The Keynesian Recovery Meme Is About To Get Mugged, Part 2

When the bust comes, these foolish Keynesian proponents of everything is awesome will be caught like deer in the headlights. That’s because they view the world through a forecasting model that is an obsolete relic—one which essentially assumes a closed US economy and that balance sheets don’t matter.

By contrast, we think balance sheets and the unfolding collapse of the global credit bubble matter above all else. Accordingly, what lies ahead is not history repeating itself in some timeless Keynesian economic cycle, but the last twenty years of madcap central bank money printing repudiating itself.

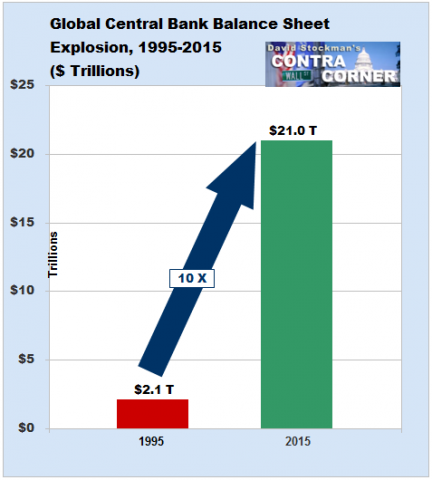

Ironically, the gravamen of the indictment against the “all is awesome” case is that this time is different——radically, irreversibly and dangerously so. High powered central bank credit has exploded from $2 trillion to $21 trillion since the mid-1990’s, and that has turned the global economy inside out.

Under any kind of sane and sound monetary regime, and based on any semblance of prior history and doctrine, the combined balance sheets of the world’s central banks would total perhaps $5 trillion at present (5% annual growth since 1994). The massive expansion beyond that is what has fueled the mother of all financial and economic bubbles.

Owing to this giant monetary aberration, the roughly $50 trillion rise of global GDP during that period was not driven by the mobilization of honest capital, profitable investment and production-based gains in income and wealth. It was fueled, instead, by the greatest credit explosion ever imagined——$185 trillion over the course of two decades.

…click on the above link to read the rest of the article…