The economic crisis brewing in Turkey seems to have surprised many. This was probably, at least partly, due to the ‘period of tranquility’ created by the central banks with theirs ‘unorthodox measures’. Many seem to have imagined that the “synchronized global growth” spurt were here to last. But, it was just a mirage, run by the stimulus of China and the major central banks.

As we warned in May, the global quantitative tightening will bring an end to the current business cycle. This is for a multitude of reasons (see Q-review 1/2018), but the most pressing of them is the fact that QT will raise interest rates and suppress liquidity. It will raise the costs of indebted companies, drive zombie companies to insolvency and ultimately crash the asset markets. A global debt crisis of epic proportions and depression are likely to follow. Turkey is showing what it might look like.

The debt conundrum

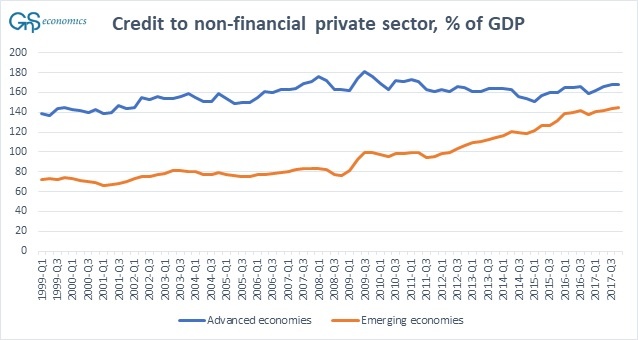

The current business cycle has had two exceptional features. First has been the steep rise in the balance sheets of central banks and the second the very fast growth of the non-financial sector debt, especially in the emerging economies. Figure 1 presents the private non-financial sector debt as a percentage of GDP in advanced and emerging economies. It shows the miniscule deleveraging in advanced economies and the harrowing rise in the private non-financial debt in the emerging economies since 2009.

Figure 1. Credit (debt) to non-financial private sector as a share of GDP in advanced and emerging economies. Source: GnS Economics, BIS

The rise of the non-financial private debt in emerging economies coincides with the QE programs of the major central banks.

…click on the above link to read the rest of the article…