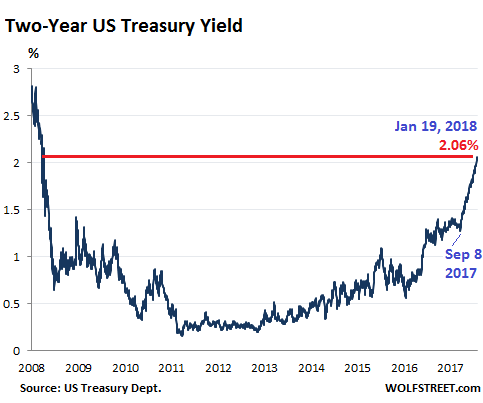

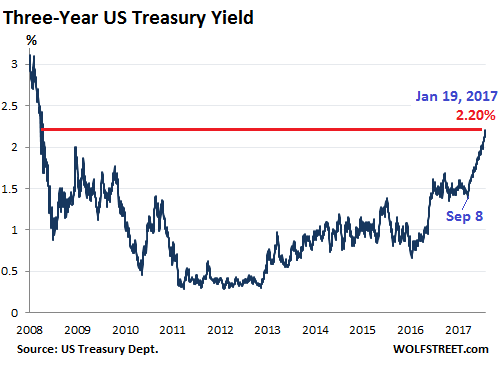

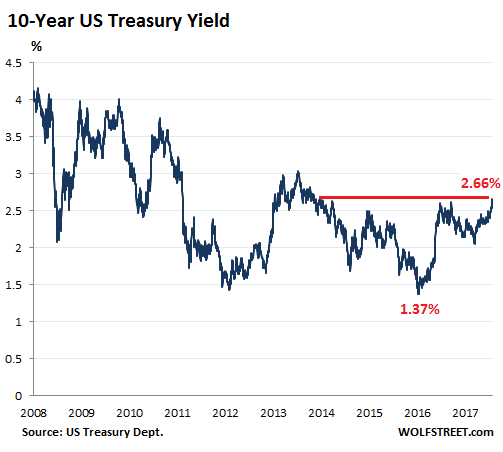

Consider the response to the 2008 financial crisis. After almost a decade of unconventional monetary policies by developed countries’ central banks, all 35 OECD economies are now enjoying synchronized growth, and financial markets are in the midst of the second-longest bull market in history. With the S&P 500 having risen 250% since March 2009, it is tempting to declare unprecedented monetary policies such as quantitative easing (QE) and ultra-low interest rates a great success.

But there are three reasons for doubt. First, income inequality has widened dramatically during this period. While negative real (inflation-adjusted) interest rates and QE have hurt savers by repressing cash and government-bond holdings, they have broadly boosted the prices of stocks and other risky financial assets, which are most commonly held by the wealthy. When there is no yield in traditional fixed-income investments such as government bonds, even the most conservative pension funds have little choice but to pile into risk assets, driving prices even higher and further widening the wealth divide.

…click on the above link to read the rest of the article…