Money Is Bailing Out of Canada

The floodgates opened in December. Perhaps it had something to do with oil, Canada’s number one export product, whose price went into free-fall in November and triggered extensive bloodletting in the Canadian oil patch. Or perhaps foreign investors got spooked by something else.

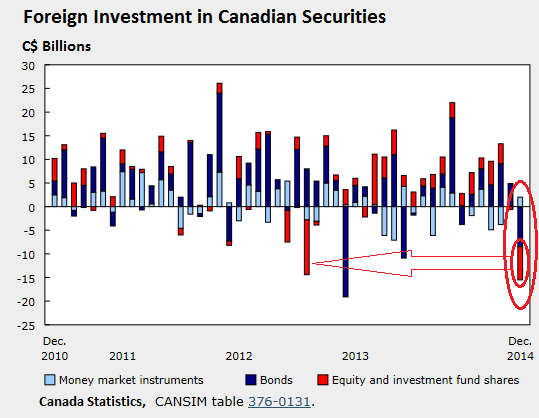

Until then, they’d been sanguine: from January through November, they’d added C$72.5 billion in Canadian securities to their holdings. But in December, they suddenly dumped C$13.5 billion – the most in 18 months.

That included C$8.5 billion in Canadian government and corporate bonds, according toStatistics Canada, which defines bonds as debt with an original term to maturity of more than one year. This wholesale dumping of bonds was partially offset by an increase of C$2 billion in money market instruments. They went looking for the safety of short maturities.

And as Canadian stocks fell a barely perceptible 0.8% in December, these frazzled foreign investors who’d splurged on Canadian equities from January through November by adding another $32.3 billion to their holdings, suddenly dumped C$7.0 billion of their shares, the most since February 2013.

But it wasn’t just foreign investors who got frazzled in December. Canadians too ran scared and sent C$13.9 billion of their hard-earned money across the border – the most since December 2000!

…click on the above link to read the rest of the article…