Home » Posts tagged 'of two minds' (Page 11)

Tag Archives: of two minds

The Fantasy of Central Bank “Growth” Is Finally Imploding

The Fantasy of Central Bank “Growth” Is Finally Imploding

Having destroyed discipline, central banks have no way out of the corner they’ve painted us into.

It was such a wonderful fantasy: just give a handful of bankers, financiers and corporations trillions of dollars at near-zero rates of interest, and this flood of credit and cash into the apex of the wealth-power pyramid would magically generate a new round of investments in productivity-improving infrastructure and equipment, which would trickle down to the masses in the form of higher wages, enabling the masses to borrow and spend more on consumption, powering the Nirvana of modern economics: a self-sustaining, self-reinforcing expansion of growth.

But alas, there is no self-sustaining, self-reinforcing expansion of growth; there are only massive, increasingly fragile asset bubbles, stagnant wages and a New Gilded Age as the handful of bankers, financiers and corporations that were handed unlimited nearly free money enriched themselves at the expense of everyone else.

Central banks’ near-zero interest rates and trillions in new credit destroyed discipline and price discovery, the bedrock of any economy, capitalist or socialist.

When credit is nearly free to borrow in unlimited quantities, there’s no need for discipline, and so a year of university costs $50,000 instead of $10,000, houses that should cost $200,000 now cost $1 million and a bridge that should have cost $100 million costs $500 million. Nobody can afford anything any more because the answer in the era of central bank “growth” is: just borrow more, it won’t cost you much because interest rates are so low.

And with capital (i.e. saved earnings) getting essentially zero yield thanks to central bank ZIRP and NIRP (zero or negative interest rate policies), then all the credit has poured into speculative assets, inflating unprecedented asset bubbles that will destroy much of the financial system when they finally pop, as all asset bubbles eventually do.

…click on the above link to read the rest of the article…

Nothing Is Guaranteed

Nothing Is Guaranteed

There are no guarantees, no matter how monumental the hubris and confidence.

The American lifestyle and economy depend on a vast number of implicit guarantees— systemic forms of entitlement that we implicitly feel are our birthright.

Chief among these implicit entitlements is the Federal Reserve can always “save the day”: the Fed has the tools to escape either an inflationary spiral or a deflationary collapse.

But there are no guarantees this is actually true. In either an inflationary spiral or deflationary collapse of self-reinforcing defaults, the Fed’s “save” would destroy the economy, which is now so fragile that any increase in interest rates (to rescue us from an inflationary spiral) would destroy our completely debt-dependent economy: were mortgage rates to climb back to historical averages, the housing bubble would immediately implode.Hello negative wealth effect, as every homeowner watches their temporary (and illusory) “wealth” dissipate before their eyes.

The Fed’s “fix” to deflationary defaults is equally destructive: bailing out too big to fail lenders will spark a political revolt that could topple the Fed itself, as the populace has finally connected the dots between the Fed bailing out the banks and financiers and the astounding rise in income and wealth inequality.

Other than the phantom “wealth” of real estate and stock bubbles, the vast majority of the ‘wealth” generated by the Fed’s actions of the past 20 years has flowed to the top 0.1%. This will become self-evident once the phantom gains of speculative bubbles vanish.

The Fed’s other “trick” to halt a deflationary collapse is negative interest rates, in effect taxing savers and those holding cash and rewarding those who borrow.Negative interest rates destroy every institution that depends on relatively low-risk interest income via bonds: pension funds, insurance companies, etc.

…click on the above link to read the rest of the article…

It’s Not Just the News That’s Fake–Everything’s Fake

It’s Not Just the News That’s Fake–Everything’s Fake

That we fall for the fakes and cons is understandable, given that’s all we have left in the public sphere.

What do we mean when we say corporate media is fake? We mean it’s a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader’s confidence in a narrative that serves the interests not of the citizenry but of a select few pillaging the citizenry.

Once upon a time in America, no adult could survive without a finely tuned BS detector. Herman Melville masterfully captured America’s culture of cons and con artists in his 1857 classic The Confidence-Man, which I discussed in The Con in Confidence (October 4, 2006).

