“Yellow Light” – Is The Credit Market Finally Reversing

Keep digging

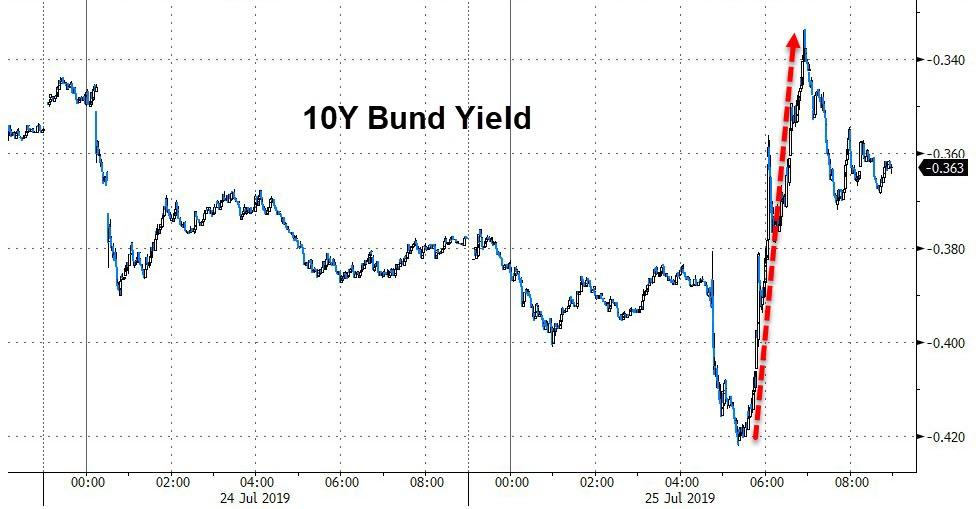

Yesterday, the European Central Bank held a stand-pat meeting, keeping the benchmark deposit rate at negative 40 basis points.

However, ECB president Mario Draghi indicated that rate cuts and a resumption of asset purchases are on tap for September. In the accompanying presser, the outgoing ECB chief captured the mood of central bank-levitated markets, stating that: “it’s difficult to be too gloomy today,” while the outlook “is getting worse and worse.” The German 10-year yield traded as low as negative 42 basis points, briefly crossing below the 40 basis point deposit rate.

While sovereign debt holders continue to rack up mark-to-market gains, not everyone is enamored with the prospect of still-more negative interest rates.

“We already have a devastating interest rate situation today, the end of which is unforeseeable,” Peter Schneider, who represents banks in the south-eastern German state of Baden-Württemburg, told Bloomberg yesterday.

“If the ECB aggravates this course, that would hit not only the entire financial sector hard, but especially savers.”

Meanwhile, policymakers down under attempt to quantify the practical limits of negative policy rates. In a paper written to New Zealand finance minister Grant Robertson in January and recently released to the public, staffers in the Treasury Department concluded:

“The Reserve Bank expect rates could only fall at most 35 basis points below zero before risking the hoarding of physical cash.”

Today, the global stock of negative-yielding debt rose to $13.74 trillion, a new record.

Yellow light

As we close out month 121 of the longest economic expansion on record, let’s take a look at the state of U.S. corporate credit. Year to date, investment-grade bonds have generated a whopping 12.3% total return, while high-yield has returned 10.6%. Leveraged loans have lagged far behind, with the LSTA Index gaining just 3.3% so far this year.

…click on the above link to read the rest of the article…