Saudi Arabia, Russia in No Mood to Cave to US Fracking Boom

The recently vaunted decline in US crude oil production, supported by granular estimates, has been used in rationalizing the newly sizzling rally in oil prices. Analysts are digging through local details to come up with clues where this might be going. Money is re-pouring into the sector. And folks are already espousing the next stage, that the glut is over and that a shortage will set in soon, or something.

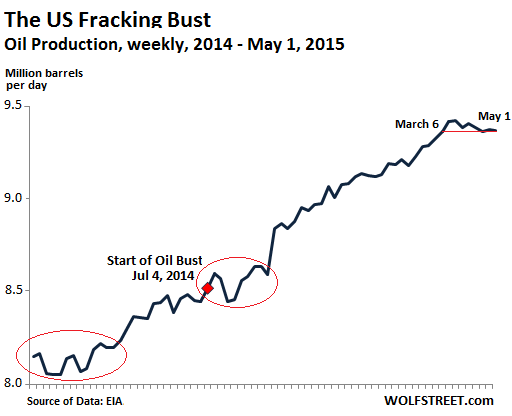

Alas, the decline in US oil production is, let’s say, relative. The EIA estimated that in the week ended May 1, producers pumped 9.369 million barrels per day. So that’s down from the crazy peak set during week ended March 20 of 9.422 MMbpd. Halleluiah, production is back where it was on March 6! And it’s up 12.2% from a year ago!

Note the circled areas in the chart: these weekly estimates are inherently volatile. In 2014, there were several periods of much sharper declines, even before the oil bust began in early July. Compared to those declines, the recent levelling off – and that’s all it is at this point – seems mild.

With US crude oil production on a weekly basis just a smidgen off its crazy peak in March, the other two of the world’s top three producers aren’t cutting back either.

Russia pumped 10.71 MMbpd in April, same as in March. Both months beat last year’s post-Soviet record average of 10.58 MMbpd.

And Saudi Arabia produced a record 10.31 MMbpd in April, after having already set a record in March of 10.29 MMbpd, “a Gulf industry source” told Reuters today. Production in both months beat the prior record going back to the early 1980s of 10.2 MMbpd set in August 2013.

…click on the above link to read the rest of the article…