This Wasn’t Supposed To Happen: One Day After Fed Rate Cut, Repos Signal Record Liquidity Shortage

Yesterday morning, when we discussed the sudden spike in liquidity shortage that resulted in both a (record) oversubscribed term repo and the first oversubscribed overnight repo since the start of the repo crisis, we said that “if going solely by the amount of securities submitted between the term and overnight repo, the overall liquidity shortage today was nearly $180BN, the highest since the start of the repo crisis, and a clear signal to the Fed that it needs to do something to further ease interbank lending conditions.“

Less than an hour later the Fed cut rates by 50bps in its first emergency intermeeting action since the financial crisis.

So with its emergency action now in the rearview mirror, did the Fed manage to stem the funding panic that has gripped repo markets following last week’s market bloodbath? The answer, if based on the latest overnight repo results, is a resounding no.

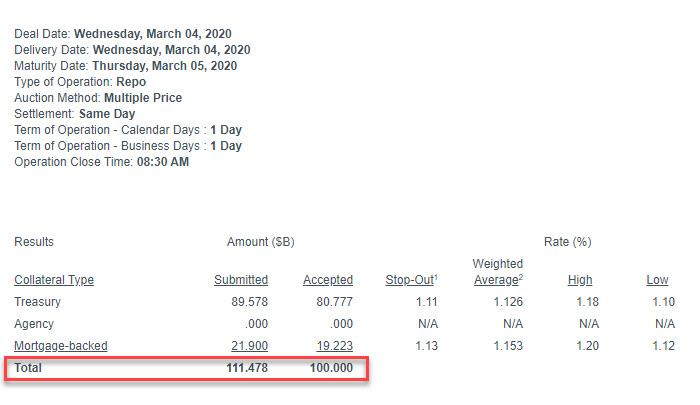

Moments ago, the Fed announced that its latest repo operation was once again oversubscribed, with the full $100 million amount of repo accepted.

In other words, for the second day in a row the overnight funding repo operation was oversubscribed (and it is safe to say that tomorrow’s term repo will be oversubscribed as well).