An essential component of the American ethos is: don’t be a chump. Don’t fall for the con. And if you do, it’s your own fault. America in 1857 was a simmering stew of con artists, flim-flammers and grifters exploiting the naive, the trusting and the credulous, and that remains the case in 2019.

We now inhabit a world where virtually everything is a con. That “organic” produce from some other country–did anyone test the soil the produce grew in? It could be loaded with heavy metals and be certified “organic” because no pesticides were used during production. Are there any nutrients left in the soil or has it been depleted? What’s in the water used to irrigate the crops?

The point of the con in offshored “organic” is the higher prices fetched. This is why it’s critical to ask of every narrative, story, product and data set: cui bono, to whose benefit?

…click on the above link to read the rest of the article…

The Planetary Insanity of Eternal Economic Growth

The Planetary Insanity of Eternal Economic Growth

This is the fantasy: we can rebuild our entire global industrial society every generation or two forever.

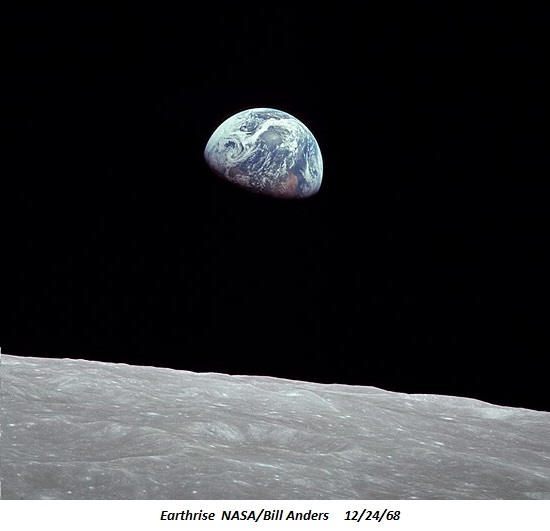

“Earthrise” is one of the most influential photographs ever published. Taken on the Apollo 8 mission in late December 1968 by astronaut Bill Anders, it captures Earth’s uniqueness, isolation and modest scale: a blue and white dot on a vast sea of lifeless darkness.

The revelation that strikes me is the insanity of pursuing eternal economic growth, not as an option but as the only possible path: there is literally no alternative to extracting ever greater quantities of the planet’s resources to enable ever greater consumption by the planet’s 7.7 billion humans.

Stripped to its essence, this mad drive is about profit and power. The necessity is sold as the only path to prosperity for humanity, but it’s really about securing wealth and power for the few.

A recent article in Scientific American magazine highlights how the idealistic impulses of protecting the planet’s diverse life from the machinery of “growth” are inevitably subsumed by the necessity for profit: The Ecologists and the Mine.

Here’s what these kinds of articles never say: markets cannot price in the value of non-monetized natural assets such as diverse ecosystems. Whatever cannot be monetized right now is worthless, as markets lack any mechanism to price in what cannot be valued by market supply and demand in the moment.

There is no way to fix this fatal flaw in markets, and attempts to do so are merely excuses deployed to enable the profitable exploitation and resulting ruin.

(Recall that neoliberalism is the quasi-religious ideology of turning everything on Earth into a market, so it can be exploited and financialized by the few at the expense of the many.)

…click on the above link to read the rest of the article…

The Three Ds of Doom: Debt, Default, Depression

The Three Ds of Doom: Debt, Default, Depression

“Borrowing our way out of debt” generates the three Ds of Doom: debt leads to default which ushers in Depression.

Let’s start by defining Economic Depression: a Depression is a Recession that isn’t fixed by conventional fiscal and monetary stimulus. In other words, when a recession drags on despite massive fiscal and monetary stimulus being thrown into the economy, then the stimulus-resistant stagnation is called a Depression.

Here’s why we’re heading into a Depression: debt exhaustion. As the charts below illustrate, the U.S. (and global) economy has only “grown” in the 21st century by expanding debt roughly four times faster than GDP or earned income.

Costs for big-ticket essentials such as housing, healthcare and government services are soaring while wages stagnate or decline in purchasing power.

