A Corporate-Debt Reckoning Is Coming

Corporate debt is the timebomb everyone saw ticking, but no one was able to defuse. Ratings agencies warned about it: Moody’s, S&P. Central banks and international financial institutions did too: the Fed, the Bank of England, the Bank for International Settlements, the IMF. Financial luminaries expressed concern: Jamie Dimon, Seth Klarman, Jes Staley, Jeffrey Gundlach, Henry McVey. Even a presidential candidate brought the issue on the campaign trail: Elizabeth Warren. Yet, as we’ve documented in these pages for more than two years, corporations have only piled on more debt as their balance sheet health has deteriorated.

Total U.S. non-financial corporate debt sits at just under $10 trillion, a record 47% of GDP. One in six U.S. companies is now a zombie, meaning their interest expenses exceed their earnings before interest and taxes. As of year-end 2019, the percentage of listed companies in the U.S. losing money over 12 months sat close to 40%. In the 12 months to November, non-financial S&P 500 cash balances had declined by 11%, the largest percentage decline since at least 1980.

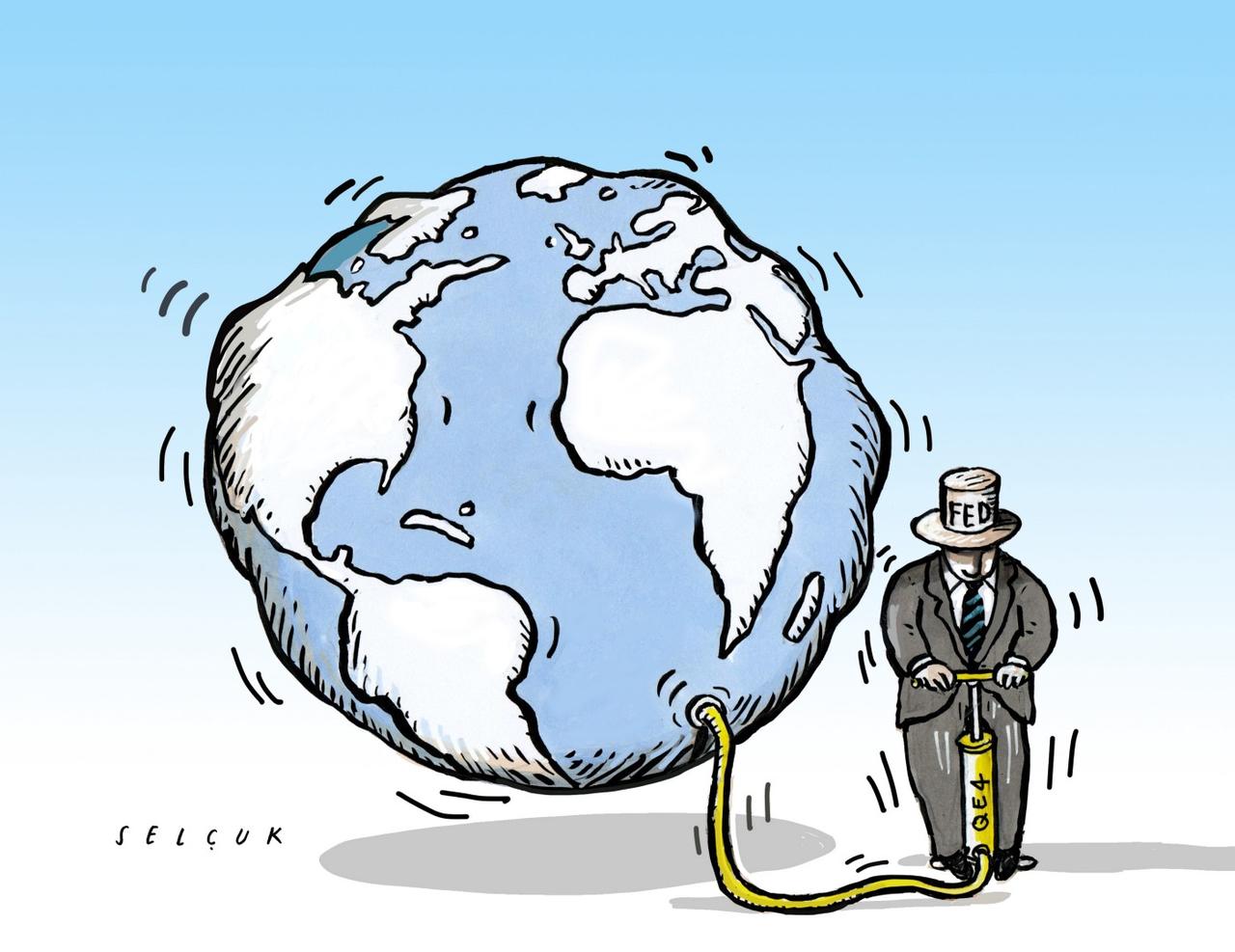

For too long, record-low interest rates inspired complacency, from companies to lenders to regulators and investors. As we warned in WILTW August 8, 2019, corporate fundamentals will eventually matter. Now, with COVID-19 grinding the global economy to a halt, that time has come.

Systemic threats are littered throughout the corporate debt ecosystem. Greater than 50% of outstanding debt is rated BBB, one rung above junk. As downgrades come, asset managers will be forced to flood the market with supply at a time demand has dried up. Meanwhile, leveraged loans — which have swelled by 50% since 2015 to over $1.2 trillion — threaten unprecedented losses given covenant deterioration. And bond ETFs could face a liquidity crisis as a flood of redemptions force offloading of all-too-illiquid bonds (see WILTW January 31, 2019).

…click on the above link to read the rest of the article…