Unbeknownst to the giddy participants, they’re not just betting on the omnipotence of the Fed Politburo, they’re also making a max-leverage bet that “the madness of crowds” will never end.

Imagine an economy so dominated by its central bank that all markets hang on every word of its priesthood as life or death. You know, like the Federal Reserve and the American economy.

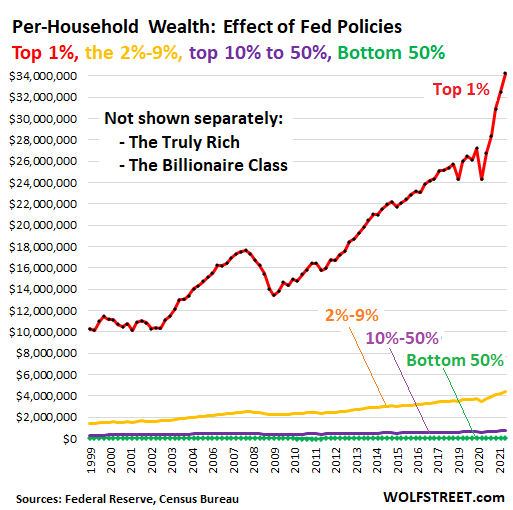

Now imagine this central bank issues enormous sums of new money which supercharges speculative activity such as hundreds of billions of dollars in stock buybacks, special purpose acquisition casinos, oops, I mean companies, and so on. You know, like the Federal Reserve’s trillions in nearly free money for financiers.

Next, imagine that the central bank makes barely concealed promises that should any big gambler lose money in the casino, the bank will flood the financial system with even more nearly free money for financiers and bail out the loser.

Since flooding the system with nearly free money for financiers keeps the speculative frenzy going, the bank has implicitly promised that assets driven higher by speculative frenzy will never be allowed to drop. This promise naturally incentivizes even more speculative borrowing, leverage and risk, generating a titanic Everything Bubble in which risky assets skyrocket from pennies into dollars and dollars into fortunes.

Now imagine that this speculative frenzy spreads into every nook and cranny of the economy such that everyone is drawn into one casino or another, and previously sober, cautious people are seized by a quasi-religious fervor in which they become convinced that their gambling chips on NFTs, SPACs, meme-stocks, obscure alt-coins, homes, collectables and pretty much anything within the manic swirl of speculative frenzy is now a can’t lose path to carefree permanent wealth because the central bank guarantees it and anyone who questions this is in league with the Devil (or worse).

…click on the above link to read the rest of the article…