What’s purchasing power? Rather than get caught in the endless thicket of defining inflation, ask yourself this: how much of X does one hour of labor buy now compared to 20 years ago? For example, how much healthcare does an hour of labor buy now? How many days of rent does an hour of labor buy now compared to 1999? How many hours of labor are required to pay a parking ticket now compared to 1999?

Our earnings are buying less of every big-ticket expense that’s essential, and we’ve covered the gigantic hole in our budget with debt. The only way the status quo could continue conjuring an illusion of “prosperity” is by borrowing fantastic sums of money, all to be paid with future earnings and taxes.

At some point, the borrower is unable to borrow more. Even at 0.1% rate of interest, borrowers can’t borrow more because they can’t even manage the principal payment, never mind the interest. That’s debt exhaustion: borrowers can’t borrow more without ramping up the risk of default.

…click on the above link to read the rest of the article…

Following in Rome’s Footsteps: Moral Decay, Rising Inequality

Following in Rome’s Footsteps: Moral Decay, Rising Inequality

Here is the moral decay of America’s ruling elites boiled down to a single word.

There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, what’s mine is mine and what’s yours is mine, too.

I’ve previously covered two other key characteristics of an empire in terminal decline: complacency and intellectual sclerosis, what I have termed a failure of imagination.

Michael Grant described these causes of decline in his excellent account The Fall of the Roman Empire, a short book I have been recommending since 2009:There was no room at all, in these ways of thinking, for the novel, apocalyptic situation which had now arisen, a situation which needed solutions as radical as itself. (The Status Quo) attitude is a complacent acceptance of things as they are, without a single new idea.

This acceptance was accompanied by greatly excessive optimism about the present and future. Even when the end was only sixty years away, and the Empire was already crumbling fast, Rutilius continued to address the spirit of Rome with the same supreme assurance.

This blind adherence to the ideas of the past ranks high among the principal causes of the downfall of Rome. If you were sufficiently lulled by these traditional fictions, there was no call to take any practical first-aid measures at all.

A lengthier book by Adrian Goldsworthy How Rome Fell: Death of a Superpower addresses the same issues from a slightly different perspective.

Glenn Stehle, commenting on a thread in the excellent website peakoilbarrel.com (operated by the estimable Ron Patterson) made a number of excellent points that I am taking the liberty of excerpting: (with thanks to correspondent Paul S.)

…click on the above link to read the rest of the article…

No, Autos Are Not “Cheaper Now”

No, Autos Are Not “Cheaper Now”

According to the BLS, inflation in the category of “New Vehicles” has been practically non-existent the past 21 years.

Longtime readers know I’ve long turned a skeptical gaze at official calculations of inflation, offering real-world analyses such as The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) and Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43% from 2001 (May 31, 2018).

Official claims that grossly understate real-world inflation is a core feature of debt-serfdom and neofeudalism: we’re working harder and longer and getting less for our earnings every year, but this reality is obfuscated by official pronouncements that inflation is 2%–barely above zero.

Meanwhile, quality and quantity are in permanent decline. New BBQ grills rust out in a few years, if not months, appliance paint is so thin a sponge and a bit of cleanser removes the micron-thick coating, and on and on in endless examples of the landfill economy, as new products are soon dumped in the landfill due to near-zero quality control and/or planned obsolescence.

Free-lance writer Bill Rice, Jr. recently analyzed shrinkflation, the inexorable reduction in quantity:

What Does Your Toilet Paper Have to Do With Inflation?

Manufacturers have been engaging in “shrinkflation,” leaving consumers paying more for less, but stealthily.In the guest post below, Bill looks at new car prices, and finds that official inflation for “new vehicles” from November 1983 to November 2013 measured only 43.8 percent… while actual car inflation (based on archived price records in Morris County, NJ) is 4.85 times higher than official CPI “new vehicle” inflation.

Prices for new cars sky-rocketed over 30 years (or did they?)

A lesson in ‘hedonic adjustments’

…click on the above link to read the rest of the article…

The Lessons of Rome: Our Neofeudal Oligarchy

The Lessons of Rome: Our Neofeudal Oligarchy

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy.

The Inheritance of Rome: Illuminating the Dark Ages 400-1000 is not an easy, breezy read; its length and detail are daunting.

