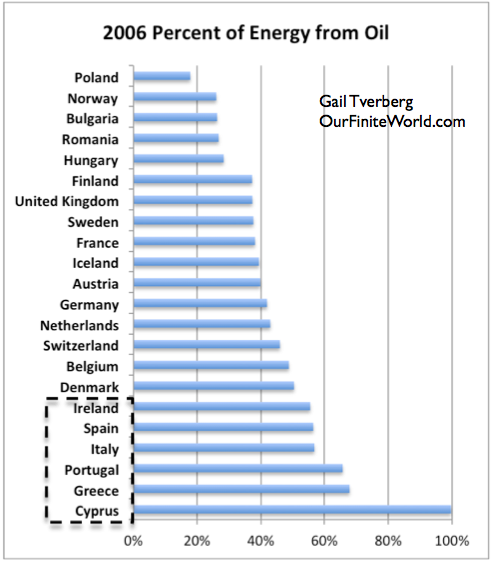

Greece and Cyprus are at the bottom of this chart. The other “PIIGS” countries (Ireland, Spain, Italy, and Portugal) are immediately above Greece. Puerto Rico is not European so is not on Figure 1, but it if were shown on this chart, it would between Greece and Cyprus–its oil as a percentage of its energy consumption was 98.4% in 2006. The year 2006 was chosen because it was before the big crash of 2008. The percentages are bit lower now, but the relationship is very similar now.

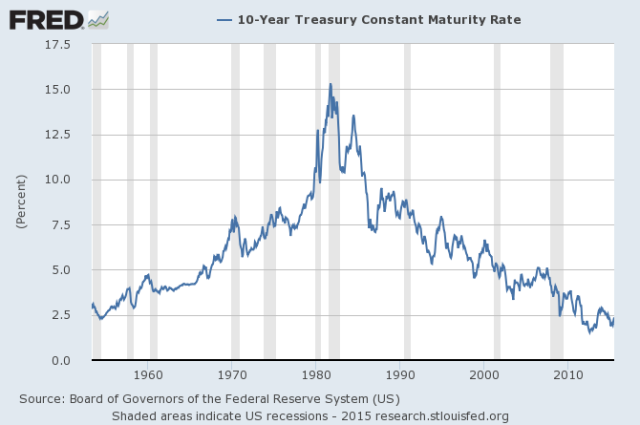

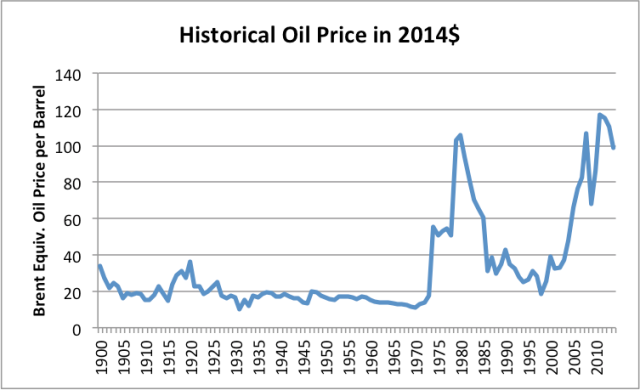

Why would high oil consumption as a percentage of total energy be a problem for countries? The issue, as I see it, is competitiveness (or lack thereof) in the world marketplace. Years ago, say back in the early 1900s, when countries built up their infrastructure, oil price was much lower than today–less than $20 a barrel (even in inflation-adjusted dollars). Between 1985 and 2000 there was another period when prices were below $40 barrel. Back then, the price of oil was not too different from the price of other types of energy, so an energy mix slanted toward oil was not a problem.

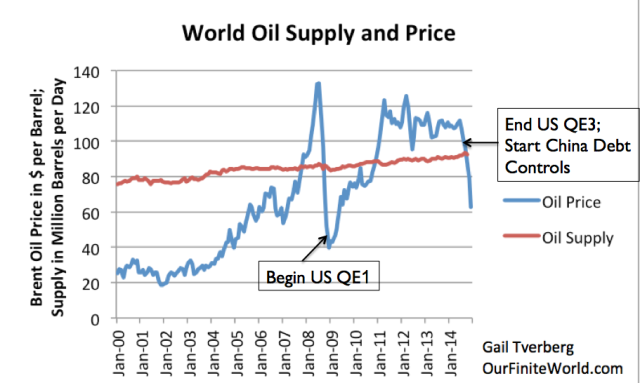

Oil prices are now in the $60 barrel range. This is still high by historical standards. Furthermore, much of the financial difficulty countries have gotten into has occurred in the recent past, when oil prices were in the $100 per barrel range.

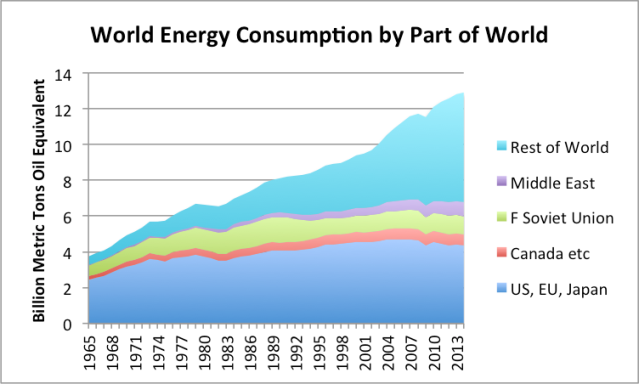

While countries with a large share of oil in their energy mix tend to fare poorly, at least some countries with a preponderance of cheap energy fuels in their energy mix have tended to do very well. For example, China’s economy has grown rapidly in recent years. In 2006, its share of oil in its energy mix was only 23.0%, putting it below Norway but above Poland, if it were included in Figure 1.