Global Debt To Hit All Time High $255 Trillion, 330% Of World GDP

There are three certainties in life: death, taxes and that global debt will keep rising in perpetuity.

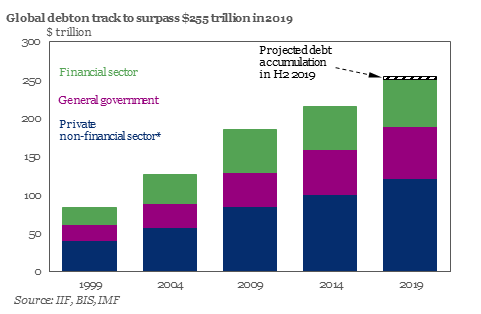

Addressing the third, yesterday the Institute of International Finance reported that global debt has now hit $250 trillion and is expected to hit a record $255 trillion at the end of 2019, up $12 trillion from $243 trillion at the end of 2018, and nearly $32,500 for each of the 7.7 billion people on planet.

“With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year,” the IIF said in the report.

The surge was driven by a $7.5 trillion surge in the first half of the year which was used to reverse the global slowdown that sent stocks into a bear market in 2018, and which shows no signs of slowing. Around 60% of that jump came from the United States and China. Government debt alone is set to top $70 trillion this year, as will overall debt (government, corporate and financial sector) of emerging-market countries.

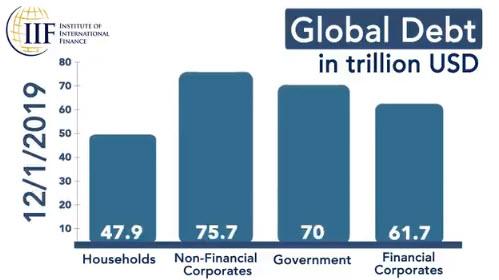

The total debt breakdown as of Dec. 31 is as follows:

- Household debt: $47.9 trillion

- Non-financial corporate: $75.7 trillion

- Government: $70 trillion

- Financial corporate: $61.7 trillion

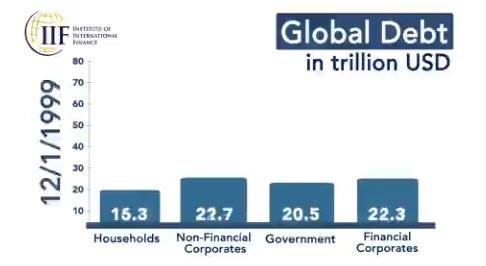

And this is what the total debt picture was like at the start of the century, 20 years ago…

This amounts to a grand total of just over $255 trillion, roughly equivalent to a record 330% of global GDP.

WATCH: Follow the increase of global #debt over two decades.

Latest IIF Global Debt Monitor finds global debt has now surpassed a record $250T & is projected to reach $255T by the end of 2019. pic.twitter.com/D001VVzZmD— IIF (@IIF) November 14, 2019

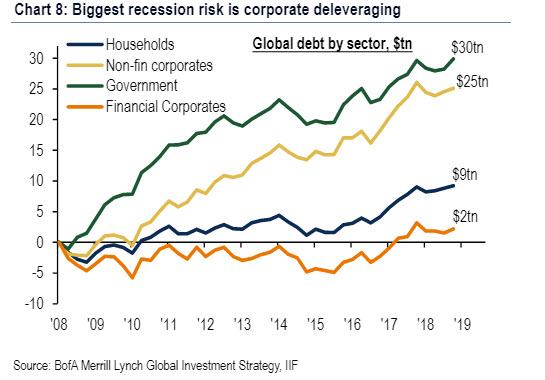

Separately, Bank of America’s Michael Hartnett on Friday calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that “the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging.”