The effort is well worth it, as the book helps us understand how the power structures of societies change over time in ways that may be largely invisible to those living through the changes.

The Inheritance of Rome focuses on the lasting influence of Rome’s centralized social and political structures even as centralized economic power and trade routes dissolved.

This legacy of centralized power and loyalty to a central authority manifested 324 years after the end of the Western Roman Empire circa 476 A.D. in Charlemagne, who united much of western Europe as the head of the Holy Roman Empire. (Recall that the Eastern Roman (Byzantine) Empire endured another 1,000 years until 1453 A.D.)

But thereafter, the social and political strands tying far-flung villages and fiefdoms to a central authority frayed and were replaced by a decentralized feudalism in which peasants were largely stripped of the right to own land and became the chattel of independent nobles.

In this disintegrative phase, the central authority invested in the monarchy of kings and queens was weak to non-existent.In the long sweep of history, it took several hundred years beyond 1000 A.D. for central authority to re-assert itself in the form of monarchy, and several hundred additional years for the rights of commoners to be established.

Indeed, it can be argued that it was not until the 1600s and 1700s–and only in the northern European strongholds of commoners’ rights, The Netherlands and England–that the rights of ownership and political influence enjoyed by commoners in the Roman Empire were matched.

…click on the above link to read the rest of the article…

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the “losers” connect their discontent and decline with central bankers is approaching.

The Ruling Elites’ Chattering Classes still haven’t absorbed the key lesson of the 2016 U.S. presidential election: the percentage of the populace that’s becoming wealthier and more financially secure in the bloated, corrupt, self-serving Imperial status quo is declining and the percentage of the populace that’s increasingly insecure and financially precarious is increasing, and candidates that mouth the usual platitudes in support of the bloated, corrupt, self-serving Imperial status quo lose to those who speak of the failing status quo as a travesty of a mockery of a sham, i.e. a “populist” speaking truth to power.

Donald Trump steered clear of the status quo’s favored platitudes and embraced a bit of populist cant, and so to those who understand that the majority of Americans have been abandoned by America’s hubris-soaked, self-serving managerial / ruling elites, his victory was not entirely surprising.

Just as we’ve reached Peak hubris-soaked, self-serving managerial / ruling Elites, we’ve also reached Peak Central Bank Cargo Cult: from now on the majority that’s been abandoned by the managerial / ruling elites will become increasingly aware that the unprecedented asymmetries of wealth and power that have undermined American social and economic life can be traced directly back to the central bank, the Federal Reserve, which has become the all-powerful Cargo Cult of the global economy.

The same awareness of central bankers’ responsibility for soaring wealth-income inequality and the decline of social mobility is spreading in other nations as well.

…click on the above link to read the rest of the article…

The Self-Destructive Trajectory of Overly Successful Empires

The Self-Destructive Trajectory of Overly Successful Empires

It’s difficult not to see signs of this same trajectory in the U.S. since the fall of the Soviet Empire in 1990.A recent comment by my friend and colleague Davefairtex on the Roman Empire’s self-destructive civil wars that precipitated the Western Empire’s decline and fall made me rethink what I’ve learned about the Roman Empire in the past few years of reading.

Dave’s comment (my paraphrase) described the amazement of neighboring nations that Rome would squander its strength on needless, inconclusive, self-inflicted civil conflicts over which political faction would gain control of the Imperial central state.

It was a sea change in Roman history. Before the age of endless political in-fighting, it was incomprehensible that Roman armies would be mustered to fight other Roman armies over Imperial politics. The waste of Roman strength, purpose, unity and resources was monumental. Not even Rome could sustain the enormous drain of civil wars and maintain widespread prosperity and enough military power to suppress military incursions by neighbors.

I now see a very obvious trajectory that I think applies to all empires that have been too successful, that is, empires which have defeated all rivals or have reached such dominance they have no real competitors.Once there are no truly dangerous rivals to threaten the Imperial hegemony and prosperity, the ambitions of insiders turn from glory gained on the battlefield by defeating fearsome rivals to gaining an equivalently undisputed power over the imperial political system.

