Last Two Times This Happened, Stocks Crashed

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record.

There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per monthin the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch.

And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

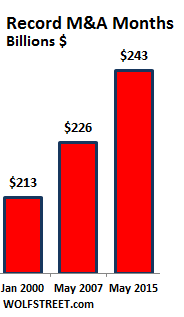

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to theFinancial Times. And so in May, M&A deals hit an all-time record of $243 billion.

The prior two record months: May 2007 ($226 billion) and January 2000 ($213 billion). Not long after those records were set, markets crashed with spectacular results.

May included Charter’s $90-billion acquisition of Time Warner Cable and Bright House. Charter will issue around $30 billion in junk-rated debt to accomplish this, likely the second largest junk-debt deal ever, behind that of TXU in October 2007, which is now in bankruptcy [read… Junk-Debt Apocalypse Later].

May also includes Avago’s $37-billion acquisition of Broadcom, the largest tech deal since the dotcom bubble blew up.

…click on the above link to read the rest of the article…