East Coast retail diesel prices moving significantly higher than overall US hikes

Extremely tight inventories are seen as the driving factor blowing out spreads with benchmark Gulf Coast market

East Coast retail diesel prices are soaring relative to the rest of the country, propelled by inventories in the region that are almost half of what they normally should be at this time of year.

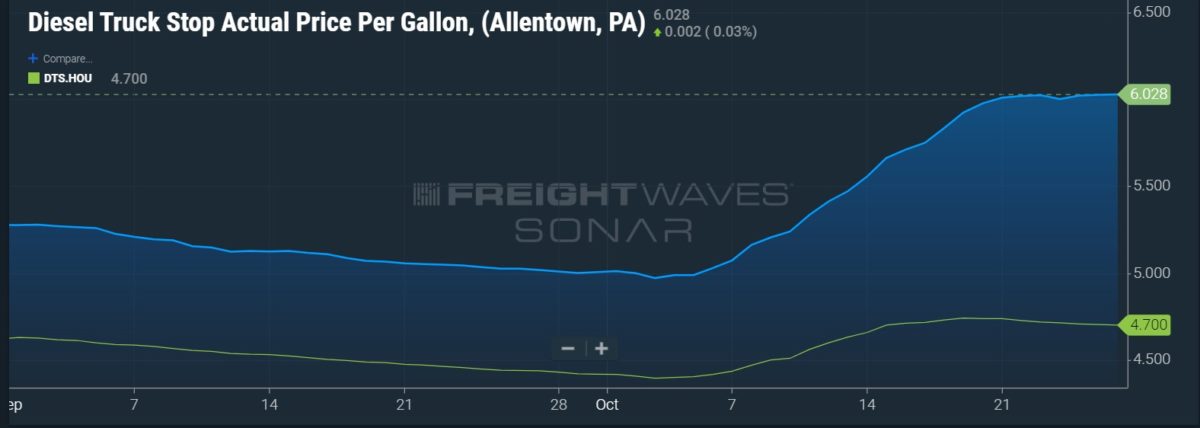

Retail prices recorded in the DTS data series in SONAR tell the story of how much diesel has surged. On Sept. 16, retail diesel in Allentown, Pennsylvania, a major logistics center, was $5.116 a gallon, while the Houston price was $4.513 a gallon, a spread of just over 60 cents. On Oct. 15, Allentown was $5.663 a gallon while Houston was $4.70, a 96.3 cent gap. By Thursday, Allentown was at $6.028 a gallon and Houston was $4.70 a gallon, a spread of $1.328 a gallon.

The East Coast price blowout has been propelled largely by the tight inventory situation in what is known as PADD 1, the Department of Energy’s designation for that region.

Weekly statistical data reported by the EIA this week had PADD 1 inventories of ultra low sulfur diesel at 21.3 million barrels for the week ended Oct. 21, a more than 7% decline in just one week. But more striking was the fact that those inventories are 56.5% of the five-year average for the corresponding October weeks, excluding the pandemic-influenced data from 2020.

By contrast, national inventories for all distillates, which are not broken down by specific grades, are running about 80-81% of the five-year average, and that is considered extremely tight by analysts.

…click on the above link to read the rest…