The empire’s very success in eliminating threats and rivals dissolves the primary source of political unity: with no credible external threat, insiders are free to devote their energies and resources to destroying political rivals.It’s difficult not to see signs of this same trajectory in the U.S. since the fall of the Soviet Empire in 1990.

…click on the above link to read the rest of the article…

Forget “Money”: What Will Matter Are Water, Energy, Soil and Food–and a Shared National Purpose

Forget “Money”: What Will Matter Are Water, Energy, Soil and Food–and a Shared National Purpose

If you want to identify tomorrow’s superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land.

The status quo measures wealth with “money,” but “money” is not what’s valuable. “Money” (in quotes because the global economy operates on intrinsically valueless fiat currencies being “money”) is wealth only if it can purchase what’s actually valuable.

As the world slides into an era of scarcities, what will matter more than “money” are the essentials of survival: fresh water, energy, soil and the output of those three, food. The ability to secure these resources will separate nations that fail and those that survive.

In a world of abundance, it’s assumed every essential resource can be bought on the open market. Surpluses are placed on the market and anyone with “money” can buy the surplus.

Things work differently in scarcity: “money” buys zip, zero, nada because nobody with what’s scarce can afford to give it away for “money” which can no longer secure what’s scarce.

Parachute into a desert with gold, dollars, euros, yen and yuan, and since there’s nothing to buy, all your money is worthless. Once you’re thirsting to death, you’d give all your money away for a liter of fresh water. But why would anyone who needs that liter for their on survival trade it for useless “money”?

Imagine the longevity of a regime which sold the nation’s food while its populace went hungry. Not very long once the truth comes out.

Having resources is only one component: consumption is the other half of the picture. Having 4 million barrels a day of oil (MBPD) is nice if you’re only using 3 MBPD, but if you’re consuming 8 MBPD, you still need to import 4 MBPD.

Water and soil are not tradable commodities.

…click on the above link to read the rest of the article…

The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

The net result is we have an economy that’s supposedly expanding smartly while our well-being and financial security are collapsing.

Gross Domestic Product (GDP) and other metrics of economic activity don’t measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite nicely while the security and well-being of the bottom 90% plummets.

Under the hood of “recovery” and a higher GDP, life has gotten harder and more insecure for the bottom 90%. The key is not to look just at wages (trending up, we’re assured) or inflation (near-zero, we’re assured) but at aspects of daily life (lived experience) that cannot be captured by conventional economic / financial attempts at quantifying the economy.

How do we quantify the cost of the financial anxiety provoked by huge insurance deductibles or staggering healthcare bills? What matters isn’t just whether the patient or their family has to declare bankruptcy because they can’t afford the enormous co-pays: what matters is the debilitating stress caused by having to decide between risking an operation and bankrupting the family or foregoing the operation and hoping for a miracle.Or how about the eventual cost of foregoing healthcare except in emergencies due to having to pay cash for any care due to the high deductibles?

Small stresses add up, leading to chronic stress and a host of debilitating consequences. Consider the daily commute to work, which has become longer and more stressful due to increasing congestion and the limits of public transport infrastructure that hasn’t been improved or expanded in decades.Why New York City Stopped Building Subways (via Mark G.) Unlike most other great cities, New York’s rapid transit system remains frozen in time: Commuters on their iPhones are standing in stations scarcely changed from nearly 80 years ago.

…click on the above link to read the rest of the article…

Unrealistically Great Expectations

Unrealistically Great Expectations

Our expectations have continued ever higher even as the pie is shrinking..

Let’s see if we can tie together four social dynamics: the elite college admissions scandal, the decline in social mobility, the rising sense of entitlement and the unrealistically ‘great expectations’ of many Americans.

As many have noted, the nation’s financial and status rewards are increasingly flowing to the top 5%, what many call a winner-take-all or winner-take-most economy.

This is the primary source of widening wealth and income inequality: wealth and income are disproportionately accruing to the top slice of earners and owners of productive capital.

This concentration manifests in a broad-based decline in social mobility: it’s getting harder and harder to break into the narrow band (top 5%) who collects the lion’s share of the economy’s gains.

Historian Peter Turchin has identified the increasing burden of parasitic elites as one core cause of social and economic collapse. In Turchin’s reading, economies that can support a modest-sized class of parasitic elites buckle when the class of elites expecting a free pass to wealth and power expands faster than what the economy can support.

