How “Wealthy” Would We Be If We Stopped Borrowing Trillions Every Year?

These charts reflect a linear system that is wobbling into the first stages of non-linear destabilization.

The widespread presumption is the U.S. is wealthy beyond words, and will remain so as far as the eye can see: wealthy enough to fund trillion-dollar weapons systems, trillion-dollar endless wars, multi-trillion dollar Medicare for all, multi-trillion dollar Universal Basic Income, and so on, in an endless profusion of endless trillions.

Just as a thought experiment, let’s ask: how “wealthy” would we be if we stopped borrowing trillions of dollars every year? Or put another way, how “wealthy” would we be if the rest of the world stops buying our trillions in newly issued bonds, mortgages, auto loans, etc.?

The verboten reality is our “wealth” is nothing but a sand castle of debt. Take away more borrowing and the castle melts away. I’ve gathered a selection of charts that show just how dependent we are on massive debt expansion that continues essentially forever, as any pause in debt expansion will collapse the entire system.

Corporate buybacks have powered rising corporate earnings–and the buybacks are funded by debt. Corporate debt has exploded higher in the past decade, enabling stock buybacks on an unprecedented scale.

Government debt–federal, state and local– is rising an exponential rates.We’re not paying for more government programs with earnings–we’re simply borrowing trillions and hoping we can borrow the interest payments that will also rise along with the debt.

Household debt, student loans, auto loans–all are soaring. The corporate sector, government and the household sector–all are living on borrowed money, and relying on magical thinking to mask the inevitable consequences.

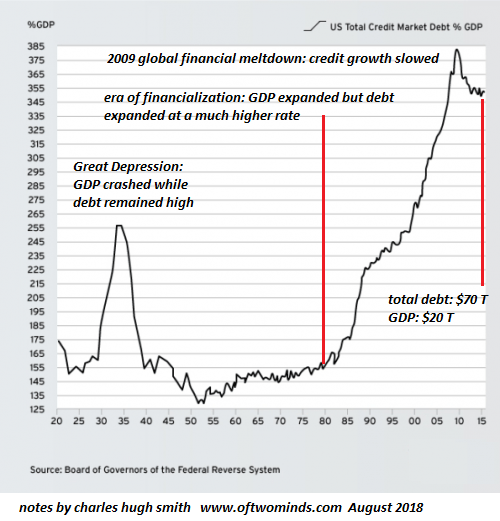

Here’s debt to GDP. Yes, the economy expanded, but debt expanded much faster. Every additional dollar of GDP now requires multiple dollars of new debt.

…click on the above link to read the rest of the article…