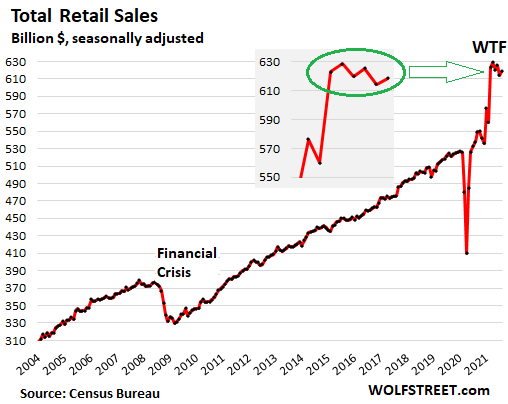

What Comes After Mind-Blowing Free-Money Blow-Off Spike in Retail Sales? A Spike Doesn’t Spike Forever

Powered by price increases.

Total retail sales – not adjusted for inflation, now a big factor – inched up 0.7% in August from July, to $619 billion (seasonally adjusted), up a stunning 18% from two years ago and 15.1% from a year ago. The insert in the chart shows that this wasn’t a proper “rebound,” as it has been widely called in the media today, but an uptick in a four-month down-trend from the mind-blowing superlative historic free-money blow-off spike in April. August retail sales were down 1.6% from that April stimmie-craziness:

A spike doesn’t spike forever. But Americans are still making a heroic effort to spend the pile of free money they got … the last two stimmies totaling $2,000 per person, the $800 billion in forgivable PPP loans that just about everyone with a little or big business got, extra unemployment benefits, massive gains on asset prices, all of it fueled by the Fed’s $4-trillion money-printing binge and the government’s $5-trillion deficit-spending binge in 18 months, which created the most monstrously overstimulated economy and markets ever.

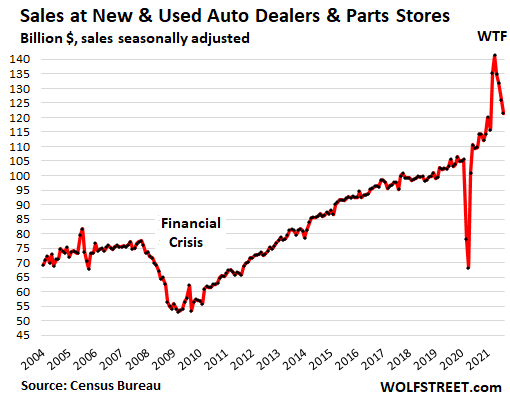

New & used auto dealers and parts stores: Sales dropped another 3.6% in August from July, to $121 billion (seasonally adjusted), fourth month in a row of large declines off the free-money spike in March and April.

There is plenty of demand, and prices have surged amid inventory shortages of used vehicles and historic inventory shortages of new vehicles. Customers face dealer lots that are nearly empty and out of popular models amid rotating shutdowns of assembly plants globally due to the semiconductor shortages.

But these $121 billion in sales in August were still up 10.7% from a year ago and 22.2% from two years ago, in dollar terms, thanks to massive price increases – 32% year-over-year for used vehicles and 7.6% for new vehicles, according to the Consumer Price Index.

…click on the above link to read the rest of the article…