The same dynamic applies to productive elites: as I have often mentioned, graduating 1 millions STEM (science, technology, engineering, math) PhDs doesn’t magically guarantee 1 million jobs will be created for the graduates.

Such a costly and specialized education was once scarce, but now it’s relatively common, and this manifests in the tens of thousands of what I call academic ronin, i.e. PhDs without academic tenure or stable jobs in industry.

This glut is a global: I’ve known many people with PhDs from top universities in the developed world who have struggled to find a tenured professorship or a high-level research position anywhere in the world.

In other words, what was once a surefire ticket to status, security and superior pay is no longer surefire.

No wonder wealthy parents are so anxious to fast-track their non-superstar offspring by hook or by crook.

There is an even larger dynamic in play. As I explained here recently, the economic pie is shrinking, not just the pie of gains that can be distributed but the pie of opportunity.

The Great Unraveling Begins: Distraction, Lies, Infighting, Betrayal

The Great Unraveling Begins: Distraction, Lies, Infighting, Betrayal

The good news is renewal becomes possible when the entire rotten status quo collapses in a putrid heap.

There are two basic pathways to systemic collapse: external shocks or internal decay. The two are not mutually exclusive, of course; it can be argued that the most common path is internal decay weakens the empire/state and an external shock pushes the rotted structure off the cliff.

As Dave of the X22 Report and I discuss in The World Is About To Change & It’s Going To Be Glorious, we are in the early stages of terminal internal decay.There are a number of dynamics shared by decaying empires/states:

1. The ruling elites lose the moral imperative to sacrifice for the good of the empire/state. Instead they use the power of the state to further their own private interests and agendas.

2. The ruling elites start “fudging” reports (i.e. lies are presented as truths) and promoting narratives to mask their self-aggrandizement and the erosion of the nation/empire under their self-interested rule.

In other words, the elites know the public would resist their leadership if the truth were widely known, so the ruling elites devote tremendous resources to massaging the news to distract the public from reality and reflect positively on their self-serving leadership.

Since the weaknesses of the empire are being hidden, they cannot be addressed, and so rot that could have been fixed early becomes widespread and fatal.

3. Flush with the state’s wealth and power, the ruling elite splinters into warring camps which squander the empire’s remaining wealth on private battles over which camp will rule what appears solid and eternal–the empire.

4. As the elites battle it out, the nation/empire falls apart as the leadership’s focus is on internecine conflicts over the spoils of the empire, rather than on preserving the foundations of the empire’s wealth and security.

…click on the above link to read the rest of the article…

This Is the End of the Cycle

This Is the End of the Cycle

Both new households and new businesses are in secular decline. Goosing the stock market and GDP doesn’t change this reality.

Everyone wants every cycle of expansion to last forever, but alas every cycle ends. The growth cycle that began in 2009 is finally coming to an end. The signs are everywhere, notwithstanding the torrid 3.2% GDP growth for the first quarter of 2019 (which as others have noted, is less than meets the eye.)

Gross Domestic Product (GDP) is the standard measure of expansion, but it is an imperfect metric. GDP can still notch gains while the majority of the economy is stagnating and assets are losing value.

Better guides to expansion than GDP are sales volumes, prices, profits, wage increases and sustained rises in new enterprises and households. All of these measures of expansion are stagnant, indicating that monetary and fiscal stimulus are no longer moving the needle.

Corporate profits are higher as a result of accounting gimmicks, not soaring sales or expanding gross profit margins. Stocks are being pushed higher by the old trick of lowering earnings estimates so that corporations can “beat by penny.”

In many once-hot real estate markets, sales are slowing while prices continued edging higher but at much slower rates than in the past. This is classic late-cycle activity: sales are declining as the pool of buyers has been drained while price increases have become marginal.

Global sales of pricey mobile phones and vehicles have slowed, indicating the exhaustion of the cycle is global. Again, this is classic late-cycle activity: trends that powered the narrative of “strong growth everywhere” are fading, despite attempts to hype some blip as a sign that strong growth is about to start up again.

…click on the above link to read the rest of the article…