Today’s Turning Point on ECM

I have been warning that this turning point is not in markets, it is centered in government. The number of issues coming to a head are just mind-blowing from the Catalonia vote to separate from Spain to the resignation of Boehner with non-politicians leading not just in the USA, but everywhere. The elections in Greece was most likely the last vote for any political establishment since the Greeks do not expect any promise to be kept.

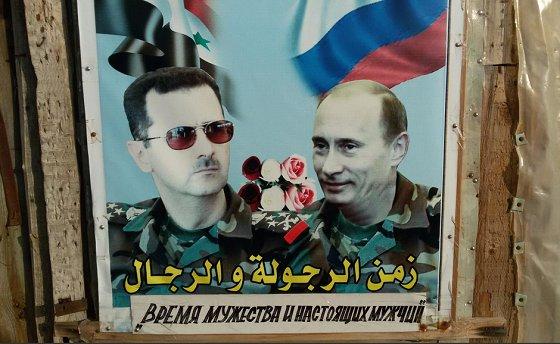

Yet today just may mark a very strange event that might be extremely important. Today, Russia gave the US 1 hour notice and began bombing both ISIS and rebels seeking to overthrow the Syrian government. It is extremely curious that this beginning precisely on the day of the ECM. Will this prove to be the start of international war?

Meanwhile, Christine Lagarde of the IMF came out to state today also on the turning point of the ECM that the rate of economic growth this year will probably be weaker than in 2014. I had a meeting in Europe with a former board member of the IMF and we had some very frank discussions. To put it mildly, they are indeed worried. The inflation rate for Euroland just turned NEGATIVE again.

Meanwhile, Christine Lagarde of the IMF came out to state today also on the turning point of the ECM that the rate of economic growth this year will probably be weaker than in 2014. I had a meeting in Europe with a former board member of the IMF and we had some very frank discussions. To put it mildly, they are indeed worried. The inflation rate for Euroland just turned NEGATIVE again.

So while cash is now KING, stocks remain vulnerable and commodities have no bid sufficient to change the trend, it appears we are headed into the wonderland of our political-economy.