The Everything Bubble and What it Means for Your Money

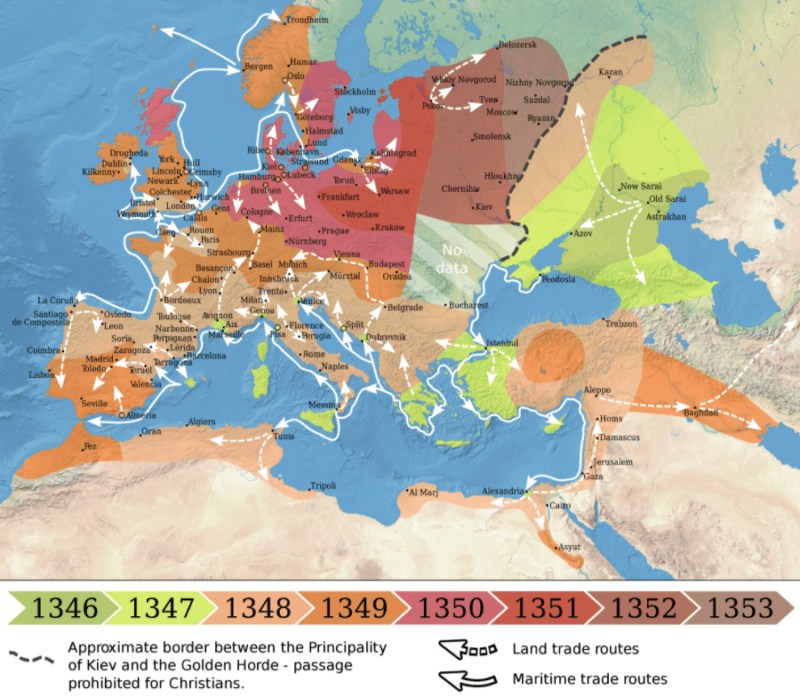

In the aftermath of the Black Plague which swept across Europe between 1347 and 1353, wiping out between 30 and 60% of the population, the European economy changed dramatically.

The Black Plague had a lasting socioeconomic impact; for example, towns and cities emptied, and the sudden reduction in the labour force saw wages rise. Meanwhile attitudes towards death – and life – changed. The Latin phrase, carpe diem, quam minimum credula postero – seize the day, place no trust in tomorrow – epitomised this profound shift in attitudes.

The current pandemic, whilst utterly tragic, has been far less catastrophic, but due to the policy response it too appears destined to leave its mark in changing patterns of living and working. Unlike the 1350’s, however, where the changing price of goods and services signalled imbalances in supply and demand, the valiant monetary and fiscal actions of governments and institutions have distorted this price discovery mechanism.

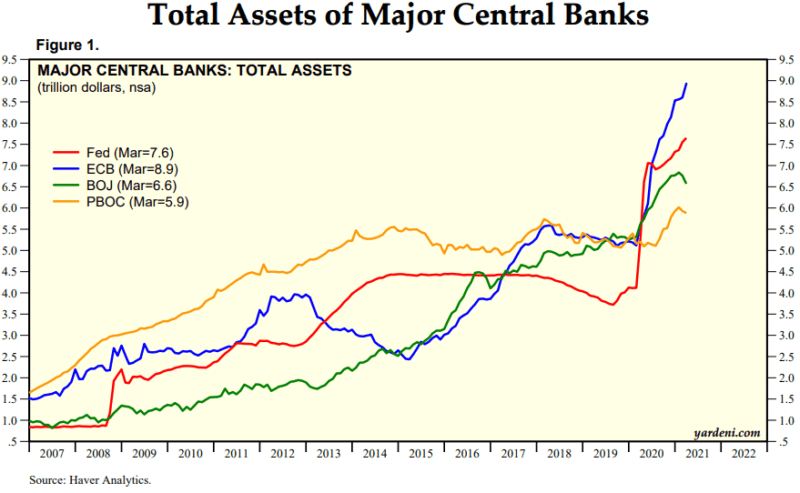

During the first months of the lockdown, economic growth declined and the price of many equities – and even bonds – fell rapidly. Central banks responded, as they had during the Great Financial Crisis (GFC) of 2008/2009, by cutting interest rates, or, where interest rates could be cut no further, by increasing their purchases of government bonds and other high grade securities. As a result of these purchases, major central banks balance sheets have swollen to $29trln: –

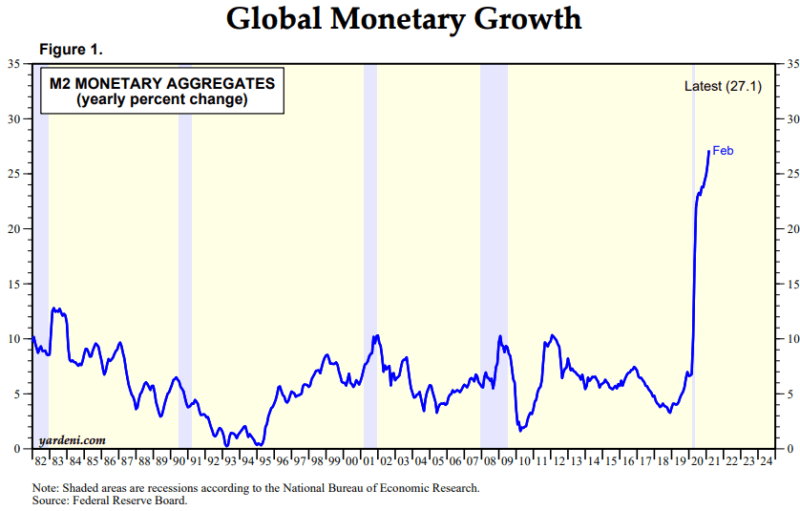

The effect of central bank actions has spilled over into a ballooning of global money supply: –

Governments, cognizant of the limitations of their central banks, also reacted, providing loan guarantees, supporting the furloughing of employees and sending direct payments to the rising ranks of the unemployed…

…click on the above link to read the rest of the article…